Executive Summary

Last week all the economic focus was on what Fed Chairman Powell would say at the Jackson Hole meeting. It seems the Fed, as usual, allowed itself enough wiggle room with no real time commitment, and investors decided to opt for a bullish interpretation. The stock market reacted bullishly while many thought the opposite would happen at news of bond purchase reductions later this year. Last week’s newsletter indicated the bond market appears to be signaling lower growth, which contrasts with a rising stock market. The Fed forecasted asset purchase reductions; however, interest rate moves do not seem to be in the near future. The unresolved question remains, if the Fed does not change its current monetary policy, can the stock market continue to rise in the face of weakening economic growth?

Please proceed to The Details.

“I know that you believe you understand what you think I said, but I’m not sure you realize that what you heard is not what I meant.”

–Alan Greenspan

The Details

The attitude of investors has been that as long as the Federal Reserve Bank (Fed) does not reduce their $120 billion in monthly bond purchases (Quantitative Easing) or raise interest rates, the stock market will go up forever. Last week this was put to the test, and it appeared to falter. The news espoused from the much-anticipated Fed Jackson Hole meeting last week was tapering should begin later this year. However, interest rate hikes seem to be in the distant future. One would have expected the stock market to plunge on news of upcoming tapering. What happened?

It seems the Fed, as usual, allowed itself enough wiggle room with no real time commitment, and investors decided to opt for a bullish interpretation. Here are a couple points from Fed Chairman Jerome Powell’s speech from Jackson Hole (via Real Investment Advice):

“We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, measured since last December, when we first articulated this guidance. My view is that the ‘substantial further progress’ test has been met for inflation. There has also been clear progress toward maximum employment. At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.

The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.”

These statements are as clear as mud. Maybe investors are seeing through the economic data, realizing the economy is starting to slow; and therefore, there will not be any taper later this year. And forget about interest rate hikes. But then is a weakening economy bullish for markets? It seems a stand-off is approaching between Fed actions and economic reality.

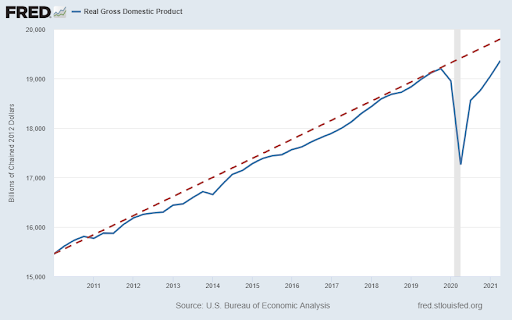

Many investors get caught up in the short-term data and cannot see the forest for the trees. Yes, the annualized quarterly GDP growth numbers seem large now, but they are the direct result of close to $4 trillion in Federal spending to juice an economy which had fallen off a cliff due to Covid19. Big drops plus massive stimulus equal big short-term bounces. For instance, the Atlanta Fed’s GDPNow forecasting model is projecting third quarter annualized GDP growth to be 5.1%. This sounds outstanding until one realizes this number has already been revised down from well over 6% and will probably get revised even lower. See the chart below.

But more importantly, even with the significant short-term spurts this year, including the above, the level of real gross domestic product remains about 2% below the pre-Covid trend.

As written in last week’s missive, the bond market typically provides a better picture of what is to come in the economy. The 30-year Treasury bond is currently yielding around 1.89%. It appears to be indicating that economic growth is in the process of turning lower. Lower growth will lead to even lower long-term yields, absent another major stimulus program.

It is my belief that the Fed will not taper its bond purchases because they will proclaim what the bond market is signaling. And furthermore, there is far too much debt for the Fed to even consider the option of raising short-term rates. The unresolved question remains, if the Fed does not change its current monetary policy, can the stock market continue to rise in the face of weakening economic growth? Time will tell.

The S&P 500 Index closed at 4,509 up 1.52% for the week. The yield on the 10-year Treasury Note rose to 1.31%. Oil prices rose to $69 per barrel, and the national average price of gasoline according to AAA fell to $3.15 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.