Executive Summary

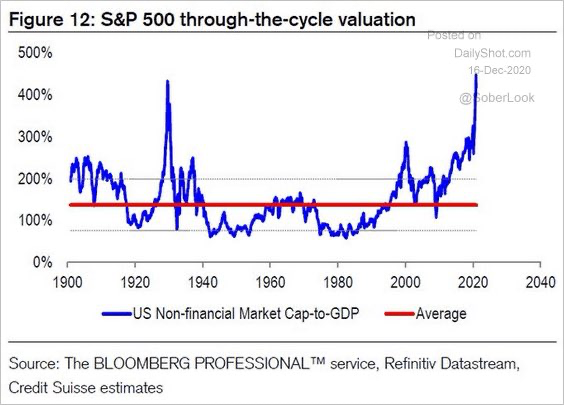

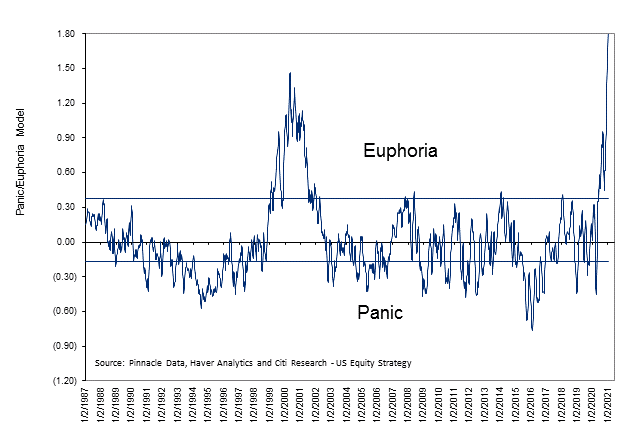

The movement of stock prices is governed by the law of supply and demand. If the urge to “buy” is greater than the desire to “sell,” then prices move upwards and vice-versa. Although stock prices should represent the present value of a long-term stream of cash flows, the psychology of investors leads to significant deviations from this norm. According to Warren Buffett’s favorite stock market valuation indicator, the market is more overvalued now than any point in history (see first graph below). Currently investor psychology has reached the euphoric state as evidenced in the second graph. Many in the investor community believe in the fallacy of “cash on the sidelines” available to push stock prices higher. I debunk this theory in The Details below. All this to say that the current market bubble is wrought with risk. Stock prices will correct when investor sentiment changes, despite attempts to prevent it by the Fed.

Please proceed to The Details.

“There is nothing riskier than the widespread perception that there is no risk.”

–Howard Marks

The Details

The movement of stock prices is governed by the law of supply and demand. If the urge to “buy” is greater than the desire to “sell,” then prices move upwards and vice-versa. Although stock prices should represent the present value of a long-term stream of cash flows, the psychology of investors leads to significant deviations from this norm. As explained by William Hamilton, the successor to Charles Dow as the editor of The Wall Street Journal, the reason bull and bear trends are inevitable “…lies in human nature itself. Prosperity will drive men to excess, and repentance for the consequence of these excesses will produce a corresponding depression.”

It is these excesses which lead to stock market bubbles. Currently, stock prices, according to Warren Buffett’s favorite valuation indicator, market capitalization (total shares outstanding times market prices) divided by Gross Domestic Product (GDP) is higher than ever before as shown in the chart below.

As expected, at the same time valuations are at all-time highs, speculative investor psychology has reached euphoric levels as illustrated in the following graph.

The state of euphoria and valuations could become even more stretched if additional speculators seek to purchase stocks. The one thing that does not contribute to stock market increases is the concept of “money on the sidelines.” The fallacy of “money on the sidelines” is often proclaimed by financial media and even some well-known investors. The claim by such believers is that a number of investors have become more risk averse and sold their stock holdings, thus building a sum of cash on the sidelines just waiting to re-enter the market.

To the novice investor (and even some experienced advisors) this concept sounds reasonable. However, when an investor sells his stock holdings to someone else, no additional cash is accumulated “on the sidelines.” In reality, the same amount of cash exists after the transaction as did before the sale. That is how the secondary market works. A buyer and seller agree on a price and effectively exchange cash for stock. The seller now holds the same amount of cash the buyer was holding before the transaction. No more, no less. So, don’t be fooled by the claims that there is a pile of cash on the sidelines waiting to push stock prices higher.

The speculative nature of this bubble has been fueled by the Federal Reserve Bank (Fed) and the Federal Government through various monetary and stimulus programs. These programs have given speculators confidence that every time the market falls, a new program will be implemented, or new funds created to prevent a bear market. This concept has been given a nickname, the Fed Put. A put is an option to sell stocks at a predetermined price to profit from price declines. The analogy is the Fed stands ready to rescue the stock market as if selling a put option on the market.

History proves there is no such thing as a reliable Fed Put. In fact, the Fed has implemented loose monetary policy during almost every prior bear market, to no avail. What stops bear markets is a change in investor sentiment. Presently, the extreme bubble in stocks could reverse once either: an exogenous event occurs leading to a rush to reduce risk, or simply a point is reached where there are no longer speculators willing to pay the prices requested by sellers. The larger the bubble, the more force exerted once sentiment changes and selling begins. If prices fall far enough, there are a few accelerants which will fuel the selling. One is stop losses which automatically sell holdings once they reach a certain price, and the other is margin calls which also force selling to satisfy collateral demands.

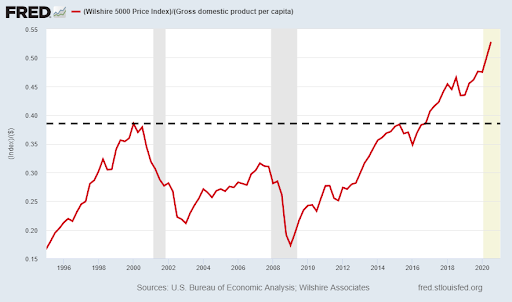

To get an understanding of the extent of the current state of euphoria, the graph below shows the price of the total stock market index, the Wilshire 5000 Index, divided by GDP per capita. Stock prices have soared at the same time the economy has slowed as the U.S. remains in recession. Thus, the line has jumped to a level 3.3 times greater than that which existed in 1995, and 1.4 times greater than the peak of the previous record bubble in 2000.

What this tells speculators is that once investor psychology turns toward risk aversion, the selling could transpire quickly, leading to a correction rarely seen historically. In fact, renowned investment manager Jeremy Grantham recently wrote in “Waiting For The Last Dance,”

“The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.”

The Fed and the Federal Government will try to stop it, but the determining factor is investor sentiment, not Monetary or Government policy.

The S&P 500 Index closed at 3,768, down 1.5% for the week. The yield on the 10-year Treasury Note fell to 1.09%. Oil prices remained at $52 per barrel, and the national average price of gasoline according to AAA rose to $2.39 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.