Executive Summary

The current housing market appears to be booming with continually escalating prices. Substantially aided by the Fed’s low interest rates, rising home prices are disconnected from the Consumer Price Index, a proxy for inflation (see second graph below). The fifth graph in The Details demonstrates on a population adjusted basis the market is below previous cycle peaks. This reinforces the fact home prices are being pushed higher due to lack of supply and artificially low mortgage rates – not a “booming market”. So, despite a recession and a pandemic, the housing prices have risen far beyond historical norms. The Fed is encouraging home buyers to leverage-up by purchasing overpriced houses. When prices correct, many recent buyers will find themselves underwater; and therefore, stuck in their homes. Unfortunately, home buyers’ memories appear to be short.

Please proceed to The Details.

“What you want to watch are the lenders, not the borrowers. The borrowers will always be willing to take a great deal for themselves. It’s up to the lenders to show restraint, and when they lose it, watch out.”

–Michael Burry

The Details

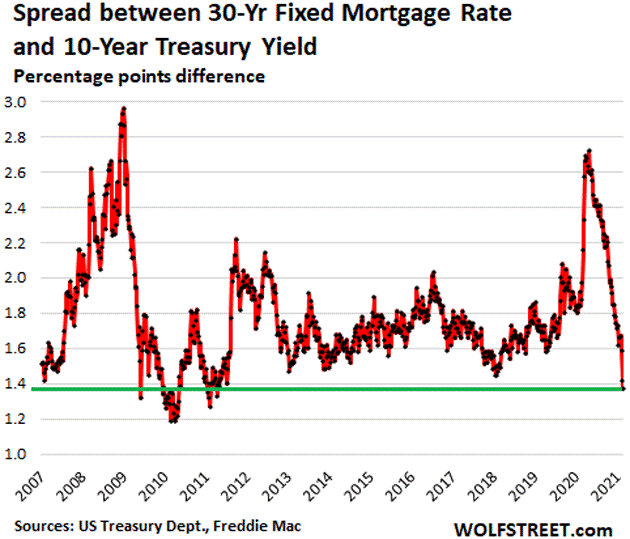

By manipulating interest rates, the Fed has amplified the bubble in the residential real estate market. For example, let’s examine the spread between the 30-year mortgage interest rate and the 10-year Treasury Note rate. As economist John Mauldin recently wrote,

“Obviously, lenders take more risk on mortgages than they do when buying Treasury bonds. We would thus expect mortgage rates to be higher, and they are. But does that risk really swing so wildly? Should it double, or fall by half, in only a few years’ time? Of course not. But that’s what happened, and there’s no mystery why. Mortgage spreads collapsed in 2009 and 2020 because the Federal Reserve bought truckloads of mortgage-backed securities.”

Notice the spread collapsing in 2009 and 2020 in the graph below.

The Fed has forced mortgage rates lower through massive Quantitative Easing programs. This activity creates more risk for lenders and moral hazard for borrowers. Artificially low interest rates contributed to the housing boom leading to the Financial Crisis in 2007-2009. Much of the same behavior is occurring again today, as home buyers are purchasing overpriced homes under the false belief that home prices only go up.

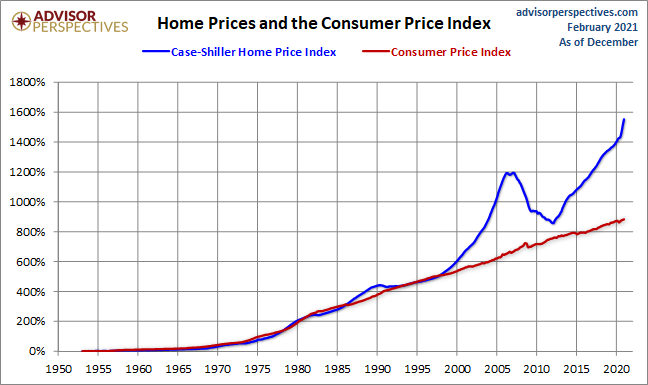

A combination of factors including lack of inventory, aging demographics and artificially low interest rates have created an environment where home prices are being bid far higher than what is considered reasonable. And this is occurring in the middle of a pandemic and recession where unemployment remains through the roof. Historically, home prices have appreciated close to the rate of inflation as illustrated by the Consumer Price Index (CPI). Notice how visible the pre-Financial Crisis real estate bubble and the current housing price bubble are in the graph below.

Each time housing prices (blue line) disconnected from the CPI (red line); they eventually correct back to the rate of growth of inflation. The greater the disconnect in housing prices from the long-term rate of inflation, the greater the crisis when prices do revert. Some home buyers have been hoodwinked into believing their home values will only appreciate from here. History tells a different story. Unfortunately for both lenders and borrowers, the underlying loans on these homes are being based upon these inflated prices. Similar to after the prior Financial Crisis, many home buyers will eventually discover they are underwater – owing more on their home loans than their homes are worth. This tragic situation results in homeowners not being able to sell their homes and often leads to high default rates. High default rates mean trouble for banks and mortgage companies.

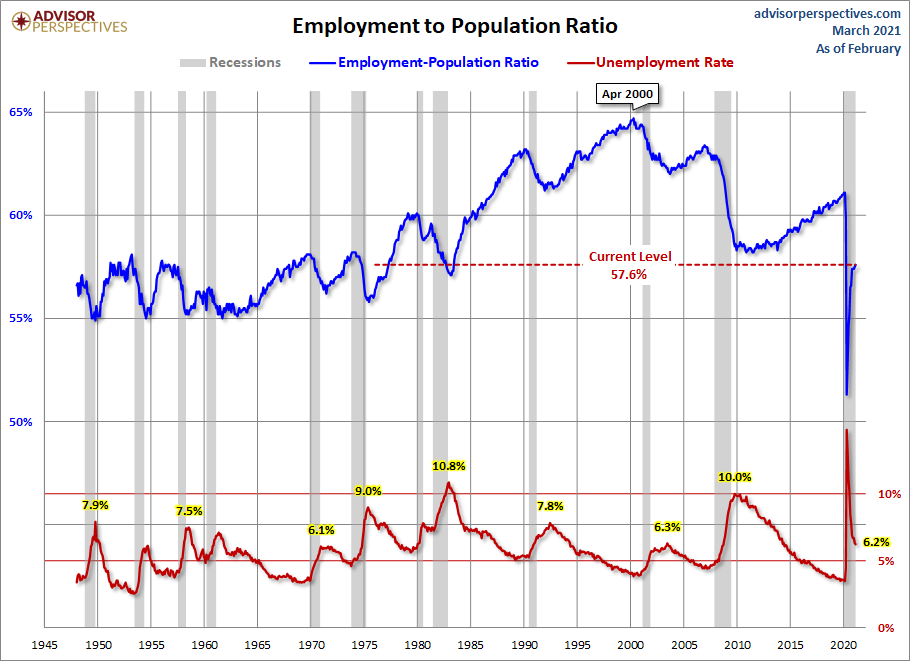

At the same time housing prices are setting records and new home sales are soaring, the Employment-to-Population Ratio sits at a level not seen since the recession in the early 1980s. The employment situation, exacerbated by the pandemic, is resulting in continuous calls for more Government benefits, on top of the previous nearly $3 trillion stimulus plan. Congress is about to finalize another stimulus plan totaling almost $2 trillion. The dichotomy of what many believe is a “booming” housing market during a recession and in a year with a potential deficit of close to $4 trillion, is astounding. It is important to understand what is causing the housing “boom,” in order to avoid being bitten when prices reconnect to long-term norms.

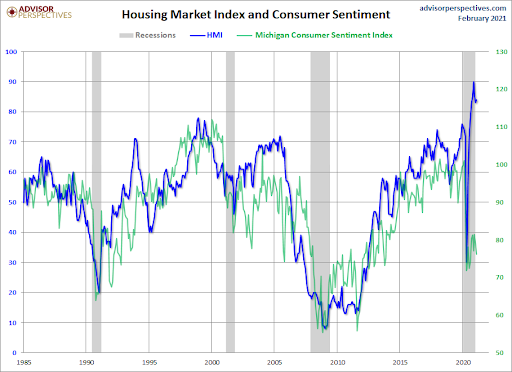

The tight housing market boosted by artificially low mortgage rates is being mistaken as a “booming” market. The graph below illustrates the huge disconnect between housing activity and underlying consumer sentiment. Normally, the Housing Market Index and Consumer Sentiment Index are highly correlated. The disconnect has never been greater from 1985 to present. Eventually the two will reconnect.

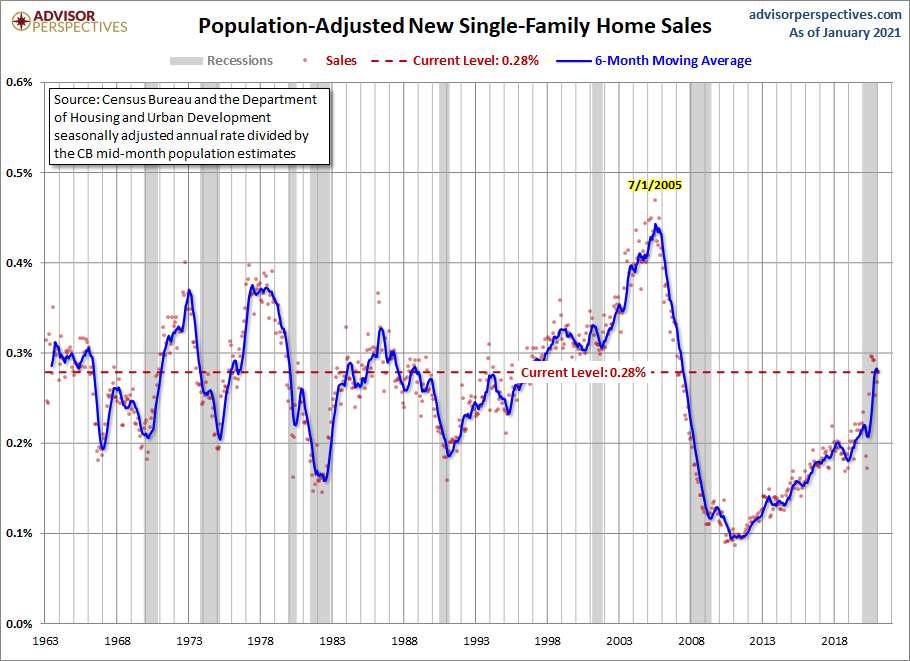

The graph below from Advisor Perspectives illustrates that population adjusted home sales, although surging recently, remain far below previous cycle peaks. This reinforces the fact that home prices are being pushed higher due to lack of supply and artificially low mortgage rates.

Unfortunately, home buyers’ memories appear to be short. It was just a little over a decade ago when artificially low interest rates led to a housing “boom” which then led to the worst financial crisis since the Great Depression. Today, despite a recession, pandemic, and the need for perpetual Federal stimulus to keep the economy moving, housing prices have risen far beyond what has historically been considered the norm. The Fed is doing all it can to keep mortgage rates down, encouraging home buyers to leverage-up purchasing overpriced houses. To their detriment, when home prices correct, many will find themselves underwater; and therefore, stuck in their homes.

Make no mistake, the housing market, like many other financial markets, is broken. Still suffering from spillover effects from the Financial Crisis, Federal Government intervention and Fed manipulation of mortgage rates are contributing to the current housing price bubble. A rise in mortgage rates would likely put an end to the housing “boom.”

The S&P 500 Index closed at 3,842, up 0.8% for the week. The yield on the 10-year Treasury Note rose to 1.55%. Oil prices increased to $66 per barrel, and the national average price of gasoline according to AAA rose to $2.77 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.