Executive Summary

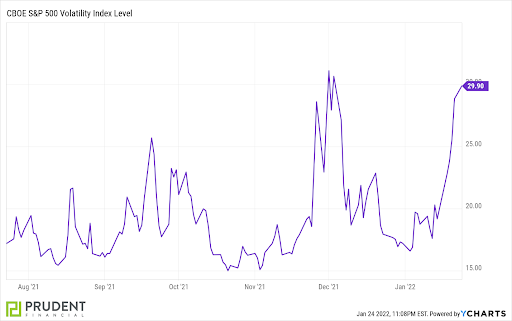

For the month-to-date period ending January 24, 2022, the stock market indices have retreated from their highs while the Vix has been increasing. In December of 2021 I wrote when the Vix is above 20 market risk is building, and when it crosses 30 volatility and downside risk are significant. (See first graph below) It is the Fed activity which pushed speculators to build these overvalued markets. However, now the Fed is reversing course in order to fight 7% inflation. This tightening monetary policy could deflate what inflated the stock market bubble. Please proceed to The Details for my description of how bear markets move.

Please proceed to The Details for an explanation of the relationships to watch moving forward.

“Volatility matters, because it defines the uncertainty of the price at which an asset will be liquidated.”

–Peter Bernstein

The Details

For the month-to-date period ending January 24, 2022, the S&P 500 Index is down 7.5%, the Nasdaq 100 is down 11.7%, and the Russell 2000 is down 9.6%. In roughly three weeks, over one-fourth of last year’s S&P 500 gains have been eliminated. Last week the Vix (Volatility Index) closed at 28.9. Monday, January 24, saw extreme volatility in the markets. The Dow plunged over 1,100 points before recovering this downturn, closing up 99 points.

As stated in my December 7, 2021, newsletter, “The Volatility Index or Vix is an index calculated from the prices of S&P 500 Index options and is intended to give a 30-day forward projection of volatility. Over the long run, the Vix has averaged around 18. When the Vix is lower than this, it typically indicates there is a lower risk of near-term volatility in the market. However, when the index jumps above 20, it usually means risk is building. In times of market turmoil, such as during the Financial Crisis and the Pandemic, the risk tends to jump rapidly to extremely high levels. The Vix has been nicknamed the ‘Fear Index.’” A Vix over 30 usually indicates extreme volatility and significant downside risk.

Last week the Vix began the week around 21 and rose throughout the week ending at 28.9. On Monday this week, the Vix soared to over 38 before settling back to close at 29.9. See the recent rise in the Vix in the chart below.

As explained in last week’s missive, the Fed has signaled their plans for tightening monetary policy. The incredible bubble in stock valuations was fueled by the “risk-on” sentiment of investors and speculators. For many, this sentiment was based upon the mantra, “Don’t fight the Fed.” It appears sentiment is changing to “risk-off” as a result of the Fed’s plans for tightening.

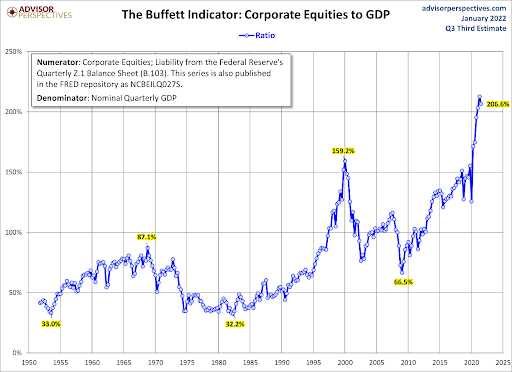

The combination of the Fed’s change in monetary policy, a slowing economy, high inflation, and record debt-to-GDP appears to have triggered the start of a new bear market. Market valuation, as shown by Warren Buffett’s favorite indicator, Market Cap-to-GDP, is in record territory. This means there is a long way for this bear market to go to reach “normal” valuations. See the chart below from Advisor Perspectives.

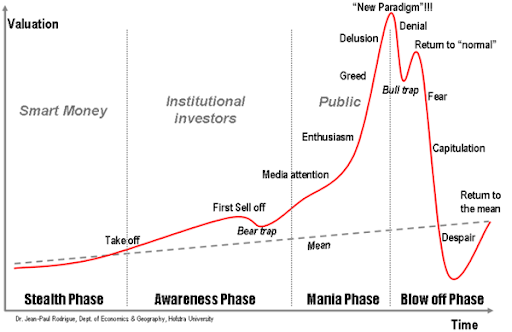

Stock prices in bear markets do not drop in a straight line. In fact, some of the strongest rallies occur during bear markets. Monday’s massive reversal, recapturing over 1,100 Dow points, is a perfect example of a bear market rally. When the Vix is in the upper 20’s or higher, daily market volatility is typically high. Investors should expect huge down-days with intermittent strong rallies. When the rallies occur, many financial pundits will claim the bear market is over, and it is time to jump head-first into the market. This behavior devastated many investors during the 2000-2002 bear market. In today’s technologically advanced world, program trading, options trading and hedging transactions exacerbate intra-day market movements.

Historically, bear markets don’t end after a strong rally with investors anxiously waiting to buy, buy, buy! Typically, at the end of bear markets, investors have become so fearful they are afraid to jump back into the market. Investors are no where near the “Despair” portion of the Blow off

Phase in the chart below.

It should be noted that should the Fed announce any reversal in their tightening plans, this early in the bear market, sentiment could quickly change pushing the market back to all-time highs. All this would do is delay the ultimate bear market and increase the level of overvaluation which will eventually be corrected.

The S&P 500 Index closed at 4,398 down 5.7% for the week. The yield on the 10-year Treasury Note fell to 1.75%. Oil prices increased to $85 per barrel, and the national average price of gasoline according to AAA rose to $3.33 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.