Executive Summary

This week’s update is brief, so a summary may seem unnecessary. The two main points are the disappointing 235,000 new jobs reported on Friday of the holiday weekend, and the Atlanta Fed’s revision lower of the third quarter GDP forecast. The jobs number was a big miss, and the unemployment rate does not make sense (explained below). And with growth revised lower, Fed policy, interest rates and the stock market will be impacted.

Please proceed to The Details.

“No major institution in the US has so poor a record of performance over so long a period as the Federal Reserve, yet so high a public reputation.”

–Milton Friedman

The Details

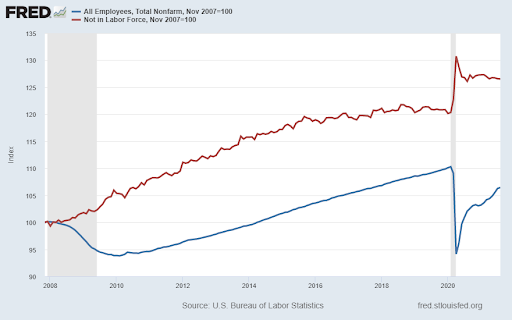

This week I will provide a brief post-Labor Day update. Last Friday, the Bureau of Labor Statistics (BLS) disappointed, reporting 235,000 new jobs in August, about 500,000 short of estimates. The number of employed individuals as of August 31 was about 153.2 million. For comparison, on December 31, 2007, the month the Great Recession started, the number of employed individuals totaled 146.2 million. Therefore, despite the working-age population growing by 28.5 million people, the number employed has only grown by 7 million over the past 13.7 years. Additionally, the labor force participation rate has dropped from 66% on December 31, 2007, to 61.7% today. As a result, the number of working-age individuals “not in the labor force” jumped from 79.3 million to 100.1 million. The unemployment rate was a low 5% at the start of the Great Recession. Today the rate has recently fallen to 5.2%. Does that make sense based upon the data provided? The reason this does not make sense is the number of people “not in the labor force” are not included in the calculation of the unemployment rate. Notice the difference in the rate of change of the number employed versus not in the labor force in the graph below.

In discussing the slowing economy, last week I highlighted the drop in the Atlanta Fed’s GDPNow forecast for third quarter GDP growth had fallen from over 6% to 5.1%. Well, hold on to your hat, last Friday this forecast plunged to 3.7%.

Still below the pre-Covid trend, this revision will delay the opportunity of getting back on trend. It is important to notice the disappointing economic data as it will impact the future of long-term interest rates, Fed policy and the stock market.

The S&P 500 Index closed at 4,535 up 0.58% for the week. The yield on the 10-year Treasury Note rose to 1.32%. Oil prices remained at $69 per barrel, and the national average price of gasoline according to AAA increased to $3.19 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.