Executive Summary

The quote below is from Warren Buffet’s long-time business partner, Charlie Munger, and speaks to the recent irrationality in the stock market. One valuation metric used to evaluate the price of a stock is the price to earnings ratio. Historically, the average P/E ratio for the S&P 500 is 16. With the 2020 earnings drop due to COVID and the recession, the current P/E is 42. (see chart and graph below) The Russel 2000 Index represents small cap companies. After the March 2020 market lows, investors flocked into these stocks. Interestingly, the last graph shows the absurd disconnect between earnings and price for this index, which includes numerous “zombie” companies. In the past, speculative markets experienced sudden drops making it impossible for everyone to exit at the same time. Please proceed to The Details for a more complete discussion.

Please proceed to The Details.

“Shareholders should be more sensible and not crowd into stocks and just buy them just because they’re going up and they like to gamble.”

–Charlie Munger, Daily Journal annual meeting, 2-24-21

The Details

If there are any investors who are not convinced the stock market is in a massive bubble, the data in this missive might clarify the situation. When investors purchase stock in a company, they are effectively paying for future earnings. Therefore, it has become standard practice to determine what “multiple” of earnings a company’s stock is worth. The long-term average multiple for the trailing 12-months earnings for the S&P 500 is about 16. So, one could say that on average a reasonable “price” for the S&P 500 Index would be 16 times prior year’s earnings. This multiple can also be referred to as the Price-to-Earnings ratio or P/E. With that in mind, let us examine the earnings and P/E picture for the S&P 500 Index.

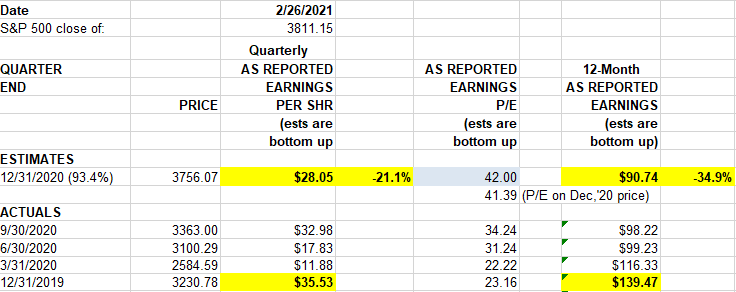

The chart of S&P 500 earnings below was excerpted from the spglobal.com website. In this chart, I have highlighted the quarterly and annual year-over-year earnings with about 93% of companies reporting. Quarterly earnings for the fourth quarter 2020 fell about 21% and 12-month earnings plunged around 35%. The P/E ratio is 42. Remember I stated the mean P/E is about 16, so the current P/E ratio is 2.6 times higher than the long-term average. To return the P/E ratio to the long-term average would require a drop of 62% in the price of the Index. However, if the price has remained above the mean for a long period of time, it is only reasonable the price would fall below the mean for a period of time. A drop in price below the mean would require a fall over 62%.

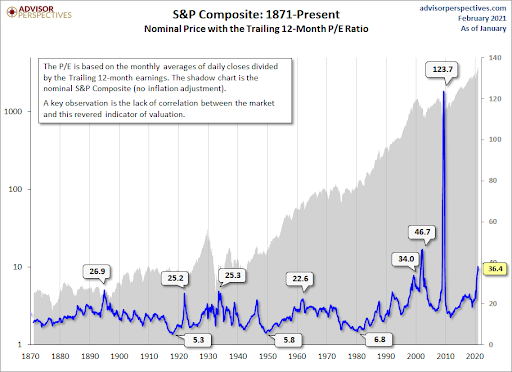

The graph below prepared by Advisor Perspectives, overlays the S&P 500 Index (from 1871 forward) and the 12-month P/E ratio. Note the data in this graph is slightly older than the current data in the chart above, thus the difference in the P/E ratios (36.4 vs 42). The P/E ratio is determined by dividing the price of the index by net earnings. When a recession or financial crisis arrives, corporate earnings typically plunge sending the P/E skyrocketing. The only times in the graph below when the P/E ratio was higher than today were after the Tech Bubble (peak 2000) and Financial Crisis (2007-2009). Both of these events led to plummeting earnings (the denominator in the P/E ratio) thus sending the P/E ratio soaring.

The enormous disconnect between stock prices and corporate earnings is even more evident in the Russell 2000 (small cap) Index. This is the index where a large percentage of companies are not even earning enough to cover their debt service requirements and have thus been labelled “zombies.” For some reason, beginning at the market low last March, speculators flocked into the Russell 2000 Index at the same time their earnings plunge accelerated. Notice in the graph below how earnings per share over the prior 12-months are negative, yet the price of the Index soared.

If investors concur with the maxim that price should be a multiple of earnings, then the speculation in the market has never been more obvious. The S&P 500 P/E is 2.6 times greater than the long-term average. The disconnect in the small cap Russell 2000 has never been greater. To bring prices back to established norms would require a 62% pullback in the S&P 500 and an even greater drop in the Russell 2000.

The movie theater might get more crowded (with assistance from the Federal Reserve), but if a fire starts, speculators better hope they can reach the exit before their peers.

The S&P 500 Index closed at 3,811, down 2.5% for the week. The yield on the 10-year Treasury Note rose to 1.46%. Oil prices increased to $62 per barrel, and the national average price of gasoline according to AAA rose to $2.72 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.