Executive Summary

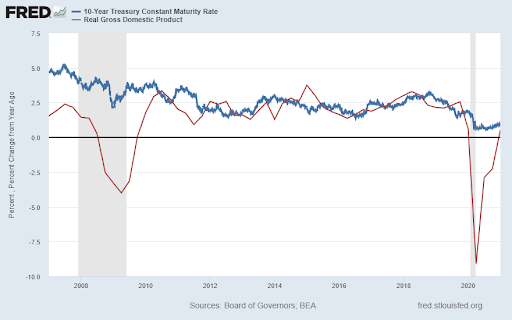

The bond market is often considered a better indicator of the economy than the stock market. Currently the 30-year Treasury yield has fallen to 1.87%, and the 10-year Treasury Note yield is down to around 1.25%. (See the second graph illustrating the 10-year Treasury rates typically have tracked Real Gross Domestic Product growth.) While the yield drop means an increase in bond prices, these trends in yields correlate with slower growth. Thus, the bond market may be signaling a slowing economy and investors may want to pay attention as to the possible negative impact on the stock market.

Please proceed to The Details for my full analysis.

“The actions taken by central banks and other authorities to stabilize a panic in the short run can work against stability in the long run if investors and firms infer from those actions that they will never bear the full consequences of excessive risk-taking.”

–Ben Bernanke

The Details

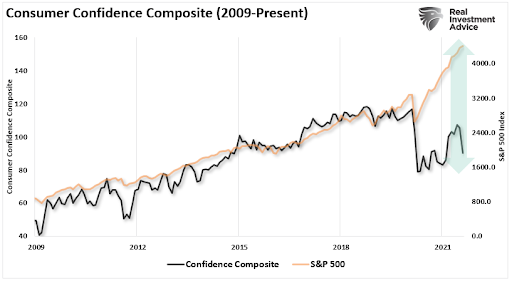

I have often written that the bond market represents a better indicator of the economy than the stock market. This is especially true today as stocks now represent gambling tools, as they reach all-time record valuations. The chart below from Real Investment Advice shows stocks are even deviating from Consumer Confidence. Presently, Confidence seems to agree more with the bond market.

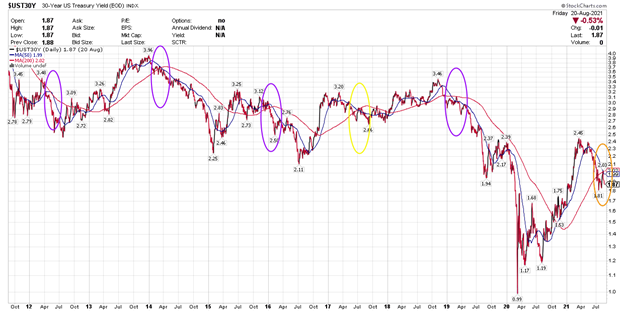

Often yields on Treasury bonds fall when economic growth is anticipated to be weak. In the graph below, the 30-year Treasury yield has been falling since early April of this year, now down to 1.87%. When the 50-day moving average crosses below the 200-day moving average, it usually presages a drop in yields. Notice in the graph below, the last 6 crossovers are highlighted. The crossovers in purple were followed by steep declines in the 30-year yield. The one in 2017, highlighted in yellow, resulted in a slight drop and sideways movement before rising. At the moment the outcome of the most recent crossover is unknown. However, indications are the economy is slowing and rates could potentially fall precipitously.

The graph below illustrates the correlation between the 10-year Treasury Note yield and real GDP growth.

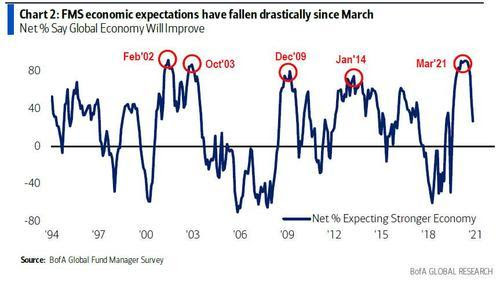

Expectations that the global economy will improve are rapidly declining, as shown below in the BofA Global Fund Manager Survey.

At the same time economic growth seems to be hitting some speedbumps, the Federal Reserve is contemplating reducing their monthly bond purchases (QE). While I do not believe the Fed will actually taper their purchases, the talk of tapering combined with slowing global economic growth could send the massively overvalued stock market into a correction. The depth and length of any potential downturn in stock prices will largely depend upon how current events impact investor psychology. It is important to understand that once psychology reverses course, the distance to long-term valuation averages is substantial.

The crossover in moving averages of 30-year Treasury yields could be forewarning investors of what lies ahead. It might be wise not to ignore such warning.

The S&P 500 Index closed at 4,442 down 0.59% for the week. The yield on the 10-year Treasury Note fell to 1.26%. Oil prices fell to $62 per barrel, and the national average price of gasoline according to AAA fell to $3.16 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.