Executive Summary

Talk by financial media for the always hoped-for Santa Claus rally is rampant. On December 13 the CPI for November will be released. If it is down, there will be hope of a Fed pivot. The Fed should state their interpretation at their meeting on Wednesday. Signs of easing could lead to an algorithmic Santa Claus rally. Conversely, talk of tightening for longer could send markets down. Historically, inflation rates experienced this year have taken 6-10 years to reduce to under 3%. Fed policy regarding Money Supply’s impact on inflation is explained in The Details. Will this week continue the roller coaster or begin a rally? However, remember the bigger financial picture will prevail over the weekly noise.

Please continue to The Details for more of my analysis.

“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

–Ludwig von Mises

The Details

It is that time of year when the talk within the financial media surrounds the always hoped-for Santa Claus rally. Every year investors begin anticipating the potential for the market to rise at the end of December. Of course, a Santa Claus rally is not a forgone conclusion. There are many other factors to consider, including the status of monetary policy, the macro economy and corporate earnings growth just to name a few. The hope this year hangs on whether the Federal Reserve Bank (Fed) “pivots” and stops, or hints at stopping, further interest rate hikes. Of course, no one actually expects the Fed to announce an end to rate hikes this month. The Fed has hinted at, and investors are expecting, a 50 basis points (0.50%) increase in the Fed Funds Rate (FFR). However, every syllable of the Fed announcement this Wednesday will be analyzed with the hope the message can be interpreted as Fed easing is nearing.

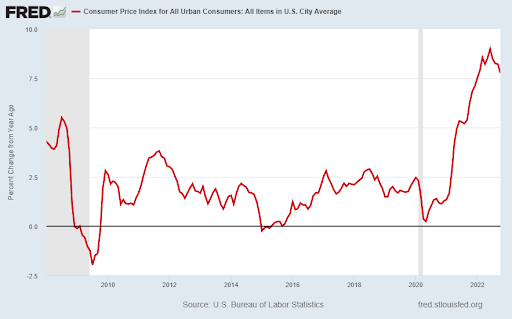

If that occurs, then the Santa Claus rally could develop, albeit likely short-lived. Many believe the tone in the Fed message this week will depend upon the extent of movement in inflation and inflation expectations. The November Consumer Price Index (CPI) readings will be announced Tuesday, December 13. It is expected that the year-over-year CPI will decrease from 7.8% last month to around 7.3%. The Producer Price Index (PPI), representing input costs, rose 7.4% in November (year-over-year). This was down from the year-over-year rise of 8.1% in October.

A lower CPI will excite investors, fueling the Fed easing (pivot) mantra. A higher than expected CPI would likely send the market tumbling with expectations of the Fed tightening for longer.

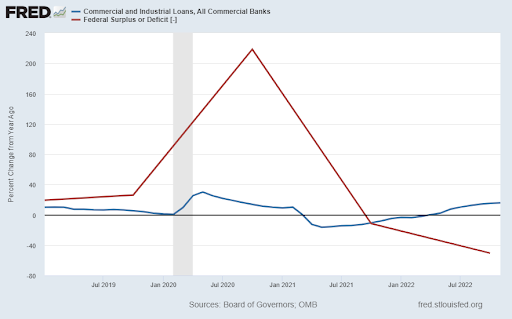

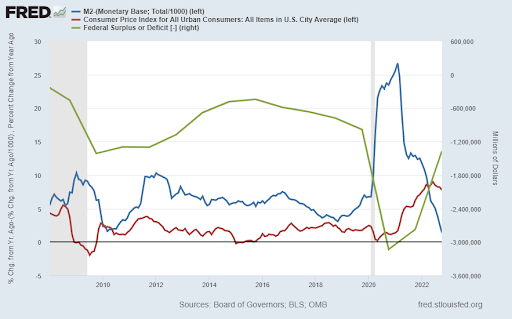

Inflation is the result of 1) supply constraints (especially on food and energy), and 2) an increase in the Money Supply. The Money Supply (M2), net of the Monetary Base, is increased when banks loan money and when the Fed monetizes deficit spending. The creation of reserves by the Fed to purchase Treasuries through QE (Quantitative Easing) does not cause inflation. It is the other side of the coin, the debt that is issued for Federal spending and paid for by the Fed which creates inflation by increasing the net Money Supply.

The jump in loans and (Fed-funded) deficit spending during the pandemic created a massive surge in the net Money Supply. See the blue line in the graph below.

Historically, inflation reaching the heights seen this year takes 6-10 years to bring back down to sub-3% levels. Much depends on the level of future spending and extent of lingering supply constraints. Tuesday, December 13, the CPI will provide an indication as to the direction and speed of the change in inflation. But remember, this is merely one month’s result.

Investors are hoping for a lower inflation reading so algorithms initiate buy programs anticipating talk of easing monetary policy. On Wednesday the Fed will try to clarify their position. Whether a two or three week Santa Claus rally occurs depends on the Fed messaging. Either way, the weak economy and falling corporate earnings will likely bring the bear market back into clear sight as the new year begins.

This week is sure to be a bumpy one.

The S&P 500 Index closed at 3,934, down 3.4% for the week. The yield on the 10-year Treasury Note rose to 3.57%. Oil prices fell to $71 per barrel, and the national average price of gasoline according to AAA decreased to $3.28 per gallon.

I wanted to say thank you to everyone that donated to the cause!

If you didn’t know, I like to run the St. Jude’s Marathon every year to support St. Jude’s Children’s Research Hospital and we still have time to help them reach their goal!

We have until Thursday to help St. Jude’s raise $14,000,000 for cancer research, and we would absolutely appreciate your donation.

I may have already ran the race, but your donations can help us cross the fundraising finish line, and help find a cure for childhood cancer.

Thank you again to everyone who donated!

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.