Executive Summary

The stock market has now become a destination for speculators. The most recent target of the market’s lure has been retail investors. Retail investors historically have been the last to arrive and depart the party; thereby, suffering the most damage during the speculative market’s reversion cycle. Retail investors received a boost from Federal stimulus funds. With margin debt at record highs and stimulus checks in the rearview mirror, where will the money come from to keep demand for stocks growing? When demand no longer exceeds supply, a reversion to the mean could be next. How far must stocks fall to reach the mean?

Please proceed to The Details for a more in-depth analysis.

“The most dangerous people in the world are very smart traders who have never gotten their teeth kicked in.”

–F. Helmut Weymar

The Details

As described in my June 2, 2021, newsletter, the stock market has now become a destination for speculators. The most recent target of the market’s lure has been retail investors. Retail investors historically have been the last to arrive and depart the party; thereby, suffering the most damage during the speculative market’s reversion cycle. The retail investor was provided a boost during this cycle from the Federal government in the form of stimulus payments. Much of this “stimulus” became fodder for overvalued markets. These markets included stocks, IPOs (initial public stock offering), stock options, cryptocurrency, real estate and certain commodities. Most of these speculators have never experienced a bear market and will learn the hard way what follows massively overvalued, vertically ascendant markets.

Stock prices rise when demand is greater than supply. As long as more people want to buy stocks versus sell, prices will go up. This cycle has received extra fuel in the form of leverage (margin) and stimulus funds. What happens to markets – which have reached prices relative to fundamentals never before seen – when the fuel stops flowing?

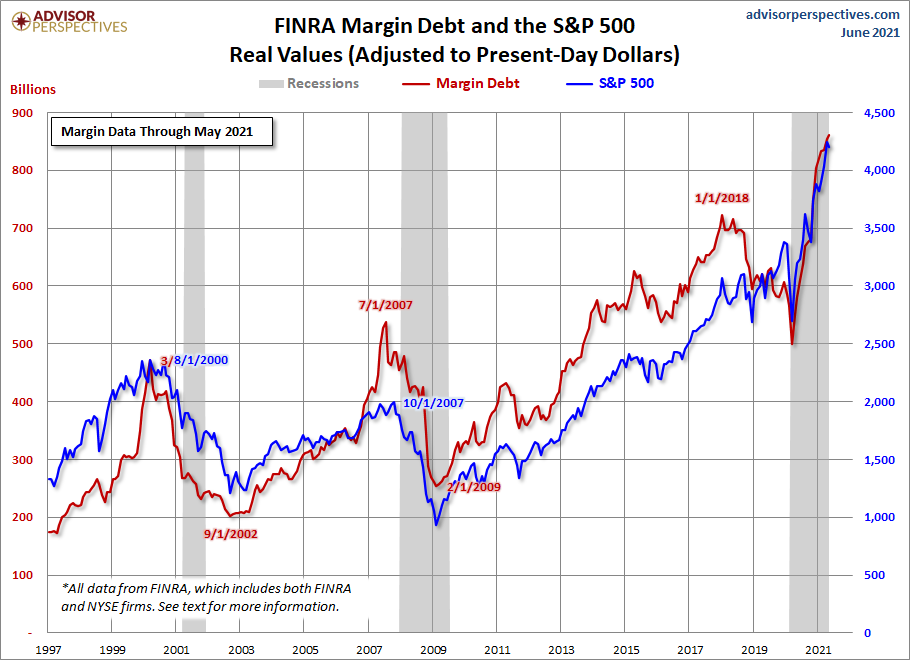

The following chart shows the amount of margin debt provided to purchase stocks exceeds all previous cycles.

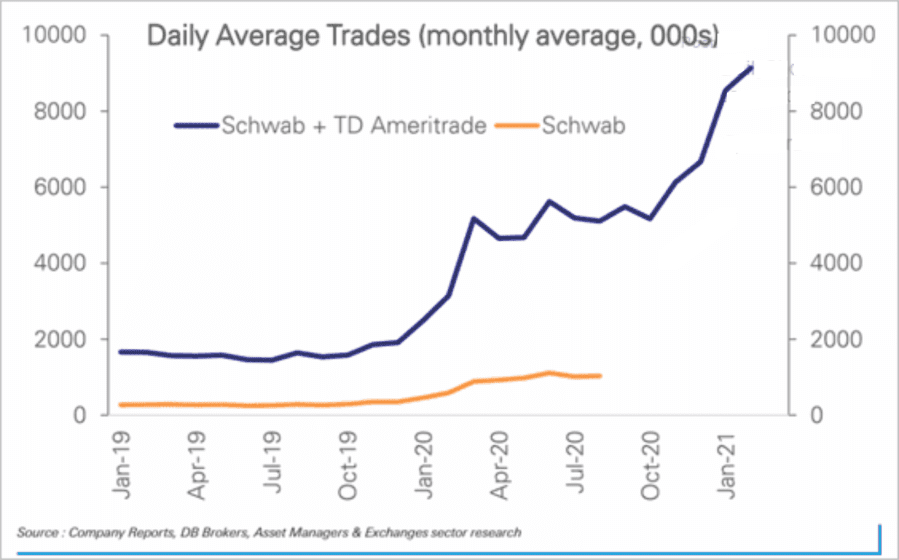

The following chart shows the surge in daily trading which began as stimulus checks ramped up. (Charts below via Real Investment Advice)

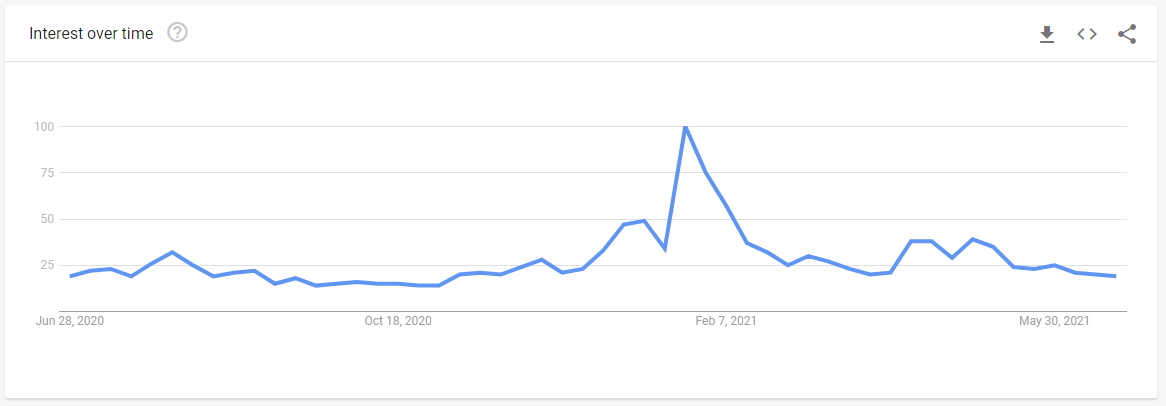

The graph of internet searches for How to Invest in Stocks also skyrocketed with the newfound money and has since waned.

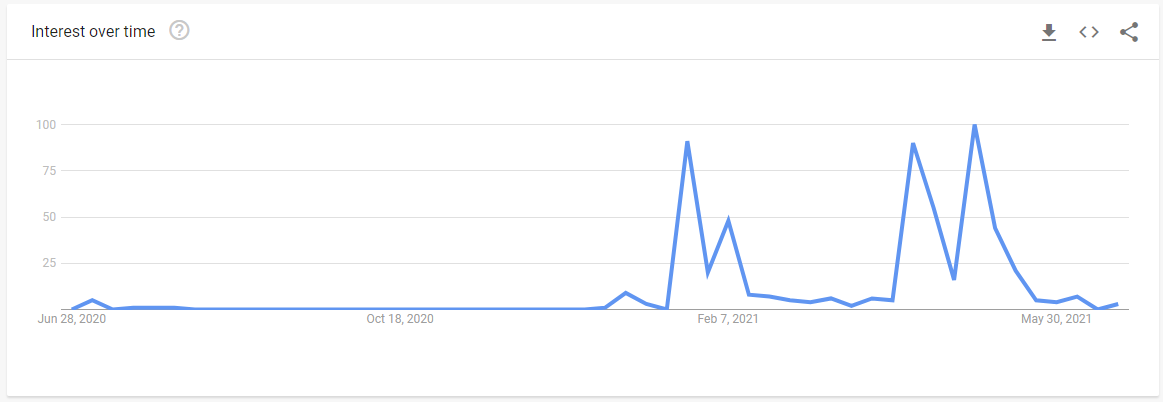

And even interest in the “fake” cryptocurrency Dogecoin has faded.

With margin debt at record highs and stimulus checks in the rearview mirror, where will the money come from to keep demand for stocks growing? Once the short-term “reopening” optimism diminishes, and the reality of massive amounts of debt dragging economic growth slower becomes apparent, will “professional” investors continue to support valuation levels over three standard deviations above the mean. These levels are only seen 0.3% of the time! In other words, 99.7% of the time valuation levels are lower relative to revenue and earnings.

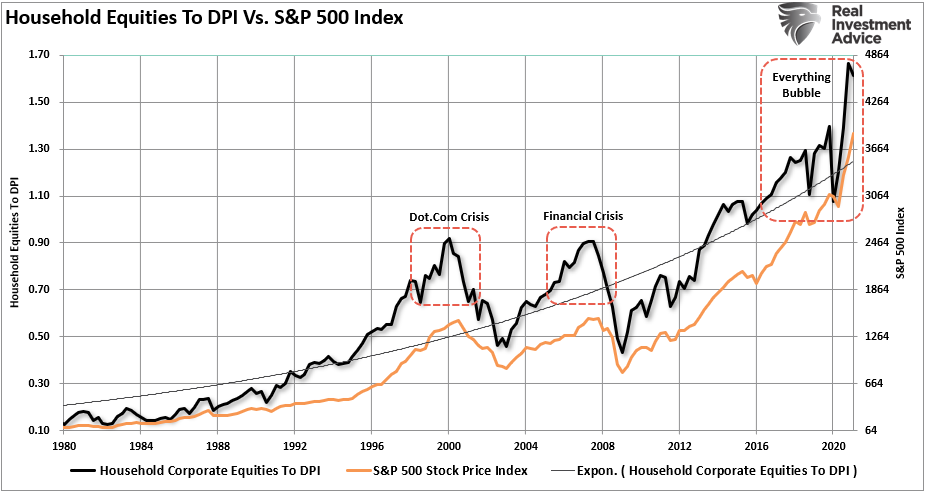

Government benefits, in addition to stimulus checks, are now dwindling. Incomes will be impacted, and discretionary funds will fall. Currently, household holdings of stocks relative to disposable income have soared with the retail plunge into the speculative pool. Unfortunately, history shows retail will be the last to get out of the pool once the reversion begins.

When stocks are this detached from fundamentals, and “professional” investors are utilizing algorithms and programmed trading to achieve faster trading, the risk of an “air pocket” arriving leaving retail investors stunned becomes more likely. With no more “free money” arriving, the demand from retail investors will fall. When demand no longer exceeds supply, a reversion to the mean could be next. The math (not opinion) indicates the mean is over 65% below current prices.

The S&P 500 Index closed at 4,352 up 1.67% for the week. The yield on the 10-year Treasury Note fell to 1.43%. Oil prices increased to $75 per barrel, and the national average price of gasoline according to AAA rose to $3.13 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.