Executive Summary

Last week I described what causes stock prices to rise and fall. In this week’s issue, I share comments and data from three investment gurus. Howard Marks states that: “Fear of missing out has taken over from the fear of losing money.” (see below for more) In the first graph below, investment legend Jeremy Grantham presents his projections for many asset classes over the next seven years. And finally, from economist John Hussman, his projections over the next twelve years (second graph). Hussman’s methodology has one of the highest correlations with actual subsequent returns, meaning it is more accurate than mainstream media projections pulled out of a hat. FOMO is causing many investors to take on more risk and could very well end detrimentally for many buy-and-hold portfolios. I provide examples using forecasts below to show the potential negative impact to retirement portfolios.

Please proceed to The Details.

“The most reliable way to forecast the future is to try to understand the present.”

–John Naisbitt

The Details

Last week I described what causes stock prices to rise and fall. To recap, in the short run stock prices move based upon the sentiment of investors. If more investors are inclined to purchase stocks, prices will rise and vice-versa. Some look to valuation measurements to determine if stock prices are in line with long-term norms based upon fundamentals, such as revenue and earnings growth. Research has shown that in the short run valuations are of little use in determining stock price movements. On the other hand, over the long-term, say 7-15 years, valuations tend to be more reliable indicators of what will happen to stock prices.

Once sentiment pushes prices far above levels considered reasonable based upon fundamentals, bubbles are born. When euphoria kicks in, speculators of all types are drawn into markets for fear of missing out (FOMO) on “easy” money. As Jeremy Grantham of investment firm GMO wrote recently, “…when price rises are very rapid, typically toward the end of a bull market, impatience is followed by anxiety and envy. As I like to say, there is nothing more supremely irritating than watching your neighbors get rich.”

Investment legend Howard Marks of Oaktree Capital Management stated the following in a recent interview with Bloomberg (via Real Investment Advice):

“Fear of missing out has taken over from the fear of losing money. If people are risk-tolerant and afraid of being out of the market, they buy aggressively, in which case you can’t find any bargains. That’s where we are now. That’s what the Fed engineered by putting rates at zero.

We are back to where we were a year ago—uncertainty, prospective returns that are even lower than they were a year ago, and higher asset prices than a year ago. People are back to having to take on more risk to get return. At Oaktree, we are back to a cautious approach. This is not the kind of environment in which you would be buying with both hands.

The prospective returns are low on everything.”

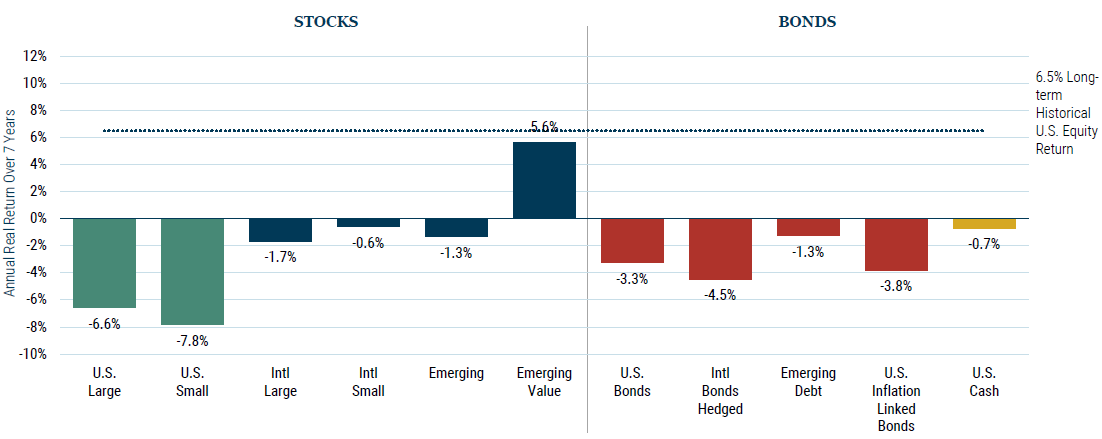

When referring to “prospective returns” Marks is referring to future long-term returns. The level of projected returns can be calculated using actual historical data. Jeremy Grantham of investment firm GMO is known for publishing a 7-year forecast broken down by asset class. His most recent projection as of December 31, 2020 is shown below.

The above projections are shown as average annual real (inflation adjusted) returns over the next seven years. These are not intended to show the return achieved every year, but instead the average over the upcoming seven-year period. For example, a $100,000 investment in U.S. large cap stocks could result in an after-inflation loss of about $38,000 leaving $62,000. Now, this journey is likely to resemble a roller coaster ride versus a linear path.

Economist John Hussman has developed his own methodology for projecting long-term future return expectations. In his graph below, he projects future average annual nominal (before inflation) returns for the S&P 500 Index over the upcoming 12-year period (blue line). Next, he plots the actual 12-year returns achieved (red line). Notice the red line stops in 2008. This is because that is the last year which can show 12-year future actual returns. The highly correlated methodology indicates that based upon current extreme valuations, future 12-year returns (before inflation) should average about -3% per year. Yes, that is a negative number. Using the same example as illustrated with the GMO data, a $100,000 investment in the S&P 500 today, held for 12-years would likely provide an end-result of about $69,400 or a loss of around $30,600 over 12 years.

Investors lose sight of valuations when exuberance in markets becomes extreme. The reason is valuations have little impact on what will happen this week or next. However, the level of accuracy in projecting long-term returns is much greater when considering the state of prices versus fundamentals. Investors who choose to ignore such deviations will likely live to regret it once the cycle turns.

And the longer the bubble lasts, the greater the deviations, thus the greater the downside movement needed to return to reasonable price levels. Using the examples above, it should be apparent that the gap, which will eventually close, is larger than ever before in over one hundred years of market history.

If the next bear market were to start this year, a 55-year-old investor remaining invested in large cap stocks throughout this phase of the cycle, using Hussman’s research, could lose over 30% of his/her funds by the time the investor reaches age 67.

If investors have succumbed to FOMO and are attempting to squeeze every last dollar out of this bubble, they might find themselves extremely distraught by the end of the cycle.

The S&P 500 Index closed at 3,842, up 1.9% for the week. The yield on the 10-year Treasury Note remained at 1.09%. Oil prices remained at $52 per barrel, and the national average price of gasoline according to AAA rose to $2.40 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.