Executive Summary

Last week the stock market took a roller coaster ride while bonds took a hit. The 10-year Treasury Note yield rose to 1.46% based mainly on two factors: the Fed’s announcement of tapering their monthly bond purchases beginning late this year and the second is the hope that Congress passes a massive spending bill resulting in more economic growth. The hope of growth is precarious as forecasted growth is already slowing (see GDP Now in second graph). The last time the Fed attempted tapering, the stock market fell, investors sold stocks and bought Treasury bonds as a flight to safety. Thus, I believe that the yield moves are short-term, and in the big picture interest rates remain low.

Please proceed to The Details.

“There are two kinds of people in the world: (1) Those who can extrapolate from incomplete data.”

–Anonymous

The Details

Last week saw the stock market plunge on Monday only to bounce back by the end of the week, ending the week slightly positive. But what really caught investors’ eyes was the move in the 10-year Treasury Note yield, rising to 1.46%. As usual, there are a couple narratives floating around to “explain” why rates jumped last week. Let’s examine these explanations and see if they have any merit to them.

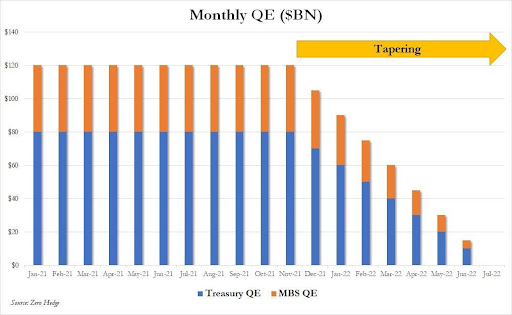

The first reason has to do with the Federal Reserve Bank’s (Fed’s) announcement regarding potential tapering of their QE (Quantitative Easing) programs. During their last press conference, Chairman, Jerome Powell, made it clear that absent significant new data, the Fed will likely announce plans to taper their bond purchases at the November FOMC (Federal Open Market Committee) meeting. Chairman Powell indicated they could complete the tapering process by mid-2022.

Under the existing QE program, the Fed has been purchasing $80 billion of Treasury securities per month, and approximately $40 billion of mortgage-backed securities for a total monthly buy of about $120 billion. There are those who believe that the announcement of a potential reduction in the purchases will create less “demand” for Treasuries, thus causing prices to fall and yields to rise. This simple analysis excludes the real danger involved in tapering. The mantra by investors over the past decade has been “don’t fight the Fed.” In other words, as long as interest rates are low and they Fed is implementing QE, stock prices will rise. This phenomenon is really based upon the psychological impact of QE on investors versus any actual mechanical connection between the two. However, low interest rates have encouraged using leverage to purchase stocks. When tapering finally begins, it is possible investors begin to lose confidence in the Fed’s ability to keep record high valuations propped-up. If equity prices begin to correct, much of that money will likely move into Treasury securities, thus sending their prices up and yields down. See a graph of QE purchases and potential tapering below.

The second narrative for justifying the slight rise in long-term rates surrounds hopes that if Congresses passes a massive new infrastructure bill, economic growth will jump. There are a couple fallacies with this assumption. Initially, it ignores the fact that economic growth is already slowing. As prior Federal stimulus has run its course and supplemental unemployment benefits have ended, the expectation for growth is waning. Notice in the graph below from the Atlanta Fed that the expectation for third quarter growth has fallen from over 6% to only 3.2%.

And there is a tremendous misunderstanding about how an infrastructure bill differs from prior stimulus packages. The stimulus programs put money directly into consumers’ hands. This allowed the funds to be spent immediately providing a short-term boost to the economy. As I have stated previously, this type of boost is like a “sugar high” and does not provide long-term economic benefits but does harm future growth through the creation of additional debt. Politically, the short-term boost scores points; however, they don’t last very long.

While infrastructure involves more durable spending, the timing of such programs tends to encounter unforeseen problems. The spending of such funds can take years, delaying any potential economic benefit far beyond what was originally hoped. The thing is infrastructure spending is local. But it can take years for funds to work through the processes and red tape required to receive final authorization for expenditures. Funds must be allocated to states, where they are then earmarked for counties and ultimately cities. Studies must be performed to determine what programs are most needed. Feasibility and environmental studies might need to be performed. Then there is competitive bidding considering union and minority contractor needs. The process is far from the shot in the arm received through direct stimulus. And for the trading algorithms to jump the gun and assume GDP growth will surge and therefore interest rates rise, is getting ahead of the game to say the least.

I have written previously that I do not believe the Fed will actually taper their QE purchases. If they do, it won’t last long in my opinion. The way this could play out is tapering is announced in November to begin in December 2021 or January 2022. Investors become scared and shift to a “risk-off” mentality, selling equities hand and foot. The downward pressure on the stock market, combined with what should be a more noticeable decline in GDP growth rates, could force the Fed to “delay” tapering or reduce the amount of tapering and extend the period over which it is anticipated. Either way, it is my opinion the recent bump in long-term interest rates is merely a short-term misinterpretation of the data, or algorithms selling when in reality they should likely be buying long-term Treasuries. Despite the short-term blips, I expect long-term interest rates to remain low.

The S&P 500 Index closed at 4,455up 0.5% for the week. The yield on the 10-year Treasury Note rose to 1.46%. Oil prices rose to $74 per barrel, and the national average price of gasoline according to AAA remained at $3.19 per gallon.

Thank you for taking the time to read this week’s report. If you frequent these posts, you know that I always like to take a moment of my day to be grateful for the life I live and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.