Executive Summary

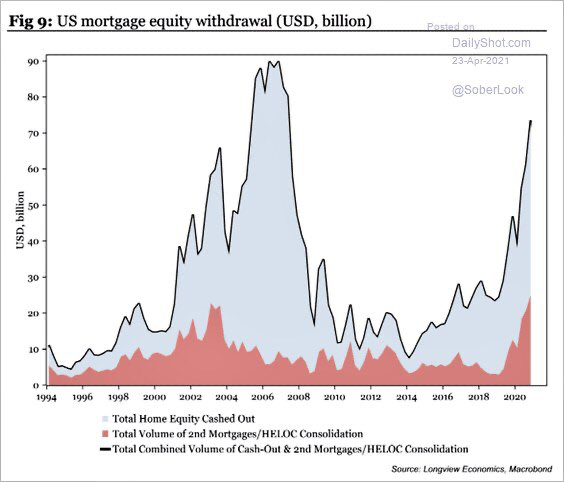

Anyone who has been paying attention to the residential real estate market lately is probably shaking their head. It is definitely a seller’s market. The driving factor in housing, like most markets, is supply and demand. The lack of supply, combined with other factors discussed in The Details, has contributed to a residential real estate market that is on fire. Increased demand due to rising rents, low mortgage rates, as well as government stimulus money are all stoking the fire as well. In the fourth graph below notice the price increases from 2012 to current. The graph also shows how the housing bubble popped after 2006. Historically home prices have tracked inflation (see fifth graph). After home prices disconnect from inflation such as from 2000-2006 and 2012-current, eventually a reversion to the mean (CPI) will result, leaving many homeowners underwater. In addition to buyers overpaying for homes today, many are withdrawing equity – resulting in a greater chance of being underwater (see last graph). There is no simple short-term solution to this dilemma. It is important to understand the long-term dynamics in today’s market if a home purchase is on one’s agenda.

Please proceed to The Details.

“We’ve never had a decline in house prices on a nationwide basis.”

–Ben Bernanke, Former Fed Chair, 2005

The Details

Anyone who has been paying attention to the residential real estate market lately is probably shaking their head. It is definitely a seller’s market. Unfortunately for most people, in order to take advantage of the hot market, they must also buy a house. Home prices have been rising since 2012 but have taken a decisive vertical trajectory over the past year. Many people might wonder why homes are selling so fast and for so much money. In this missive I will dig into the details and try to explain what is happening.

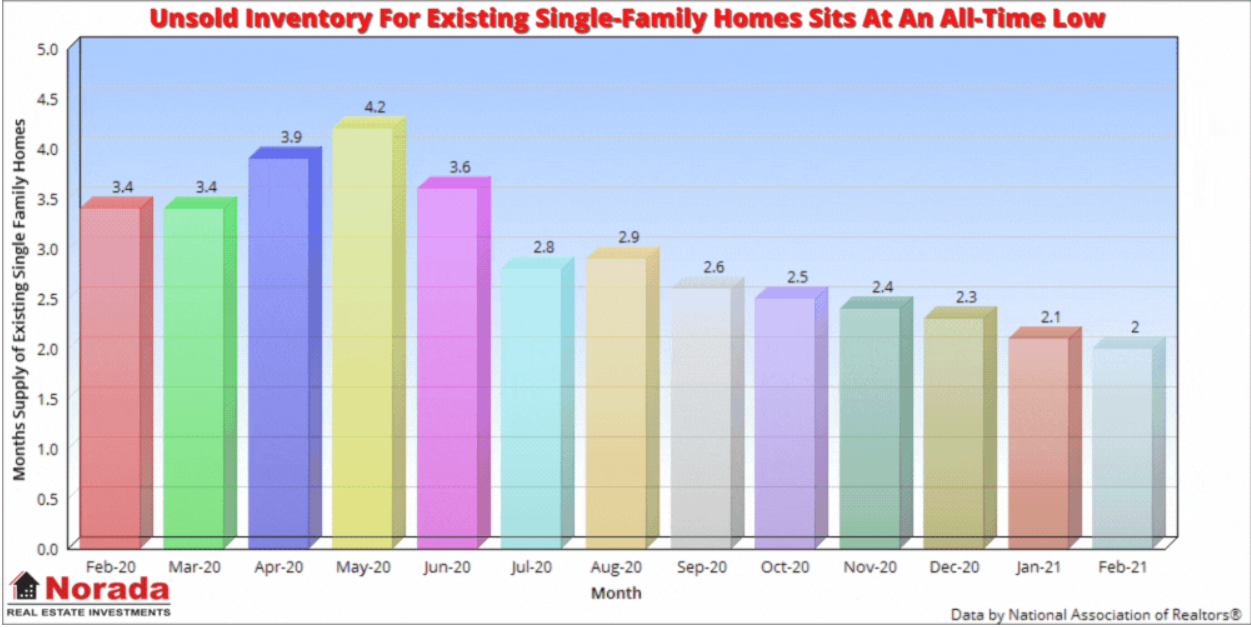

The driving factor in housing, like most markets, is supply and demand. If supply is greater than demand, homes sell slowly and for lower prices. If demand exceeds supply, homes fly off the shelf at increasing prices. According to Marco Santarelli at Norada Real Estate Investments, “The U.S. housing market is 3.8 million single-family homes short of what is needed to meet the country’s housing demand, up 52% as compared with 2018’s shortfall, according to a new analysis from mortgage-finance company Freddie Mac.” Stated differently, the inventory of existing homes for sale represents about 1.9 months’ supply. This is the lowest recorded inventory since 1999 when the series began. See graph from Norada below.

Why is supply so low? That is the million-dollar question for which there is not one simple answer. Many factors are in play when it comes to available supply including: retiring baby boomers settling into their forever homes, the realization that to sell one’s home would entail purchasing another (possibly overpriced) house, home builders’ reluctance to build during the pandemic, a larger investor pool holding homes for rental purposes, and the foreclosure moratorium preventing investors from selling.

Santarelli stated, “Single-family housing starts rose last year to 991,000 units but builders would need to construct between 1.1 million and 1.2 million single-family homes a year to meet long-term demand. The last time single-family housing starts broke 1 million was in 2007.”

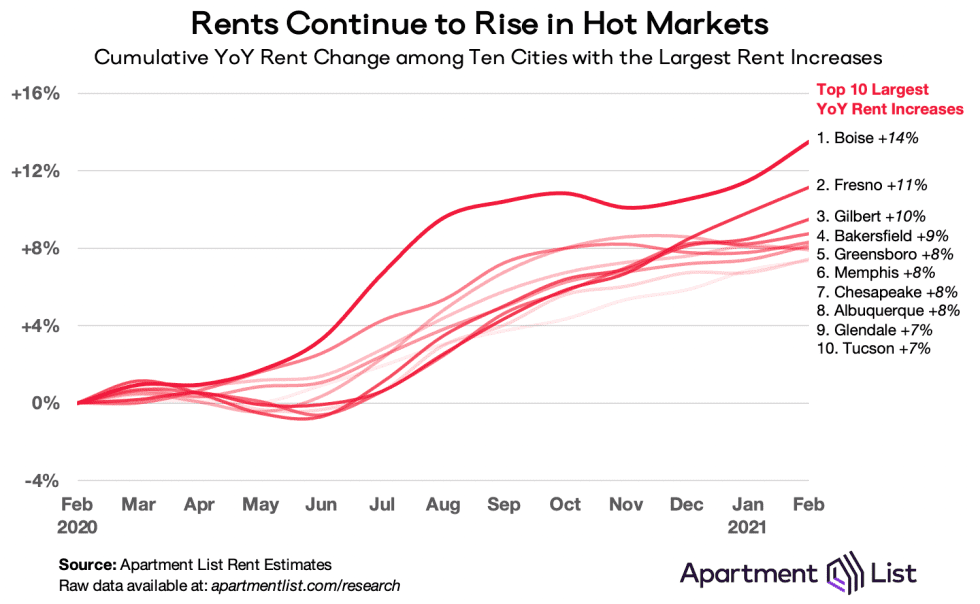

Feeding the increased demand for homes include historically low mortgage interest rates, rising rent costs, millennials reaching peak home purchase age, loosening mortgage qualification standards, and down payment liquidity provided through various Federal Government stimulus programs.

The graph below highlights the rising rental costs in many large cities. Those wanting their first home are realizing that low mortgage rates allow for monthly payments often not much more, or even less, than their rising rent costs.

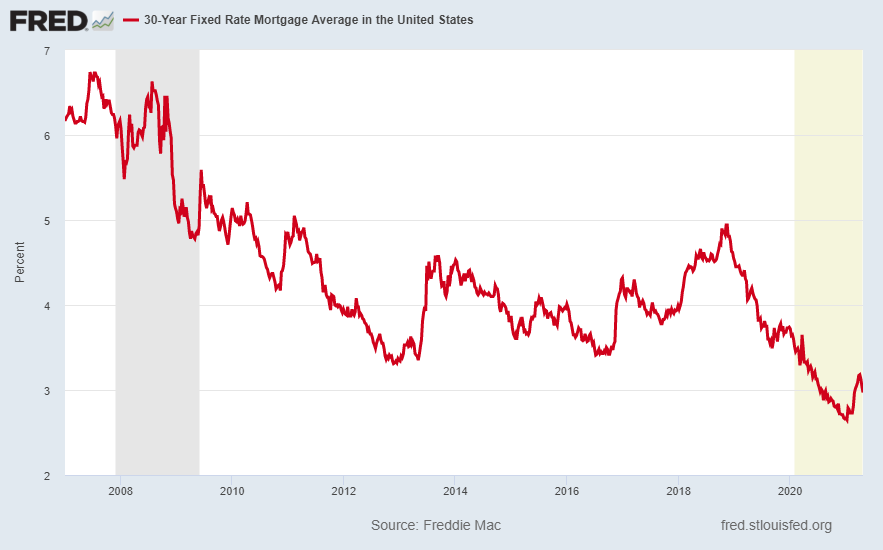

Record low mortgage interest rates began rising slightly this year causing many on the fence to commit to purchasing a home. This rush to close on a home created even more demand for the limited supply. However, this month (April) rates have started to settle back down a little. In my opinion, rates could temporarily gyrate a little higher; however, it is likely they will again return to 2020 levels or lower.

Although home prices have been rising since 2012, the past year has seen prices skyrocket. According to Santarelli, “The median sales price of an existing home has risen 17.2% from last year and they have increased even more in some regions of the country. It has reached a historic high of $329,100, with all regions posting double-digit price gains. March’s national price jump marks 109 straight months of year-over-year gains. The median existing single-family home price was $334,500 in March, up 18.4% from March 2020.”

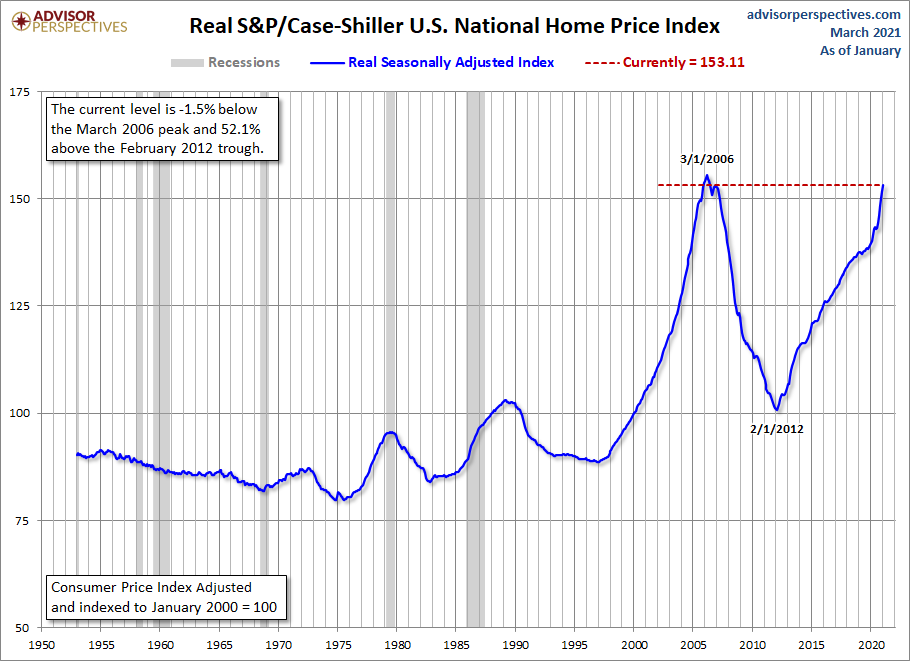

The dynamics of supply and demand, impacted by the items previously described, have pushed real (inflation adjusted) home prices back to near the bubble peak reached in 2006 before the Financial Crisis. See the graph from Advisor Perspectives below.

Prior to the Financial Crisis, the belief was that home prices could only go up. After the crisis many learned the hard way that home prices can also fall, leaving many homeowners underwater or owing more on their mortgage than their homes were worth. See the drop in prices from March 1, 2006 to February 1, 2012 in the graph above.

Over the very long-term, home prices have risen close to the rate of inflation. This makes sense because if home prices rose faster than inflation, eventually no one would be able to afford a home. The graph below, prepared with data on the St. Louis Fed FRED database, illustrates a long-term view of home prices (blue line) compared to general inflation represented by the Consumer Price Index (CPI) (red line). Notice the great disconnect prior to the Financial Crisis when home prices surged higher. Afterwards, prices began to return to the long-term norm when the Fed began lowering interest rates in order to juice the housing market again. When combined with current supply / demand imbalances, the disconnect has reappeared. What most buyers today do not fully understand is that eventually prices will again revert to the mean (CPI) leaving many underwater.

Additionally, just as occurred during the pre-Financial Crisis real estate bubble, homeowners are drawing large sums from their home “equity” resulting in an even higher risk of being underwater after prices correct. See the graph below from the DailyShot.com.

Unless homeowners are in the position where they only need to sell their homes and not purchase a new home, navigating today’s real estate market can be quite precarious. Emotions tend to push would-be buyers to go ahead and pay whatever it takes to get the house they want. Sometimes they are even paying up to get a home they really do not like, but feel they need to take before they are left without a new home.

There is no simple short-term solution to this dilemma. Eventually builders will provide more inventory, and more homeowners and investors could opt to sell. However, another recession causing lost jobs and/or a rise in interest rates could wreak havoc on the market. It is important to understand the long-term dynamics in today’s market if a home purchase is on one’s agenda.

The S&P 500 Index closed at 4,180, down 0.1% for the week. The yield on the 10-year Treasury Note remained at 1.57%. Oil prices fell to $62 per barrel, and the national average price of gasoline according to AAA increased to $2.89 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.