Executive Summary

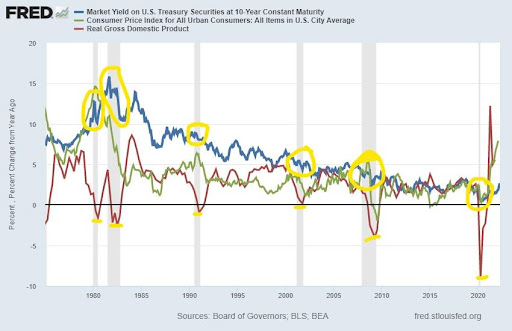

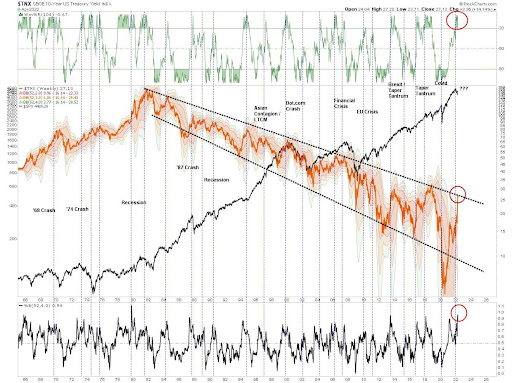

The Federal Reserve Bank’s policies including increasing the monetary base and funding the Federal Government’s stimulus programs led to a surge in growth and inflation. (See right side first graph) However, now the Fed is reversing policy stances by raising interest rates and halting QE. Balance sheet reduction will begin soon. Bond yields have followed higher. Short-term rates are controlled by the Fed, whereas long-term rates have historically followed economic growth. So as high inflation and global geopolitical tensions are now pushing down demand and consumer sentiment (outlook toward spending), bond yields could follow. See the second graph which shows the long downward channel for bond yields, which currently are at the top of the channel and appear poised to drop. The growth and inflation picture may change with the changing Fed policies leading to a slow down or recession. Bond yields typically drop in recessions as evidenced in the graphs.

Please proceed to The Details.

“If inflation continues to soar, you’re going to have to work like a dog just to live like one.”

–George Gobel

The Details

Currently, there are competing forces pulling on Treasury securities. On the one hand, the Federal Reserve Bank’s (Fed’s) excessive increase in the monetary base, funding the Federal government’s extreme stimulus programs, led to a temporary surge in consumer demand pushing economic growth sky high. This soaring growth was quickly followed by rising inflation. Add in the supply constraints and complications due to the Russian invasion of Ukraine, forcing oil and other commodity prices higher, and inflation sent chills through the Fed. Realizing their monetary policy was far behind the curve – being exceedingly too loose for too long – the Fed announced plans to reverse course. As the panic set in, watching inflation surge, Fed members have appeared in speeches all around proclaiming the need to raise rates higher and sooner than previously expressed. The ramification of the ramping economy has been for long-term Treasury yields to jump rapidly, causing the market value of existing notes and bonds to plunge. However, remember that Treasury securities are backed by the Federal government and will be paid in full.

What has made this period different than before is the speed by which record stimulus pushed economic growth and inflation higher, and the speed by which it appears it could be taken away. As discussed in last week’s missive, the tremendous rate of increase in fourth quarter 2021 real annualized GDP growth could almost fully disappear during the first quarter of 2022, when growth is projected to be close to 1% or less. And, although the Fed sets short-term interest rates through the Federal Funds Rate, long-term rates are impacted more by economic growth. As growth and inflation surged, so have long-term yields. However, I believe this is a temporary phenomenon. Since the punch bowl (stimulus) has been removed and prices are much higher – especially for energy and oil – demand is plummeting. Along with demand, consumer sentiment is also tumbling. This rapid reversal in demand is impacting economists’ GDP forecasts. Many now expect a recession to appear later this year.

In the graph below, notice that during each recession (shaded gray areas) the yield on 10-year Treasury Notes (blue line) fell. In times of falling economic growth (red line), yields are weak and dropping.

So, as quickly as the growth and inflation arrived, it could also depart. Many pundits, including myself and even the Fed, threw around the word “transitory” regarding inflation in the early days. Was it going to be transitory or not? A lot depends upon one’s definition of “transitory.” Inflation began to take-off in 2021. If demand weakens, both in the U.S. and around the globe, as expected this year leading to global recession, disinflationary pressures will begin to rise. One of the most important is the price of oil. Oil topped-out close to $130/barrel. Now, oil has dropped to around $94/barrel. Still high, but a long way down from the recent peak. The competing forces for oil will be supply constraints due to the Russian war versus falling global demand. If energy and oil prices fall, this will have a significant impact on the prices of other goods. If inflation begins to recede, was it “transitory”? In a 24-7 news cycle, inflation seems to have been around for a long time. However, in a long-term economic cycle, two years or less seems transitory. Again, it is up to one’s definition.

Another area of significant disinflation is likely to be in asset prices. The massive bubbles blown in stock and real estate prices over the past decade should come under considerable pressure with monetary tightening and a potential recession. In fact, I read of a Fed member who recently stated that a drop in stock prices should lead to a decrease in inflation. Over the next several months, it is highly likely that economic growth and inflation weaken. If a recession does materialize, I expect inflation to fall more significantly.

Since the peak in Treasury yields in 1981, yields have been in a decreasing channel. Notice in the graph below from Real Investment Advice, the yield has bounced back and forth within the channel. During recessionary periods, the yield has plummeted. The yield is currently at the top of the channel at the same time I believe a recession is in sight. Although there is no way to predict the exact top in yields, the next big move should be downward. The deeper the recession and market sell-off, the farther yields should fall. The graph indicates yields are at a spot that should indicate a possible reversal.

It appears the forces pushing yields higher – economic growth and inflation – are about to reverse course as economic weakness and disinflation could be on the horizon. If so, expect yields to fall and Treasury prices to rise. It is possible, that 10-year yields could return to their lowest levels experienced during the pandemic by the time the cycle completes. Time and future Fed actions will impact the ultimate result.

The S&P 500 Index closed at 4,488, down 1.3% for the week. The yield on the 10-year Treasury Note rose to 2.72%. Oil prices decreased to $98 per barrel, and the national average price of gasoline according to AAA fell to $4.12 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.