Executive Summary

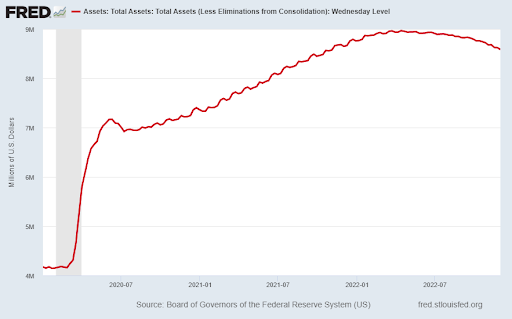

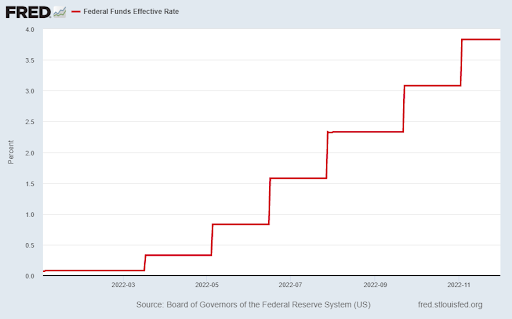

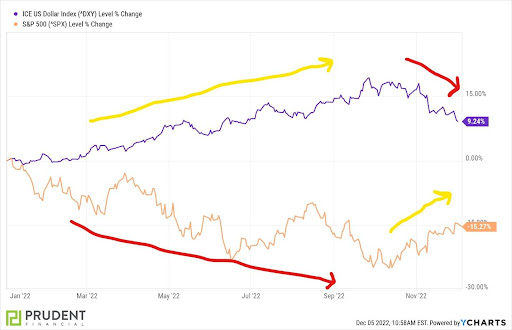

After the pandemic, inflation hit in 2022 because of the massive government stimulus programs. The Fed began fighting inflation by reducing the balance sheet (first graph) and raising interest rates (second graph). The dollar also rose by around 19%, and after giving up some of those gains, is now up 9% for the year. Interesting is the last graph below showing the inverse correlation between the S&P 500 and the dollar. Historically, the dollar strengthens during recessions. In 2023, if the inverse correlation continues, it could mean a strong dollar and weaker equities.

Please continue to The Details for more of my analysis.

“Give me the power to issue a nation’s money; then I do not care who makes the law.”

–Anselm Rothschild

The Details

When the pandemic hit the world, the global economy suffered. In attempts to right the ship, global central banks enacted various forms of stimulus plans. None more so than the U.S. The enactment of unprecedented Federal stimulus resulted in an over $3 trillion Federal deficit funded by the Federal Reserve Bank (Fed). This led to inflation in the U.S at levels not seen for 40 years. The Fed began to panic and soon developed plans to reduce their balance sheet (Quantitative Tightening) and to begin raising the Federal Funds Rate. The graph below shows that Fed assets peaked at just under $9 trillion in April of this year. Currently, assets have dropped to a little over $8.6 trillion. The second graph shows the series of rate hikes enacted this year bringing the effective Fed Funds Rate to 3.83%.

These moves combined with the fact that the U.S. economy, although weak, appears stronger than other major global economies, have pushed the dollar up significantly this year. The dollar, using the index DXY as a proxy, rose over 19% by the end of September. This is an extraordinary move for a large, developed country’s currency. The dollar has since given up some of those gains but remains up over 9% for the year.

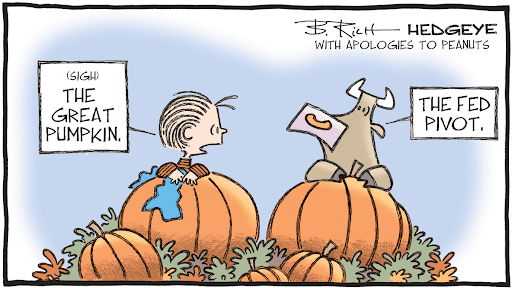

When the dollar rises this much relative to other currencies, it makes exports more expensive to other countries. This effectively exports inflation and imports deflation. Also, a strong dollar hurts multinational corporations as they suffer losses on foreign currency translation. One reason for the pullback in the dollar since the end of September is due to the – unjustified in my opinion – hopes of investors that the Fed will “pivot” and stop hiking interest rates. The investment word of the year is “pivot” and is all one hears if listening to financial media.

This year, the dollar has maintained a relatively strong inverse correlation with the S&P 500. In fact, as calculated by Hedgeye Risk Management, LLC, the 180 day correlation is -0.77. See the comparison in the chart below showing the rate of change of the DXY in purple and the S&P 500 in orange.

Lately, anytime investors jump on the “pivot” bandwagon pushing stock prices higher in another bear market rally, the dollar tends to fall. Normally, when a global slowdown or recession occurs, the dollar strengthens, as it is viewed as a safe haven versus other currencies. I expect this time also, as a recession deepens or becomes more apparent in 2023, the dollar could resume its ascent. The inverse correlation with the stock market should also continue.

The bottom line for the U.S. is likely a continued bear market with a strong dollar.

The S&P 500 Index closed at 4,072, up 1.1% for the week. The yield on the 10-year Treasury Note dropped to 3.50%. Oil prices rose to $80 per barrel, and the national average price of gasoline according to AAA decreased to $3.41 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.