Executive Summary

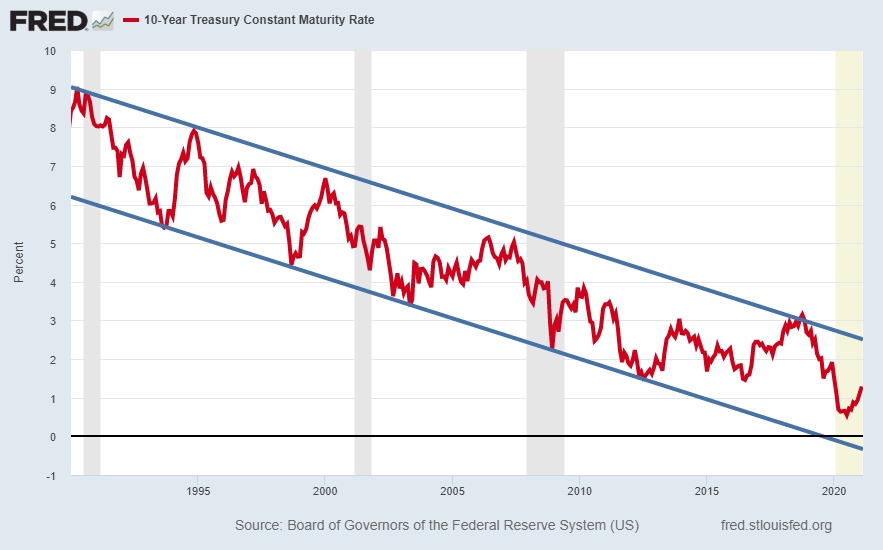

Long-term interest rates, while cycling up and down over the last 35 years, have remained in a downward channel (see first graph). During the pandemic and recession of 2020, yields dropped to .5% – however escaping going negative like Japan and Europe. Many suggested inflation would take-off along with long-term interest rates after the Federal government COVID stimulus efforts. However, after a run up to 1.75%, rates have settled back to about 1.35%. Typically, the bond market has been a better indicator of the economy than the stock market, especially at extreme valuations. Economist Lance Roberts recently wrote:

“Given that we are in the most extended bull market cycle in history, combined with high valuations and weakening fundamentals, it might be time to pay more attention to what bonds can offer you.

For the complete explanation of the relationship between growth in GDP and long-term treasury rates –

Please proceed to The Details.

“Investing is an activity of forecasting the yield over the life of the asset; speculation is the activity of forecasting the psychology of the market.”

–John Maynard Keynes

The Details

Long-term interest rates have been falling since the early 1980’s. While they tend to cycle up and down, they have remained in a downward channel over the past 35 years. During the recent pandemic and recession, fear pushed bond prices higher and yields to extreme lows as the 10-year Treasury yield fell to around 0.5%. As low as this appears, rates did not go negative as they did in Japan and Europe. Then came tremendous stimulus funds from the Federal government in attempts to bail-out businesses and provide assistance to households. With this injection of created money came a surge in the stock market and a rise in interest rates as speculators shifted from the safety of Treasury bonds to equities. Many suggested inflation would take-off along with long-term interest rates. I wrote about this expectation on February 23 of this year and included the following graph of the 10-year Treasury interest rate channel.

Since my February missive, I have written several newsletters discussing the relationship between long-term interest rates, economic growth and inflation. These factors tend to be correlated. The consensus at the time, and for many still today, felt the economy would take off on a sustainable basis leading to long-term high inflation and soaring long-term interest rates. I stated in February,

“My expectation is the outrageous speculative bubble in stocks will burst leading to a significant correction in stock prices. This will lead to another slowdown in the economy. As is always the case, businesses, banks and investors will look to the Federal Government and Fed to ‘save’ the economy and stock market. As the equity market plunges, I believe long-term Treasury yields will drop as investors look for safe havens.”

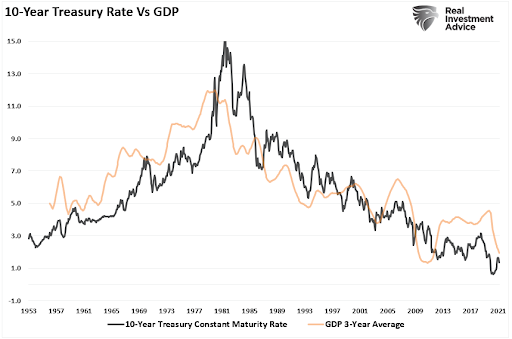

In March, rates continued their ascent peaking around 1.75%. Since then, rates have been falling, now down to about 1.35%. This pull-back in rates could be the result of market participants seeing that the massive new debt will hold back future economic growth. The short-term surge this year was to be expected considering the $3 trillion in stimulus programs, but the debt represents a drag on future growth. Realistically, it is likely economic growth will fall back to the 2% or lower range next year. The graphs below were prepared by Real Investment Advice. The following graph illustrates the correlation between the 10-year Treasury rate and GDP (using 3-year average GDP).

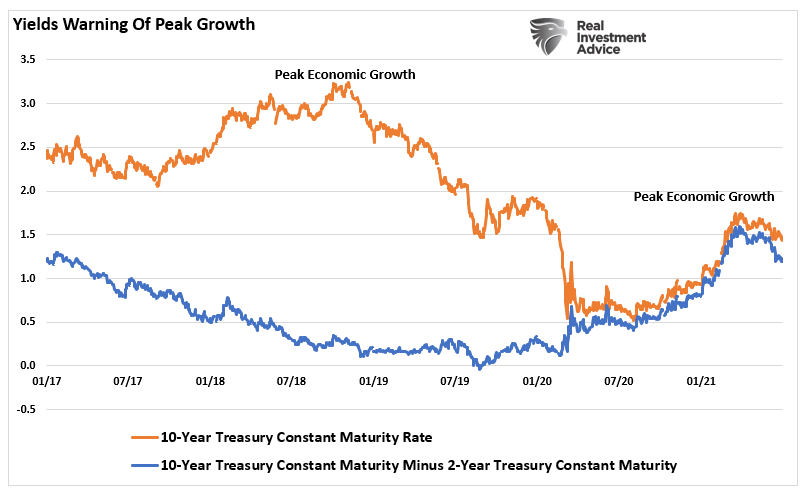

With falling 10-year rates and a flattening yield curve, economist Lance Roberts wrote:

“Bond yields are sending an economic warning as this past week 10-year Treasury yields dropped back to 1.3%. With the simultaneous surge in the dollar, there is rising evidence the economic ‘reflation’ trade is getting unwound.”

As far as inflation is concerned, I have written two comprehensive newsletters recently, which can be found on our website, explaining why I believe the recent surge in inflation will be transitory. However, I also explained what could cause this “transitory” inflation to turn into serious stagflation.

Typically, the bond market is a better indicator of the economy than the stock market. At current extreme valuations, the speculative pool called the stock market is not a good predictor of what is to come. Instead, it has turned into a game of musical chairs as we wait to find out who remains standing in the end. The bond market, on the other hand, seems to be providing an alert for speculators to be wary. Action in other speculative markets seems to be moving in advance of the stock market. For instance, Bitcoin has plunged almost 50% from its speculative peak. Lumber has also plunged over 60% from its ludicrous top. Other commodities including copper have also fallen from their peak. At the same time, the dollar has risen 3% from its low (using the DXY index).

Lance Roberts wrote:

“Given that we are in the most extended bull market cycle in history, combined with high valuations and weakening fundamentals, it might be time to pay more attention to what bonds can offer you. Bonds are sending a warning once again.”

Although many in financial media will continue to rave about short-term economic numbers and warn of unleashed inflation attributable to the reopening of the economy, the real concern is the incredible debt burden acting as a ball-and-chain on the economy. I continue to believe GDP will again slow to sub-2% real growth next year, and inflation will give way to deflation during the next bear market cycle. Expect the Fed to continue playing the music as loud as they can – despite what some Fed members might say in speeches – for they truly do understand what will occur once the music stops. Is it time to listen to what Treasuries are saying?

The S&P 500 Index closed at 4,370 up 0.4% for the week. The yield on the 10-year Treasury Note fell to 1.36%. Oil prices remained at $75 per barrel, and the national average price of gasoline according to AAA rose to $3.14 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.