Executive Summary

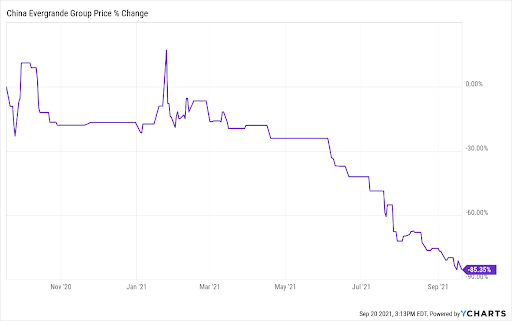

Monday’s stock market move may have seemed a bit extreme. Many financial pundits will speculate as to the cause; however, sometimes they are correct and other times it is just speculation. This move appears to have been the contagion effect from China’s Evergrande Group, whose stock is down 85% over the past year. Overdevelopment of buildings – many of which were never occupied – and too much leverage have caused the China developer to be in much trouble. Short a Chinese government bailout, things could get ugly. Whether it is Evergrande, or the many other risks baked into this overvalued market, the situation was not caused quickly and will not be resolved quickly.

Please proceed to The Details.

“A small debt produces a debtor; a large one, an enemy.”

–Publilius Syrus

The Details

There is always a post-move explanation for why the stock market jumped or fell. Oftentimes, the most recent news event is blamed as the culprit. Sometimes that is correct, but frequently there are deeper problems not discussed and/or not understood by financial pundits.

Also, it is important to note that in a stock market priced nearly three times higher than justified by fundamentals, big moves can erupt from what might seem like modest events. Anyhow, the plunge in the stock market on Monday appears to relate to the contagion effect from China Evergrande Group (Evergrande). However, remember the market has fallen the past two weeks on “other news.”

The Chinese stock market was closed Monday on holiday; however, the Hong Kong Hang Seng Index felt the impact of Evergrande, dropping over 3%. Monday morning the European markets were falling with the German DAX down 2.3%. Evergrande is China’s second largest property developer, and according to some analysts, is on the brink of collapse. Currently, Evergrande maintains over $300 billion in debt and trouble abounds.

To understand the predicament Evergrande is in, it is important to know a little about China’s recent history. Over 15 years ago China loosened restrictions on property ownership sparking a massive development boom. Citizens were purchasing one or more apartments for investment purposes, even though most of the apartments were never occupied. Developers incurred tremendous debt as projects grew. This was China’s strategy for boosting economic growth. Eight years ago, the program 60 Minutes ran a story about the construction of “ghost cities.” (See here – approx. 12 minutes – https://youtu.be/uxjwhk1ktNw)

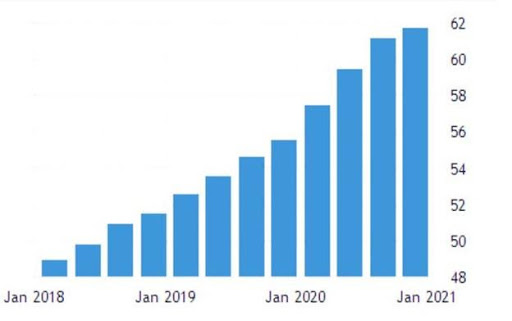

Prices soared as investors flocked to real estate investments. Many undertook debt to purchase their “investments.” Similar to the U.S. prior to 2007, many believed real estate prices could only go up. With leverage off of the charts in the midst of an enormous real estate bubble, China recognized the misallocation of capital and implemented regulations to reign in the sector. Was it too little too late? The graph below illustrates the massive growth in the % of household debt to GDP (via Real Investment Advice).

To demonstrate how absurd the undertaking became, many new, albeit unused, buildings were eventually torn down. On August 27 of this year, 15 unfinished skyscrapers were demolished after standing for seven years. These buildings had been abandoned for quite some time and were incurring damage. The video of this demolition is remarkable and can be seen here (https://youtu.be/Om6b0_ffyFQ).

Back to Evergrande, which has been struggling to pay suppliers, investors and lenders. It is reported that it has attempted to persuade suppliers to accept physical real estate in lieu of payments. According to CNBC.com, “In an August report, S&P estimated that over the next 12 months, Evergrande will have over $240 billion yuan ($37.16 billion) of bills and trade payables from contractors to settle – around 100 billion yuan of that amount is due this year.”

Reuters reports, “A major test comes this week, with Evergrande due to pay $83.5 million in interest relating to its March 2022 bond on Thursday. It has another $47.5 million payment due on Sept. 29 for March 2024 notes. […]

In any default scenario, Evergrande, teetering between a messy meltdown, a managed collapse or the less likely prospect of a bailout by Beijing, will need to restructure the bonds, but analysts expect a low recovery ratio for investors.”

As a result, Evergrande stock is down over 85% over the past year.

Already the spillover effect is impacting the stock prices in other Chinese development firms. Many U.S. investors have played-down the concerns over Evergrande, assuming the Chinese Communist Party (CCP) will bailout the company. So far, it appears the CCP is not planning on such a bailout.

There are many areas of contagion, including the impact of overleveraged Chinese consumers, the effect of debt defaults on investors and the banking system, plunging real estate prices, reduced demand for certain commodities, and as seen Monday, the fear-trade in U.S. stocks and bonds. This crisis was not created quickly and will not be resolved quickly.

The S&P 500 Index closed at 4,433 down 0.6% for the week. The yield on the 10-year Treasury Note rose to 1.37%. Oil prices rose to $72 per barrel, and the national average price of gasoline according to AAA increased to $3.19 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.