Executive Summary

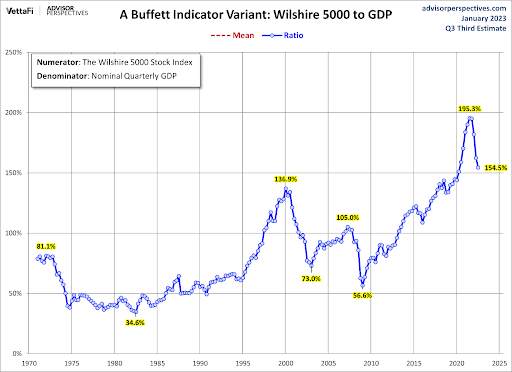

As 2023 gets underway, the bear market pattern of 2022 continues. After a few down days, another bear market rally appeared. Notice in the first graph below, the S&P 500 has been on a downward trend since the start of 2022. However, as is typical in bear markets, the past year was replete with bear market rallies. These rallies give hope to speculators not focused on the state of the macro economy. And those hoping the Federal Reserve Bank (Fed) will always be there to support the market when it turns down. The economy is weakening, and the first half of 2023 appears to be heading toward negative growth. Corporate profits are projected to be down 12.6% in the first quarter (see second graph). Although many are hoping for a Fed policy “pivot,” Jerome Powell has been clear about their intent to fight inflation. In the last graph one can see Warren Buffet’s favorite market valuation indicator shows the market is more overvalued than any time prior to the pandemic. Thus, absent a drastic change in policy, more downside risk exists.

Please continue to The Details for more of my analysis.

“He who lives by the crystal ball will eat shattered glass.”

–Ray Dalio

The Details

As 2023 gets underway, the bear market pattern of 2022 continues. After a few down days, another bear market rally appeared, rising over 5% in a handful of up days. Notice in the graph below, the S&P 500 has been on a downward trend since the start of 2022. However, as is typical in bear markets, the past year was replete with bear market rallies. These rallies give hope to speculators not focused on the state of the macro economy. And those hoping the Federal Reserve Bank (Fed) will always be there to support the market when it turns down.

The economy is weakening as real incomes fall and the rate of personal consumption slows. According to Hedgeye Risk Management, first quarter GDP growth (quarter over quarter, seasonally adjusted annual rate) is projected to be -2.9% and second quarter -1.9%. If this turns out to be accurate, two more quarters of negative growth will again lead to calls that a recession has started.

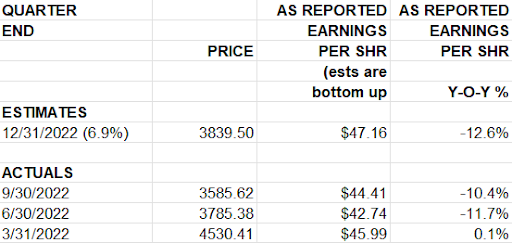

A weak economy in turn leads to falling corporate earnings. Notice in the chart of data excerpted from the SPGlobal.com website, S&P 500 GAAP (Generally Accepted Accounting Principles) quarterly earnings compared to the same quarter in the prior year fell 10.4% as of the end of the third quarter 2022. With 6.9% of companies reporting so far, fourth quarter earnings are projected to fall 12.6%. Most research firms show earnings falling through mid-year of 2023 before beginning to rise again. However, if a deep recession occurs, these future projections could be revised lower.

Most investors are hoping the Fed will halt their tight monetary policies and return to easing to support the economy and stock markets. However, the Fed is determined to get inflation under control and has consistently stated they are not wavering in their mission. The following is from Reuters on December 14:

“The Federal Reserve will deliver more interest rate hikes next year even as the economy slips towards a possible recession, Fed Chair Jerome Powell said on Wednesday, arguing that a higher cost would be paid if the U.S. central bank does not get a firmer grip on inflation.

Recent signs of slowing inflation have not brought any confidence yet that the fight has been won, Powell told reporters after the Fed’s policy-setting committee raised its benchmark overnight interest rate by half a percentage point and projected it would continue rising to above 5% in 2023, a level not seen since a steep economic downturn in 2007.”

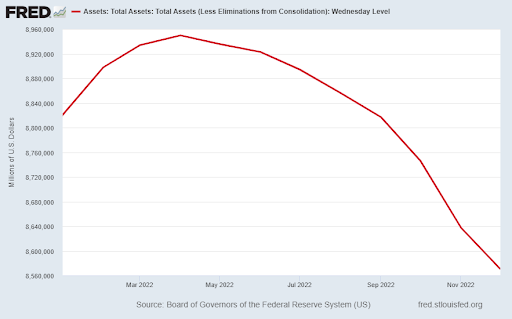

Despite sounding resolute in their position, many investors are ignoring Fed statements and pouring money into stocks every time the market jumps. In addition to the rising Fed Funds rate, many investors have forgotten that the Fed is also reducing their balance sheet every month by letting maturing bonds roll off without reinvesting the proceeds. Notice in the graph below that after topping around $8.95 trillion in April 2022, Fed assets have been declined to about $8.5 trillion.

Even after last year’s 19.4% drop in the S&P 500 and over 30% drop in the Nasdaq, stock markets remain overvalued. Although valuations are not useful for timing market movements, they provide a reliable indicator of future long-term returns. The graph below shows a variant of the Buffett Indicator, representing total market capitalization of companies divided by nominal GDP. Warren Buffett’s favorite indicator suggests that the market is still more overvalued than any time prior to the pandemic. In other words, future 10-year returns from current levels should be far below the long-term average. In fact, some calculations put future 10-year returns not far above zero percent.

Even though the stock market has jumped over the past six trading days, all indications are that this is merely another bear market rally. Could it continue a little longer? Of course. But, based upon the fact that the economy is weakening, earnings are falling, and the Fed is determined to continue their tight monetary policy, it appears the bear market will continue. Absent a drastic change in policy, expect more downside risk.

The S&P 500 Index closed at 3,999, up 2.7% for the week. The yield on the 10-year Treasury Note fell to 3.50%. Oil prices increased to $80 per barrel, and the national average price of gasoline according to AAA rose to $3.30 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.