Executive Summary

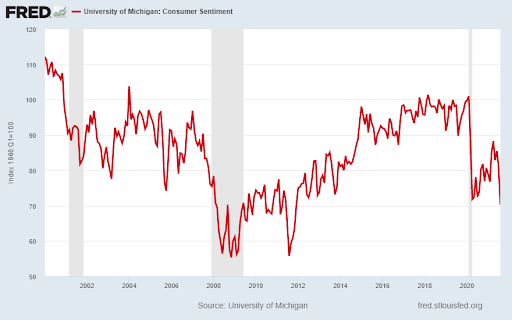

Drawing upon Dr. Lacy Hunt’s Quarterly Review and Outlook for the third quarter 2021, this week’s commentary looks at the relationship between debt and economic growth. The amount of new debt needed to produce a new dollar of GDP currently is near an all-time high. While debt and money supply have soared, the velocity of money has plunged. (See 2nd graph) Meaning the Fed can create money; however, it is not generating the intended growth. The temporary jump in GDP from the pandemic related stimulus (debt funded), is now ending. The Atlanta Fed’s GDPNow model has plummeted to 0.5% for the third quarter. Additionally, consumer sentiment has recently tumbled to a level below the lowest level experienced during the pandemic recession (third graph).

Please proceed to The Details for a complete look.

“If you don’t know where you are going, you’ll end up someplace else.”

–Yogi Berra

The Details

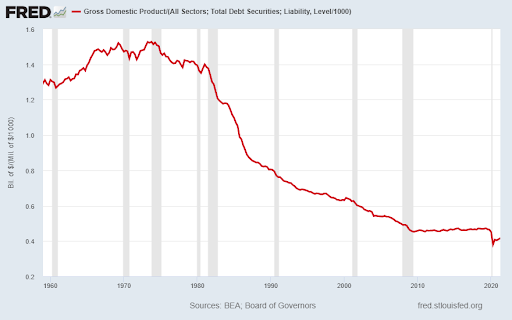

In this week’s missive, I will draw upon Dr. Lacy Hunt’s (Hoisington Investment Management) Quarterly Review and Outlook for the third quarter 2021. Consistent with his ongoing theme, the letter highlights the inverse relationship between debt and economic growth. Specifically, he illustrates the falling “Marginal Revenue Product of Debt” (MRPD: the additional dollar of GDP generated by an additional dollar of debt). See the graph below produced with data from the St. Louis Fed FRED database.

The inverse of MRPD is the amount of additional debt needed to produce a dollar of GDP. Currently, the additional debt needed to produce a dollar of GDP is near an all-time high. As Dr. Hunt states, “The historic trends and the studies indicate that the use of debt capital has moved well beyond the productive phase. This is in accordance with the law of diminishing returns, a basic concept in economic theory.”

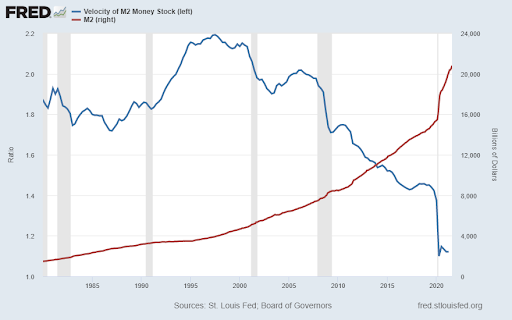

While debt as a percentage of GDP has soared, the velocity of M2 (the frequency at which one dollar is used to purchase domestically produced goods or services in a year) has plunged, illustrating the diminishing returns of additional debt. Again from Dr. Hunt, “The Fed is able to increase money supply growth but the ongoing decline in velocity means that the new liquidity is trapped in the financial markets rather than advancing the standard of living by moving into the real economy.” As can be seen below, the velocity of money has fallen almost 50% since its peak in 1997. “As velocity declines, each dollar of money produces less GDP.”

The massive increases in the money supply and debt have resulted in plunging velocity, which have led to lower economic growth. According to Dr. Hunt, real (inflation-adjusted) GDP growth per capita grew at an average annual rate of about 2.2% from 1870 until 2000. Since 2000, the rate has been cut in half to about 1.1%. So, while debt soared, economic growth plunged by about 50%.

As Dr. Hunt explained, “Excessive indebtedness acts as a tax on future growth and it is also consistent with [economist] Hyman Minsky’s concept of ‘Ponzi finance,’ which is that the size and type of debt being added cannot generate a cash flow to repay principal and interest.”

The unprecedented pandemic stimulus programs have now run their course. The temporary jump in GDP is now ending. Reality is again setting in as third quarter annualized GDP growth estimated by the Atlanta Fed’s GDPNow model has plummeted to 0.5%, from an original projection of 6.2%. Additionally, consumer sentiment has recently tumbled to a level below the lowest level experienced during the pandemic recession.

Dr. Hunt expects third quarter’s weakness to carryover through the fourth quarter and into 2022. In summary, debt continues to soar providing an ongoing drag on GDP growth. With most stimulus programs in the rearview mirror, consumer sentiment is falling. Some of this concern is spurred by the recent onslaught of inflation. On top of this, the Fed has stated they will soon start tightening monetary policy by tapering their bond purchases. With all of that said, the stock market continues to rise and disconnect further from reality. The more the disconnect grows, the further the market must eventually fall to reconnect with fundamentals.

Finally, Dr. Hunt states, “Currently, however, the decline in money growth and velocity indicate that the inflation induced supply side shocks will eventually be reversed. In this environment, Treasury bond yields could temporarily be pushed higher in response to inflation. These sporadic moves will not be maintained. The trend in longer yields remains downward.”

I agree that the weakening economy and growing debt levels will place downward pressure on long-term Treasury yields. Equity risk remains higher than ever and will eventually reverse course to reflect reality. Will the Fed’s tapering combined with weakening economic growth and consumer sentiment – together with China’s troubles outlined last week – be the tipping point?

The S&P 500 Index closed at 4,545 up 1.6% for the week. The yield on the 10-year Treasury Note rose to 1.66%. Oil prices increased to $84 per barrel, and the national average price of gasoline according to AAA rose to $3.39 per gallon.

Thank you for taking the time to read this week’s report. If you frequent these posts, you know that I always like to take a moment of my day to be grateful for the life I live and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.