Executive Summary

Last week’s Federal Funds Rate increase of .25% brings the rate over 5%, all part of the Federal Reserve’s fight to reduce inflation. The second graph shows the corresponding increases in Treasury Security rates. With the U.S. National debt now at $31.7 trillion, interest expense is skyrocketing. The third graph below illustrates how the U.S. debt is primarily short term, and thus incurring higher interest rates upon maturity. It appears the U.S. has entered a vicious circular pattern. Raising rates to slow the economy and reduce inflation could spur future stimulus plans to escape recession. This could result in higher inflation requiring more rate hikes. All of this leads to higher debt and debt service.

Please continue to The Details for more of my analysis.

“Success is going from failure to failure without a loss of enthusiasm.”

–Winston Churchill

The Details

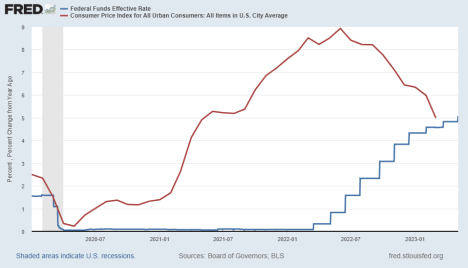

In its ongoing attempt to reduce inflation, the Federal Reserve Bank (Fed) raised the short-term Federal Funds Rate (FFR) by 0.25% last week. The FFR is now in a range of 5.0 – 5.25%, with an effective rate of 5.08%. The graph below illustrates the current level of the effective FFR in blue. The red line is the inflation rate as represented by the change in the Consumer Price Index (CPI). At the present time the inflation rate is about the same as the FFR. Many pundits believe

that inflation is now in a controlled descent and no more rate increases will be sought by the Fed. I am not convinced that inflation will return to the Fed’s 2% goal anytime soon. Instead, I can see inflation plateauing, if not rising slightly in the near term. Wage inflation with the tight job market remains a concern.

The graph below illustrates the increase in the yield on two, five and ten-year Treasury Securities. These rates have increased significantly since the pandemic period.

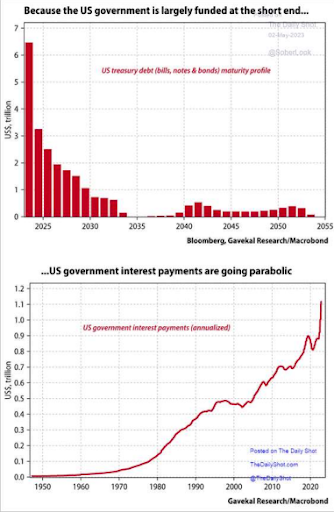

The increase in yields on Treasury Securities represents a direct increase in interest expense for the Federal Government. Presently, the National Debt totals $31.7 trillion. Instead of taking advantage of the extremely low long-term interest rates experienced at times over the past decade, to lock-in low rates and extend maturities, the Federal Government instead weighted maturities to the short end of the curve. While this might have lowered interest payments temporarily, it made them vulnerable to a rise in rates as currently being experienced. The graph below from The Daily Shot shows the majority of outstanding Treasuries mature over the next five to ten years. The highest weighted years mature in the next year or two. When these securities mature, they will need to be rolled over at today’s higher rates.

The combination of soaring debt with rapidly rising interest rates has sent annual interest payments on the debt parabolic.

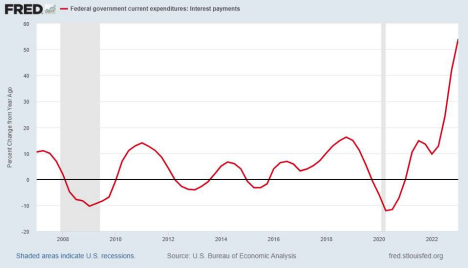

It is not only the fact that interest on the National debt is broaching $1 trillion per year, but the speed at which it is accelerating. The graph below shows the rate of change in the annual interest payments. Over the past year, interest payments have skyrocketed by over 50%!

It seems the U.S. has entered a vicious circular pattern. If the economy continues to slow, the Federal Government will likely issue some type of stimulus. The stimulus will increase the National Debt and push inflation higher. The Fed will react to higher inflation by increasing interest rates, which will slow the economy even further. The rise in rates has pushed interest payments to untenable levels. More debt will need to be issued to pay the higher interest payments. The higher debt leads to even higher interest payments. Is the problem becoming clearer?

The S&P 500 Index closed at 4,136, down 0.8% for the week. The yield on the 10-year Treasury Note remained at 3.45%. Oil prices decreased to $71 per barrel, and the national average price of gasoline according to AAA dropped to $3.54 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.