Executive Summary

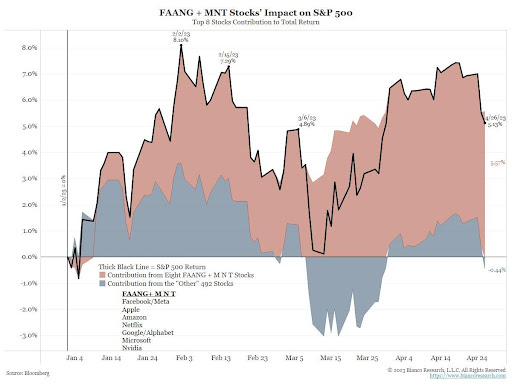

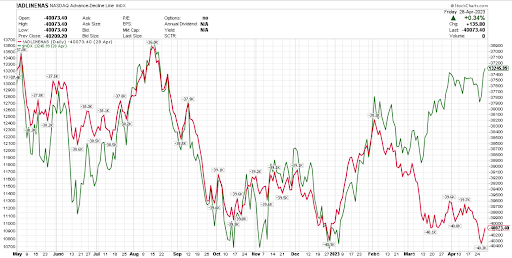

While the S&P 500 has recovered some of its 2022 losses, do not be fooled into thinking all is well. Eight stocks including Facebook (Meta), Apple, Amazon, Netflix, Google (Alphabet), Microsoft, Nvidia and Tesla are responsible for 100% of the positive return so far this year. While the other 492 stocks returned -0.44% (see first graph for visual). When eight stocks are responsible for the entire market gains, then the breadth is extremely weak. And the market is risky. In the last chart below, the Nasdaq 100 Index (green) is overlayed with the Nasdaq 100 cumulative advance-decline line (red). Notice the Index has risen, while the advance-decline line has fallen (meaning more of the 100 stocks falling than rising). The majority of stocks are depicting a more accurate view of the economy by being flat to down year-to-date. This market is not strong.

Please continue to The Details for more of my analysis.

“The greatest enemy of progress is not stagnation, but false progress.”

–Sydney J. Harris

The Details

Some investors might look at the S&P 500’s 8.6% return year-to-date and conclude that the stock market is healthy. A brief look under the hood would render that conclusion invalid. One hundred percent of the return in the S&P 500 through April 26 was attributable to eight stocks, as shown in the chart below prepared by Jim Bianco of Bianco Research. The market jumped the final two days of the month, adding another 2.8%. As of April 26th, the other 492 stocks returned -0.44%.

The eight stocks include Facebook (Meta), Apple, Amazon, Netflix, Google (Alphabet), Microsoft, Nvidia and Tesla. These eight stocks are included in the overvalued, mostly tech comprised, Nasdaq 100 Index.

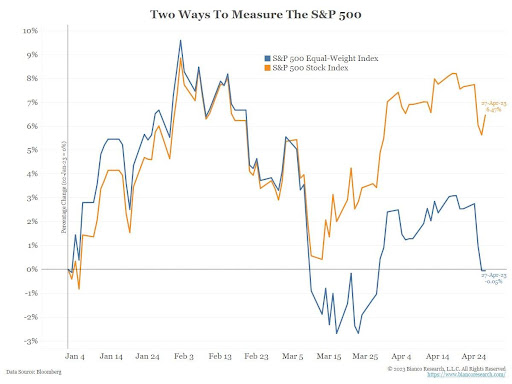

Another way to view this is by comparing the S&P 500, a market cap-weighted index, to the S&P 500 equal-weight index. As shown below, also from Jim Bianco, as of the preparation of the graph, the market cap-weighted index, which is the S&P 500 Index everyone is familiar with, was up 6.47%; while the equal-weight index was flat. This is because the largest companies, which include the eight listed previously, are given the most weight in the index.

As legendary investor Bob Farrell stated in his 10 Rules for Investing, Rule #7: “Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.”

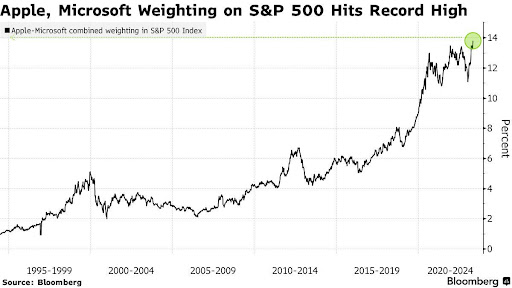

Another way to interpret this is to say breadth is important. When eight stocks are responsible for the entire market gains, then the breadth is extremely weak, and the market is risky. The S&P 500 is even more concentrated when one realizes that two companies, Apple and Microsoft, comprise 14% of the index as shown in the graph below obtained from a Bloomberg article written by Subrat Patnaik. In the article, Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management states, “It’s concerning to have such concentration in a few names and all those companies are in the very similar tech and communication services sectors.” The article went on to say, “Apple and Microsoft alone have added more than $1 trillion in combined market value in 2023, nearly half of the gains for the entire S&P 500.”

In the chart below, I have overlayed the Nasdaq 100 Index (green) with the Nasdaq 100 cumulative advance-decline line (red). The advance-decline line shows the number of stocks in the index advancing versus declining. If the line is rising; more stocks are advancing and vice-versa. Notice that while the Index has risen, the advance-decline line has fallen. This illustrates how unhealthy the Index is presently. The majority of stocks in the Index have declined but the overall Index has risen. This is primarily due to the eight stocks mentioned above. Notice the extreme gap between the two lines. This will likely close with the Nasdaq 100 (green line) falling back down to the red line, which would be a drop of around 20%.

Looking at the major stock indices and listening to financial media, one might believe that the stock market is currently strong. This could not be further from the truth. The entire market is being propped up by a handful of stocks, while the remaining stocks faulter. This is not a healthy stock market as the breadth is extremely weak.

The majority of stocks are actually depicting a more accurate, albeit overly bullish, view of the market, being flat to down year-to-date. I say overly bullish because corporate earnings continue to fall, the economy is weakening, inflation remains high and stock prices remain dangerously overvalued. Speculators have found solace for the time being in the eight stocks listed above. As the economic downturn becomes clearer and fundamentals continue to weaken, the market will eventually reflect reality. In the meantime, the market is being propped up by just a small number of stocks.

The S&P 500 Index closed at 4,169, up 0.8% for the week. The yield on the 10-year Treasury Note fell to 3.45%. Oil prices decreased to $77 per barrel, and the national average price of gasoline according to AAA dropped to $3.61 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.