Executive Summary

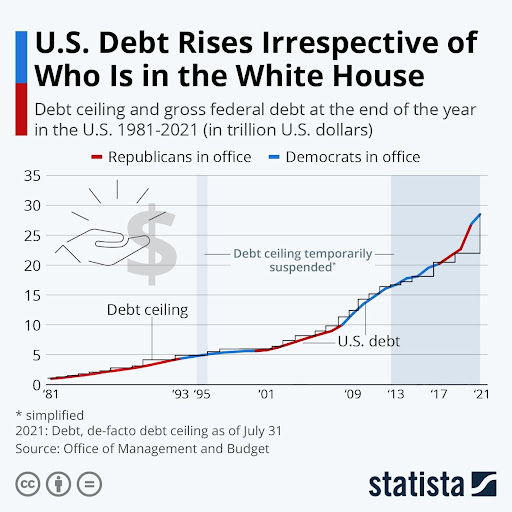

Is $28 trillion in United States government debt not enough? The answer is “no”, as the Congressionally approved deficit spending will require an increase in the U.S. debt limit. The debt has grown no matter which political party controls the White House (see first graph). However, the media and all politicians use the threat of a U.S. debt default as a fear tactic to scare investors. So, although much will continue to be debated about the raising of the debt ceiling, rest assured it will happen. Now the impact of the enormous U.S. debt due to deficit spending will come to roost someday, in the meantime the charade will play out in the news.

Please proceed to The Details.

“If printing money helped the economy, then counterfeiting should be legal.”

–Brian Wesbury

The Details

Apparently $28,837,000,000, via USDebtclock.org, is not enough debt. The charade of frightening the public that the world is about to come to an end if the “debt ceiling” is not raised is reaching a fevered pitch. The debt ceiling represents the maximum legal limit on Federal borrowing. Although the original intention was to keep a lid on too much borrowing, in reality, the limit merely allows for politicization of adding to the Federal debt. Since 1960, the debt ceiling has been pushed higher 78 times.

The media and politicians like to use the threat of not lifting the limit as a way of damaging one political party or the other. Increasing the debt ceiling does not authorize additional spending, but merely allows for additional borrowing to fund spending previously authorized. Threats of a government “default” send fear down investors’ spines. Are such fears rational? Will the U.S. truly default on its debts? No and never. A default is typically thought of as a bankrupt entity unable to pay its debts. The U.S. has the magical ability to print as much money as necessary to fund its debts and will never truly default. Although such printing could lead to other major financial disruptions, that is a topic for another newsletter.

The type of default being battered around is a “technical default.” Once the debt ceiling is eventually raised, and it always is, any postponed principal or interest payments will be made. The hyperbole about crashing economies and soaring new unemployment should be taken with a grain of salt. Yet that doesn’t stop the media from spreading the fear.

A recent Reuters article stated, “Failure to act could have catastrophic economic consequences. Moody’s last month warned that it could cause a nearly 4% decline in economic activity, the loss of almost 6 million jobs, an unemployment rate of close to 9%, a selloff in stocks that could wipe out $15 trillion in household wealth and a spike in interest rates on mortgages, consumer loans and business debts.” WOW! We better run for the hills. I believe neither political party would allow for this to occur. Neither party wants to give the impression they are for big deficit spending, despite the massive recent and forecasted deficits.

Currently, the Democrats control both houses of Congress and the Presidency. They could raise the debt ceiling without any Republican support using a process called “budget reconciliation.” However, it would be more appealing if some Republicans jumped aboard so it could be called a “bi-partisan” debt ceiling increase.

After the typical accounting gimmickry pushing off the need for new debt as long as possible, Treasury Secretary Janet Yellen indicated the debt ceiling must be raised by October 18 in order to avoid a [technical] default. So, for now it is a game of chicken. Be prepared for the end-of-world scenarios to grow.

In an equity market already priced close to three times what would be considered reasonable based upon historical valuations, it is possible that these discussions could impact stock market volatility. And with a $3.5 trillion “infrastructure” package in the wings, a significant increase in the debt ceiling is a must for Democrats.

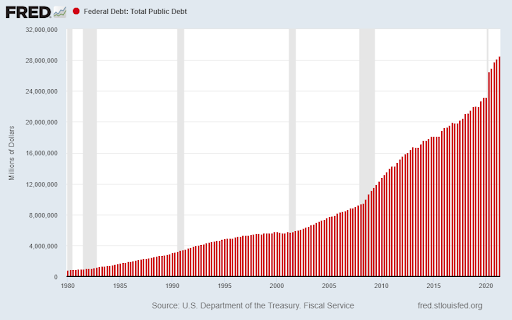

Even though everyone knows the debt ceiling will be raised eventually, and no interest or principal due will go unpaid, the amount of debt already accrued is on a trajectory to cause enormous other problems. Notice the rise in the annual debt balance shown in the graph below.

The fear mongering will continue, but the debt ceiling will be raised. However, the annual debt increases are nearing a vertical slope. This is not sustainable, but unfortunately has not and is not receiving the attention deserved. In the meantime, the charade continues.

The S&P 500 Index closed at 4,357 down 2.2% for the week. The yield on the 10-year Treasury Note rose to 1.47%. Oil prices rose to $76 per barrel, and the national average price of gasoline according to AAA increased to $3.20 per gallon.

Thank you for taking the time to read this week’s report. If you frequent these posts, you know that I always like to take a moment of my day to be grateful for the life I live and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.