Executive Summary

In the past China’s fast-growing economy was driven by production of exports for the West. However, post the Great Recession exports waned, so China turned to infrastructure spending for growth. This resulted in the over-development of buildings and entire ghost cities (never occupied). Now the massive debt used for this development is feared could become a contagion with pin popping abilities. John Mauldin wrote, “…the fear is more about possible financial contagion, which could extend outside China to foreign investors and lenders. Lately Evergrande has made headlines for defaults, and now Citigroup is watching Minsheng Bank for defaults. Only time will tell if these contagions will be the pin that pops the bubble.

Please proceed to The Details.

“Once a boom is well started, it cannot be arrested. It can only be collapsed.”

–John Kenneth Galbraith

The Details

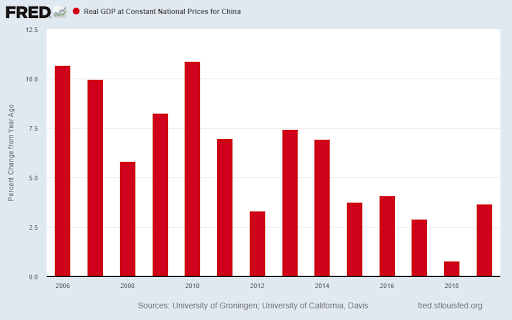

It was not too long ago when China’s economy was growing at what seemed to be astronomical rates, sometimes above 10%. Driven by Western technology and cheap labor, production soared mostly for exports to the West. With weakened demand post the Great Recession, exports waned, and economic growth began to slow. Centrally-planned China turned to infrastructure spending, resulting in massive overcapacity and mountains of debt. Real GDP growth plunged to 2.9% in 2018 (pre-pandemic). Keep in mind, it is widespread knowledge that the numbers derived from China are suspect at best, meaning 2.9% could actually be negative growth. See China’s real GDP growth rates in the table below.

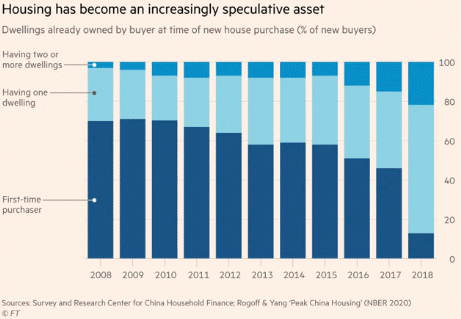

With few investment options available to the Chinese population, many dove headfirst into the real estate market. According to economist John Mauldin, prior to the Great Recession, 70% of the Chinese housing market were first-time homebuyers. Today about 85% of homes are purchased as investments. This push into real estate and infrastructure has led to massive overcapacity resulting in ghost cities and ever-growing debt. Developers have often been borrowing at interest rates over 20%. Much of the borrowing has come from off-shore lenders.

As mentioned in a prior missive, the developer Evergrande has captured the headlines of late as they default on interest payments. John Mauldin wrote (emphasis mine), “…the fear is more about possible financial contagion, which could extend outside China to foreign investors and lenders. Non-Chinese debt is around $20 billion and will likely be written off.”

According to the London Brief (via John Mauldin), “Today there are 35 ‘significant’ companies, as per the strategist’s definition, and 13 are saying in the dollar funding market that they should not be refinanced. This is like the sub-prime equivalent; one has gone down, and the others are feeling the knock-on effect. These are 12.5% of the current market cap of the property sector. The amount of market cap that has been lost is $250 billion and including Evergrande is $500 billion to give some scale of numbers.” Keep in mind, the property sector comprises almost one-third of China’s economy. And China is the second largest economy in the world.

John Mauldin highlights another of China’s risks, Minsheng Bank. “In 2008, Bear Stearns imploded due to subprime debt. Citigroup is watching Minsheng Bank, which has lost over half of its market cap over the last few months. It is currently modelling a 20% probability of default. It could create contagion effects within the banking system.”

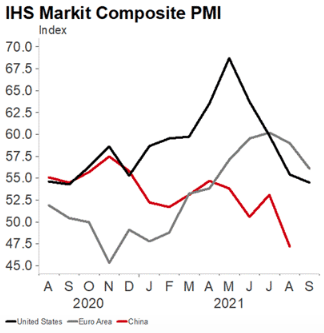

China’s third quarter GDP growth was recently reported as 4.9%, compared to the prior year. This fell short of expectations as analysts projected 5.1% growth. For 2021, second quarter GDP grew 1.3% higher than first quarter, and the third quarter rose a mere 0.2% versus second quarter GDP. The slowdown is visible in the IHS Markit PMI (Purchasing Manager Index). A reading below 50 indicates contraction. See the graph below.

China is dealing with a number of serious issues, which could have significant contagion effects around the globe. Slowing economic growth, defaulting property developers, and banks holding sketchy debt. Whether China’s problems become troubles for the U.S. is yet to be seen. However, combined with the slowing economy and debt problems in the U.S., together with planned tightening by the Fed, this could end up being the pin which pops the record high bubble in stock valuations. Time will tell.

The S&P 500 Index closed at 4,471 up 1.8% for the week. The yield on the 10-year Treasury Note fell to 1.58%. Oil prices increased to $82 per barrel, and the national average price of gasoline according to AAA rose to $3.32 per gallon.

Thank you for taking the time to read this week’s report. If you frequent these posts, you know that I always like to take a moment of my day to be grateful for the life I live and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.