Executive Summary

Despite massive stimulus and extreme monetary policy, the “expansion” period between the Great Recession and the Covid19 recession experienced the weakest post-WWII growth rate, at 2.3% average annual growth (see second graph), on record. While the Fed keeps “printing” money (3rd graph), the Federal deficits continue (4th graph) to soar. Stimulus provided to encourage personal consumption and nonproductive debt does not provide long-term results; it only delivers a temporary boost followed by a return to the pre-stimulus trend. At some point a painful restructuring will occur.

Please proceed to The Details for an explanation of the relationships to watch moving forward.

“We can ignore reality, but we cannot ignore the consequences of ignoring reality.”

–Ayn Rand

The Details

Over the past several decades, as the economy slipped into recession, the Federal Reserve Bank (Fed) in conjunction with the Federal Government, did all they could to boost economic growth. The fallacy of these actions is they only provide a brief sugar high before returning to the pre-stimulus trend. The structural obstacles are never dealt with; therefore, the impediments to growth merely compound.

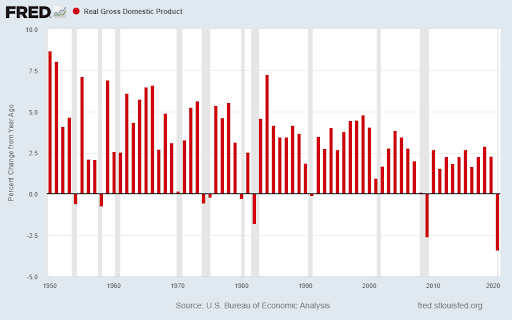

The graph below illustrates annual real GDP growth. Notice the declining trend in growth.

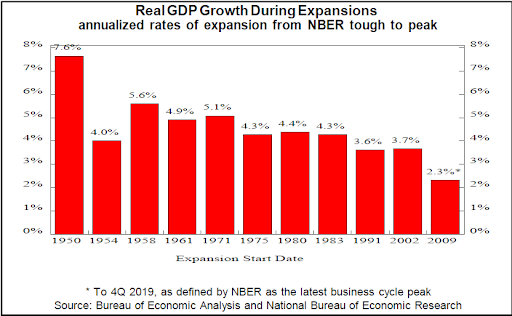

The chart below from economist Gary Shilling, shows real GDP growth during expansions (between recessions). Notice the expansion since the end of the Great Recession in 2009 had an annual growth rate of 2.3%, which is the slowest growth during an “expansion” post-WWII.

It is perplexing to those unfamiliar with the underlying structural issues, that at the same time the U.S. has experienced the lowest interest rates on record, along with the highest post-WWII stimulus-induced deficits and levels of Quantitative Easing (QE), the growth rates were the slowest.

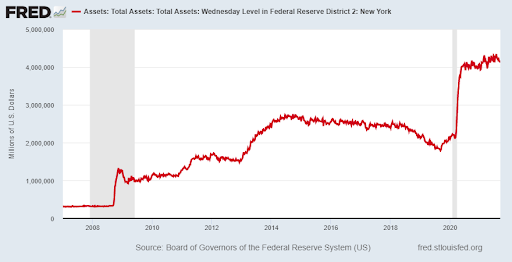

The amount of QE (asset purchases by the Fed with “printed” money) is off the charts. See the enormous growth in Fed assets since 2009.

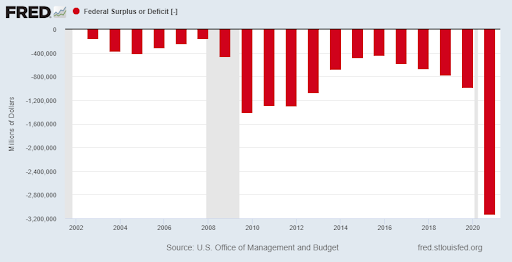

And the deficit spending has only compounded with no end in sight. The U.S. will likely see $2 trillion plus deficits as far as the eye can see.

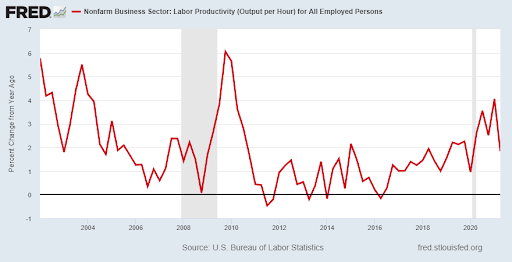

To understand the reasons why economic growth is stuck in a rut and is only getting worse with each post-recession “expansion,” one must recognize what is required to achieve economic growth. To have economic growth, it is necessary to have either increasing productivity (output per hour), a growing workforce, or both. The graph below highlights the low level of productivity growth over the past decade and the recent downturn in productivity.

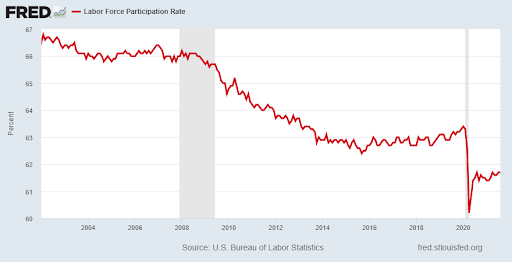

As the working-age population grows, the percent who are actually participating in the labor force is declining. Notice the extreme drop post the Covid19 recession.

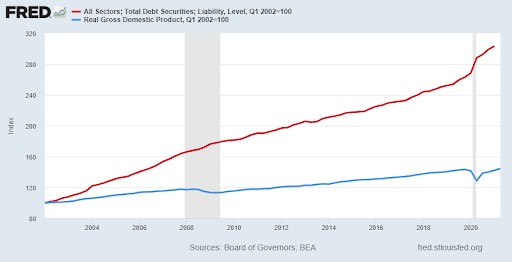

However, the overarching issue or the dirty little secret – which is never dealt with – is the amount of debt and debt growth in the economy. Productive debt – debt used for purchasing productive assets which will provide a return that can be used to service debt – growing at rates slower than the economy is considered good debt. Unfortunately, most of the debt issued has been issued for consumption purposes. This type of debt merely pulls forward future consumption. Dollars which could be used for future consumption, must now be utilized to service the debt. This provides a short-term boost to economic growth but reduces the long-term growth trend. Notice how the rate of growth of debt (red line) in the chart below is significantly higher than the rate of GDP growth. This trend has been occurring for decades and is not sustainable.

It is this debt drag which is the main culprit for why the “expansion” post the 2009 recession was the slowest post-WWII expansion. Each time the economy begins to slip into recession, instead of dealing with the debt crisis, the Fed and Federal Government conspire to prop-up debt and consumer spending through massive increases to the Federal deficit and enormous amounts of QE via “printed” money.

At some point the deficits and increases in the monetary base will be dealt with through a serious debt restructuring plan, which will not occur without significant pain. Otherwise, the U.S. could end up with significant stagflation, i.e., runaway inflation and slow growth. The day of reckoning is getting closer.

The S&P 500 Index closed at 4,459 down 1.67% for the week. The yield on the 10-year Treasury Note rose to 1.34%. Oil prices rose to $70 per barrel, and the national average price of gasoline according to AAA decreased to $3.18 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.