Executive Summary

Last week saw the collapse of Silicon Valley Bank and Signature Bank. Over the weekend, regulators and government officials scrambled to forge a rescue deal for Credit Suisse, through a purchase by UBS. Credit Suisse shareholders will still suffer losses. The banking and financial system are showing signs of crisis. As written in last week’s missive, depositors in Silicon Valley Bank and Signature Bank were guaranteed 100% of their funds, even if they were over the FDIC limit. This is a slippery slope, as the data in The Details shows almost 40% of all deposits, or nearly $8 trillion, are over the FDIC limit. Some are speculating that depositors will leave smaller banks and move to “too big to fail” banks. For now it appears bank depositors are safe; however, prudence calls for adhering to the FDIC $250,000 limit at this time.

Please continue to The Details for more of my analysis.

“It ain’t over till it’s over.”

–Yogi Berra

The Details

Last week saw the collapse of Silicon Valley Bank and Signature Bank. Over this past weekend, regulators and government officials were scrambling to forge a rescue of Credit Suisse, Switzerland’s second largest bank. In the end, UBS agreed to purchase Credit Suisse for $3.2 billion. It should be noted that as of last Friday Credit Suisse maintained an $8.5 billion market capitalization. Shareholders in Credit Suisse are suffering a tremendous loss. Under the terms of the deal, one UBS share will be given for every 22.48 Credit Suisse shares. Also, the Swiss National Bank agreed to provide up to $100 billion francs in support of the arrangement. And to the detriment of certain bondholders, $17 billion in high-risk bonds would be written-off as a total loss.

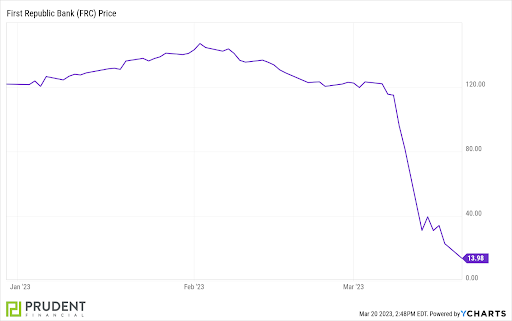

Next up is First Republic Bank. Last week a number of large banks ponied up $30 billion to provide First Republic funds to stabilize their situation and provide some comfort for depositors and investors. The graph below shows it appears investors were not satisfied with those efforts.

As written in last week’s missive, depositors in Silicon Valley Bank and Signature Bank were guaranteed 100% of their funds, even if they were over the FDIC limit. Treasury Secretary Janet Yellen stated this was due to the systemic risk it would pose to the financial systems if depositors lost money. She stated in testimony to the Senate that in the future, deposits over the FDIC limit would not be insured if it were determined there were no greater systemic risk. Picking and choosing which depositors get full FDIC protection and which are subject to the $250,000 per account limit is a slippery slope. There is a real fear that depositors in smaller institutions will pull their funds and move them to larger banks considered “too big to fail” in order to get full protection.

Some readers might wonder how many depositors over the limit exist in banks. The answer is more than you might think. According to the Kobeissi Letter via Twitter, the percentage of bank deposits above the FDIC limit for 10 banks are shown below. The numbers are significant.

Uninsured Deposits by Bank:

- BNY Mellon, $BK: 97%

- SVB, $SIVB: 94%

- State Street, $STT: 91%

- Signature, $SBNY: 90%

- Northern Trust, $NTRS: 83%

- Citigroup, $C: 77%

- HSBC Holdings, $HSBA: 73%

- First Republic Bank, $FRC: 68%

- East West Bancorp, $EWBC: 66%

- Comerica, $CMA: 63%

There are now a total of $8 trillion in uninsured deposits in the U.S.

Roughly 40% of all deposits are uninsured.

According to the FDIC, there were approximately $19.2 trillion in total deposits at the end of last year. The Financial Times reported that there were just over $10 trillion in FDIC insured deposits at the end of last year. This data is consistent with that reported above.

According to a recent article in the New York Post, “Nearly 200 more banks may be vulnerable to the same type of risk that took down Silicon Valley Bank: the value of the assets they hold.

There are 186 banks across the country that could fail if half of their depositors quickly withdraw their funds, a new study published on the Social Science Research Network found.”

The FDIC and Janet Yellen have created a real dilemma for themselves. By bailing out all depositors, including those over the FDIC limit, at SVB and Signature Bank, they have implicitly guaranteed all depositors at other institutions. Despite Secretary Yellen’s comments to the Senate, I believe the administration would be hard pressed to subject depositors to losses at this point.

The flight to bigger banks could exacerbate the problems and accelerate further bank failures. Additionally, Secretary Yellen stated that taxpayers would not be on the hook for the depositor bailouts agreed to last week. An assessment of all banks is to cover uninsured depositors. This too could be a problem. Currently, banks pay a premium to the FDIC for depositor insurance protection up to the limit. This protection is not cheap. If banks had to now cover premiums to insure ALL deposits, the cost itself could be prohibitive for many banks.

As with many crises, the initial “fix” provides many investors with the comfort that everything is resolved. Unfortunately, the existing financial troubles run far and deep. The U.S. is struggling with high inflation, rising interest rates, slowing corporate earnings and leading economic indicators that spell potential problems ahead. On top of that, banks are beginning to realize the impact of rising rates on their investment portfolios. If depositors continue to flee, the financial crisis could become much more severe.

For now, I believe depositors funds are safe. However, even though some deposits over the FDIC limits have been insured, prudence would call for remaining under the $250,000 limit per account. Shareholders and bondholders in financially troubled banks might evaluate their chances of recouping funds in the event their bank goes into receivership. This is a developing story. Stay tuned to these newsletters for ongoing updates.

The S&P 500 Index closed at 3,917, up 1.4% for the week. The yield on the 10-year Treasury Note fell to 3.40%. Oil prices decreased to $67 per barrel, and the national average price of gasoline according to AAA dropped to $3.45 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.