Executive Summary

Last week many heard about the Silicon Valley Bank failure. Over the weekend, a joint statement (included below in The Details) was released by Janet Yellen, Secretary of the Treasury, Jerome Powell, Federal Reserve Board Chair, and Martin Gruenberg, FDIC Chairman. This letter would also apply to Signature Bank, New York, which closed Sunday, March 12. This letter outlines depositor protections above FDIC limits. The summary explanation for SVB’s failure is unrealized investment losses due to rising interest rates were forced to be realized due to liquidity needs. To prevent the risk of runs at other banks whose depositors might fear similar circumstances, another statement was released introducing the new Bank Term Funding Program. This statement explains how the above mentioned protections for depositors will be financed by banks, and not by taxpayers. Policies keep creating situations which require new government solutions, when will they learn?

Please continue to The Details for more of my analysis.

“If the people only understood the rank injustice of our money and banking system, there would be a revolution by morning.”

–President Andrew Jackson, 1834

The Details

Last week investors witnessed the heightened stress exhibited by Silicon Valley Bank (SVB), Santa Clara, California. By last Saturday, depositors were in a full-fledged panic. To console depositors and assure their money would be safe, the following joint statement was released by Janet Yellen, Secretary of the Treasury, Jerome Powell, Federal Reserve Board Chair, and Martin Gruenberg, FDIC Chairman. This letter would also apply to Signature Bank, New York, which closed March 12. (h/t @macroalf for charts)

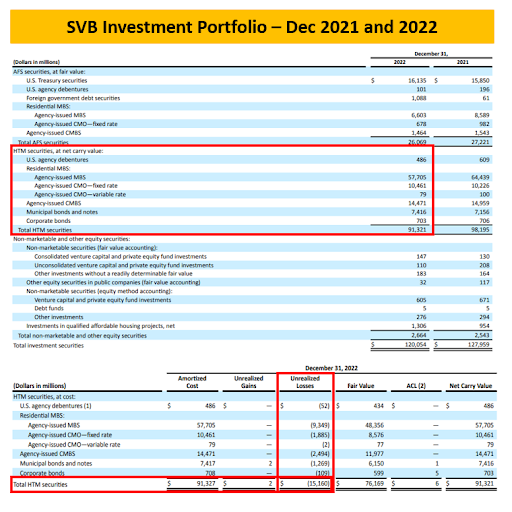

SVB found itself extremely liquidity constrained. I will provide a brief summation of the problems. SVB maintained an investment portfolio predominantly comprised of low-rate mortgage-backed securities. The vast majority were classified as HTM or “Held to Maturity.” These investments had suffered tremendous unrealized losses due to the significant rise in interest rates. However, because they were classified as HTM, the unrealized losses do not appear as financial losses on their books or as a reduction in capital. See a breakdown of investments below.

Also, the interest rate risk had not been hedged by the bank. As depositors began withdrawing large sums to either reinvest in higher paying securities, to use in their operations, or for other purposes, SVB was forced to sell investments to meet liquidity needs. These sales forced the previously unrecorded unrealized losses to become actual recorded realized losses. These losses could wipe out their capital.

In the rescue statement shown previously, depositors were guaranteed their funds even if their balances exceeded the FDIC limitations. This action creates moral hazard and gives the implicit announcement that FDIC limits no longer apply. The next time a financial institution fails, depositors will use this as a precedent for full redemption, even if above the stated FDIC limits.

To prevent the risk of runs at other banks whose depositors might fear similar circumstances, the following statement was released introducing the new Bank Term Funding Program (BTFP). Effectively, this program allows banks to borrow funds using their investment holdings as collateral. The banks can borrow up to 100% of the par value of their investments. This allows the banks to avoid selling securities at a large loss to meet liquidity needs. These one year loans accrue interest at the one-year overnight index swap rate plus 10 basis points.

The current administration is stating this save of SVB and Signature Bank is not a taxpayer bailout. Shareholders and certain unsecured creditors will not be bailed-out. They stated that any funding above the FDIC limits required to make depositors whole will be collected through a special FDIC assessment on banks.

Although this new program might alleviate the administration’s fear of contagion, the stock market appears not as convinced. The Invesco KBW Regional Bank ETF closed Monday, March 13 down 12%. More locally, First Horizon Bank closed down 20% after trading down as much as 29%.

In June 2017, Janet Yellen stated, “Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes, and I don’t believe it will be.” Well less than five years after that statement, she is desperately scrambling to prevent a major financial crisis.

Once again, the impression exists that no matter what the crisis the government will be there to bail everyone out. This belief then encourages more of the behavior that will require future bailouts. Each bailout builds upon the prior one until the consequences are inevitable. When will our leaders learn?

The S&P 500 Index closed at 3,862, down 4.5% for the week. The yield on the 10-year Treasury Note fell to 3.70%. Oil prices decreased to $77 per barrel, and the national average price of gasoline according to AAA rose to $3.47 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.