Executive Summary

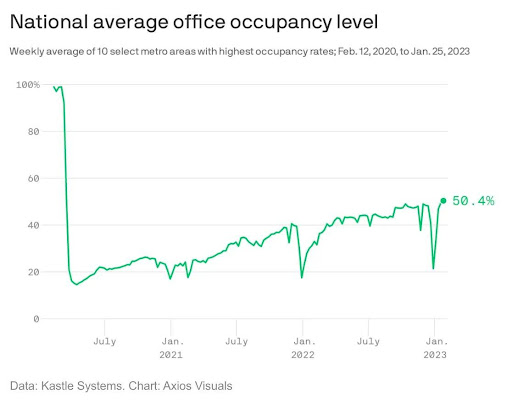

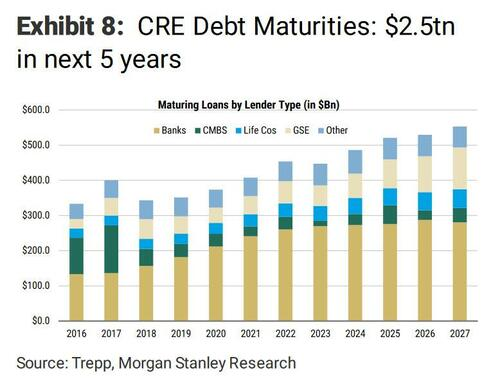

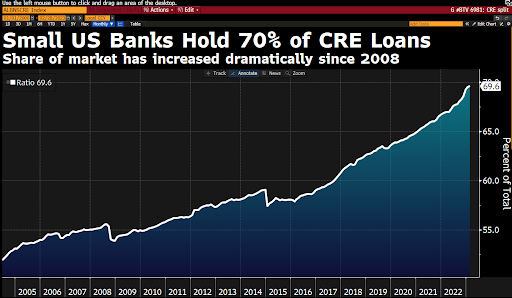

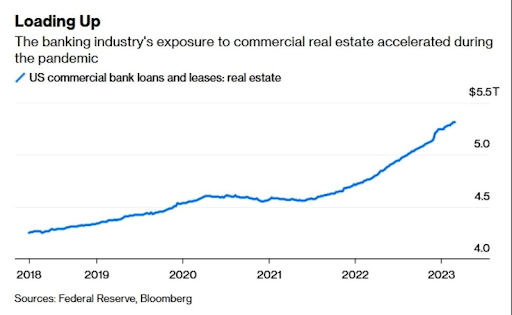

During the COVID pandemic, many companies implemented work-from-home strategies, resulting in the realization of needing less office space. The impact of reduced occupancy (see first graph) could be an issue for owners and financiers of commercial real estate. Much of which is highly leveraged with variable interest rates and typically shorter duration loans with balloon payments. These loans are typically refinanced at maturity. Which means rising interest rates could start negatively impacting the industry at the same time occupancies are down. Almost $270 billion in commercial real estate loans will be maturing this year. Banks have increased exposure to commercial real estate loans (5th graph), while small banks maintain a 70% share of these loans (4th graph). The large private equity firm Blackstone has already defaulted on a $562 million bond backed by offices and stores owned by Sponda Oy, a Finnish landlord, according to Zero Hedge. Commercial real estate could be the next shoe to drop. Please read The Details for a deeper dive into this topic.

Please continue to The Details for more of my analysis.

“If we fail to act, we risk a systemic crisis with our banking system…”

–Scott Rechler, CEO and Chairman, RXR Realty

The Details

The pandemic changed the game for commercial real estate, especially office and retail properties. Leasing office or retail space is expensive. Over the past few years, companies have learned that it is not necessary to maintain office space for every employee. Technology has improved to the degree that working from home is not much different than working in an office down the hall. Many employees relish the extra free time acquired by not needing to commute to work. This is especially true in larger cities where commuting can often consume a couple hours of one’s day. The savings in rent likely more than offsets any lost productivity. And in retail, after suffering from waning demand during the pandemic, many businesses discovered they could run some or all of their operations just as efficiently, if not more, online. The need for large expensive retail locations was not necessary for all businesses.

While these “innovations” might be helpful to many companies, they came as a detriment to many owners and financiers of commercial real estate. Commercial real estate is often valued based upon occupancy, which produces rental income. More vacancies mean less gross income, with little relief regarding maintenance expenses. And, since most real estate is highly leveraged, interest is one of the largest expenses incurred. When interest rates were in the low single digits, this cost became less of a burden. Many commercial loans are issued with a variable interest rate and have a shorter duration, with a balloon payment at the end. Typically, owners refinance the debt upon maturity, rolling over the balance for a new term.

Owners of commercial properties are facing shrinking demand which results in rising vacancies. When vacancies rise, rents often must be reduced to attract tenants. This combination means less rental income at the same time interest rates have skyrocketed. See graph of plunging occupancy rates below.

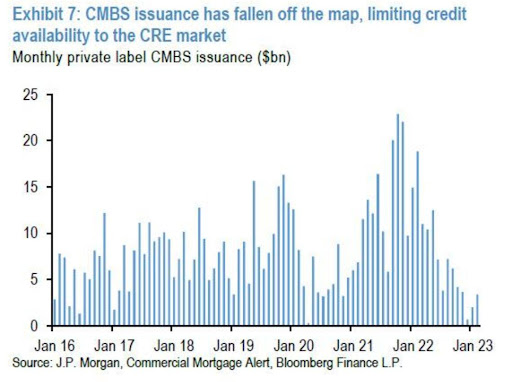

The chart below illustrates the tightening of credit in the commercial real estate market. CMBS (commercial mortgage-backed securities) issuance has almost disappeared.

So, many owners of commercial real estate face a real dilemma, falling revenues and rising expenses. This combination will lead to a rapid increase in defaults. Small banks, pension funds and reit investors (real estate investment trusts) could suffer as defaults and foreclosures jump. According to an article in The Wall Street Journal, almost $270 billion in commercial mortgages mature this year. Most of these are held by banks with assets totaling less than $250 billion. According to the graph below, almost $2.5 trillion mature over the next five years. Rolling the loans at interest rates most likely over double their previous rates could spell disaster for many.

Almost 70% of commercial real estate loans are held by small banks. If defaults begin to snowball, many of these banks will struggle to survive.

After the pandemic, banks increased their exposure to commercial real estate. This could soon be proven to have been a huge mistake.

A storm is brewing in commercial real estate. The storm could leave in its wake, rising defaults, foreclosures and ultimately a new wave of banks in crisis. No one knows how the administration and FDIC will view small banks pushed to the brink. Will they be concerned about the risk of contagion and protect all depositors no matter if they are over the FDIC limit?

The large private equity firm Blackstone has already defaulted on a $562 million bond backed by offices and stores owned by Sponda Oy, a Finnish landlord, according to Zero Hedge. They also have stopped investors seeking to redeem shares in their $71 billion real estate income trust (BREIT). When investors produce a run on a reit, the reit often must shut down redemptions as liquidity diminishes. Forced sales of commercial properties could result in selling at less than desirable prices.

Commercial real estate could be the next shoe to drop. The tentacles spread into small banks, pension funds, reits and more.

The S&P 500 Index closed at 3,971, up 1.4% for the week. The yield on the 10-year Treasury Note fell to 3.38%. Oil prices increased to $69 per barrel, and the national average price of gasoline according to AAA dropped to $3.44 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.