Executive Summary

The longer a bubble in stock prices expands, the more the word “valuation” becomes considered irrelevant. Valuation means determining what price is reasonable for a particular stock or stock index such as the S&P 500. A few months ago, I shared a valuation calculation chart, which I have updated below (see first chart). While the methodologies vary for each calculation, the results all point to significant risk in the current stock market. I am not predicting an imminent crash in the market. What I am pointing out is historically when markets were this overvalued, the second half of the market cycle has had a significant correction. It is near the peak of stock market bubbles, when the word “valuation” becomes a dirty word.

Please proceed to The Details.

“A gambler never makes the same mistake twice. It’s usually three or more times.”

–Terrence “VP Pappy” Murphy

The Details

The longer a bubble in stock prices expands, the more the word “valuation” becomes considered irrelevant. Each bubble is justified by the fad of the time. Labels are concocted to bestow legitimacy to the bubble. In the late 1920’s it was called the “New Era.” The technology bubble of the late 1990’s became acceptable because the U.S. was entering a “New Economy” where “old school” valuations were no longer applicable. Today it is the Fed (Federal Reserve Bank). Investors and speculators now believe the Fed will never “allow” the stock market to fall, so why worry with valuations?

It even gets worse than merely not concerning themselves with valuations. If someone highlights the tremendous levels of overvaluation, they are looked upon with derision and oftentimes chided with labels such as “perma-bear” or pessimist. In reality, this is a defense mechanism for speculators to rationalize stock prices, and not feel guilty about purchasing stocks priced at valuation levels never before seen.

Some might even wonder what does “valuation” mean? Valuation means determining what price is reasonable for a particular stock or stock index such as the S&P 500. There are many methodologies used to determine valuation, some more accurate than others. What I mean by “accurate” is validation of reasonable prices as determined by a valuation method corroborated by examining actual subsequent prices. Some calculations compare price to revenue, others use some derivation of earnings, and Tobin’s Q (Q Ratio) utilizes replacement costs of tangible assets. While there are some differences in the current valuation levels for the S&P 500 calculated via different methodologies, overall, the message is consistent. The market is massively overvalued.

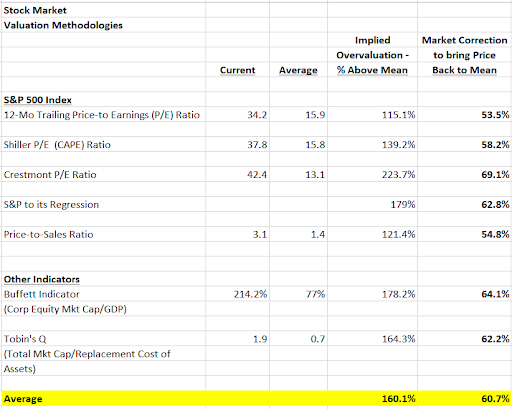

Most valuation methods determine a reasonable price based upon the long-term historical mean. The valuation method is calculated by comparing the price of the S&P 500 to earnings-per-share, sales, or some other indicator. Then the result is compared to the long-term average. A few months ago, I showed a chart of seven different valuation calculations. I have updated the chart and show the results below.

Although these seven methodologies utilize different metrics to calculate valuation, the results are fairly consistent. Overall, the average of these seven calculations indicate market valuation for the S&P 500 is about 160% above its long-term average. Stated differently, it would take a market correction of almost 61% merely to bring prices back to average valuation levels. Any drop below average would require a fall of over 61%.

When reading the above paragraph, how many readers shook their head or went “pfffft.” Maybe even thinking, there is no way the market would correct that much? Furthermore, how many not only reacted in such a manner, but also thought, “Bob is really a perma-bear!”? These are normal reactions near the peak of a market bubble. Investors do not want to believe the market could ever correct that much, so they express disbelief to any who highlight possibilities based upon history.

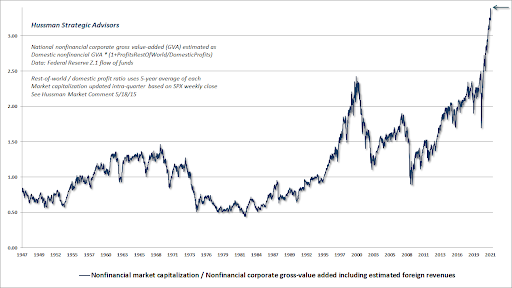

Economist John Hussman has probably performed the most research in the area of valuation and subsequent returns. The methodology he has found most correlated with actual subsequent results (i.e., most accurate) is shown below.

This methodology is consistent with those in the chart shown previously. This graph shows prices have pushed valuations to all-time highs. This too reveals a correction in the neighborhood of 60-65% would merely bring prices back to what history would indicate are more “normal” levels.

Stocks are purchased for two reasons: either their prices are at levels where future earnings will provide a reasonable return without excessive risk to principal; or they are purchased by speculators without regard to price, under the assumption that the prices will only go up in the future, no matter what amount of earnings or losses are generated. I believe it is pretty clear where prices are today.

Maybe this will be the first time speculators are proven correct, and prices never again fall to any significant degree. I would not bet on it. I believe the old saying, “History never repeats itself, but it does often rhyme.” Valuation has once again become a dirty word.

The S&P 500 Index closed at 4,391 up 0.8% for the week. The yield on the 10-year Treasury Note rose to 1.61%. Oil prices increased to $79 per barrel, and the national average price of gasoline according to AAA rose to $3.27 per gallon.

Thank you for taking the time to read this week’s report. If you frequent these posts, you know that I always like to take a moment of my day to be grateful for the life I live and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.