Executive Summary

Benjamin Graham, the father of value investing and mentor to Warren Buffett, in December 1959 commented that at the peak of all bull markets, “past experience” only represents the “sunny side of the investment”. And he also indicated the sentiment that the market has always come back after declines to make new heights fails to recognize it may take 20-25 years. By some valuation measures, the S&P500 is currently 131% above its long-term average. Furthermore, the market is rich with risk as only 66% of stocks in the S&P 500 are trading above their 50-day moving average. Recent areas of interest include weakening economic data from China, a resurgence in possible COVID restrictions and new geopolitical concerns. Although investors may believe the market and economy are now in a new paradigm, history is replete with examples of irrationality and the resulting devastating outcomes.

Please proceed to The Details.

“The present is the past rolled up for action, and the past is the present unrolled for understanding”

–Ariel Durant, The Lessons of History

The Details

Benjamin Graham, the father of value investing and mentor to Warren Buffett, made the following comments on December 17, 1959 (via Hussman Market Comment, August 2021). Notice the similarity to consensus thinking today.

“Investors accept in theory the premise that the stock market may have its recessions in the future. But these drops are envisaged in terms of the experience of the past ten years when the maximum decline was only 19 percent. The public is confident that such setbacks will be made up speedily, and hence that a small amount of patience and courage will bring great rewards in the form of a much higher price level soon thereafter.

Investors may think they are basing this view of the future on past experience, but in this they are surely mistaken. The experience of the 1949-1959 market – or of all bull markets put together – reflects only the sunny side of the investment. It is one thing to say airily that the market has always come back after declines and made new heights; it is another to reflect on the fact that it took 25 years for the market to reach again the high level of 1929, or that the Dow Jones Average sold at the same high point in 1919 as it did in 1942 – 23 years later.”

Today, investors continue in a delusional state assuming the stock market has reached a permanent plateau. The belief is founded upon a combination of market behavior over the past decade combined with blind faith that the Federal Reserve Bank (Fed), through loose monetary policy, can control the market in perpetuity. This despite the current state of valuations, market internals and the global economy. If you believe the Fed is omnipotent, please re-read Benjamin Graham’s words above.

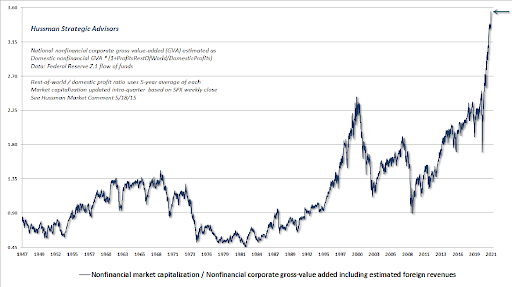

Looking at market valuations, the Shiller Price-to-Earnings (P/E) ratio – price of the S&P 500 Index divided by 10-year average inflation-adjusted earnings – is presently 38.8 or 131% above its long-term mean. Economist John Hussman determined that using a derivation of the Price-to-Sales ratio (Nonfinancial market capitalization/Nonfinancial corporate gross-value added including estimated foreign revenues or MarketCap/GVA) was the most accurate methodology for determining market valuation. This was concluded by calculating the correlation of actual subsequent results with previous valuation readings. Notice the extreme level of valuations using this methodology in the graph below.

With MarketCap/GVA currently about 3.6 times its historical norm, it would take a market drop of about 72% merely to bring it in line with the norm.

Although the market continues ploughing higher, only 66% of stocks in the S&P 500 are trading at prices above their 50-day moving average. Additionally, the number of days since the last correction to the 200-day moving average is stretched. As economist Lance Roberts stated, “Furthermore, deviations from long-term moving averages continue to get more extreme…the deviation from the 200-dma poses a credible threat in terms of magnitude and duration.”

Hussman went on to state, “Presently, we are at the most optimistic point of the most overvalued market bubble in the history of the nation. The S&P 500 is at a rare point of overextension relative to its 40-week and 200-week averages, in the context of deterioration and divergence in our key gauge of internals, indicating that the market is dangerously narrowing, in a way that reflects emerging risk-aversion.”

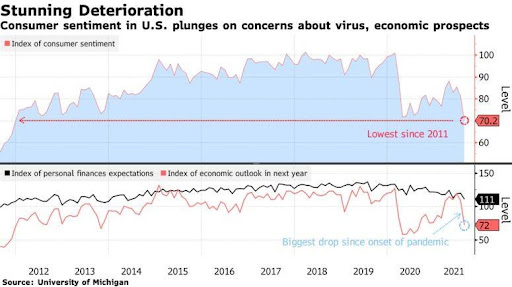

Recent areas of interest include weakening economic data from China, a resurgence in restrictions resulting from the Delta Variant of COVID19, and new geopolitical concerns. In the U.S., a shocking drop in the University of Michigan Consumer Sentiment Index was revealed last week. The drop brought the Index down to the lowest level since December 2011. If this sentiment bleeds over to the stock market, at present valuations and internals, a swift and potentially harmful correction could result.

And wrapping up with more remarks from Benjamin Graham, December 17, 1959 (via Hussman Market Comment)

Speculators often prosper through ignorance; it is a cliché that in a roaring bull market, knowledge is superfluous and experience a handicap. But the typical experience of the speculator is one of temporary profit and ultimate loss. Optimism and confidence have always accompanied bull markets; they have grown as the bull market advanced, and they had to grow, otherwise the bull markets could not have continued to their dizzy levels – and they have been replaced by distrust and pessimism when the bull markets of the past have collapsed. All my experience goes to show that most investment advisers take their opinions and measures of stock values from stock prices. In the stock market, value standards don’t determine prices; prices determine value standards.

The more it changes, the more it’s the same thing. The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. Would that fact assure the investor against a costly and discouraging bear market experience? It seems to me that this is most improbable. The central level of values will be raised, but the fluctuations around these levels may well be just as wide as in the past, in fact, one might expect even wider fluctuations – the stock market will continue to be a place where a big bull market is inevitably followed by a big bear market. In other words, a place where today’s free lunches are paid for doubly tomorrow.”

Although investors may believe the market and economy are now in a new paradigm, history is replete with examples of irrationality and the resulting devastating outcomes. Speculators will eventually learn the consequences of ignoring the lessons derived from history.

The S&P 500 Index closed at 4,468 up 0.71% for the week. The yield on the 10-year Treasury Note rose to 1.30%. Oil prices remained at $68 per barrel, and the national average price of gasoline according to AAA fell to $3.18 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.