Executive Summary

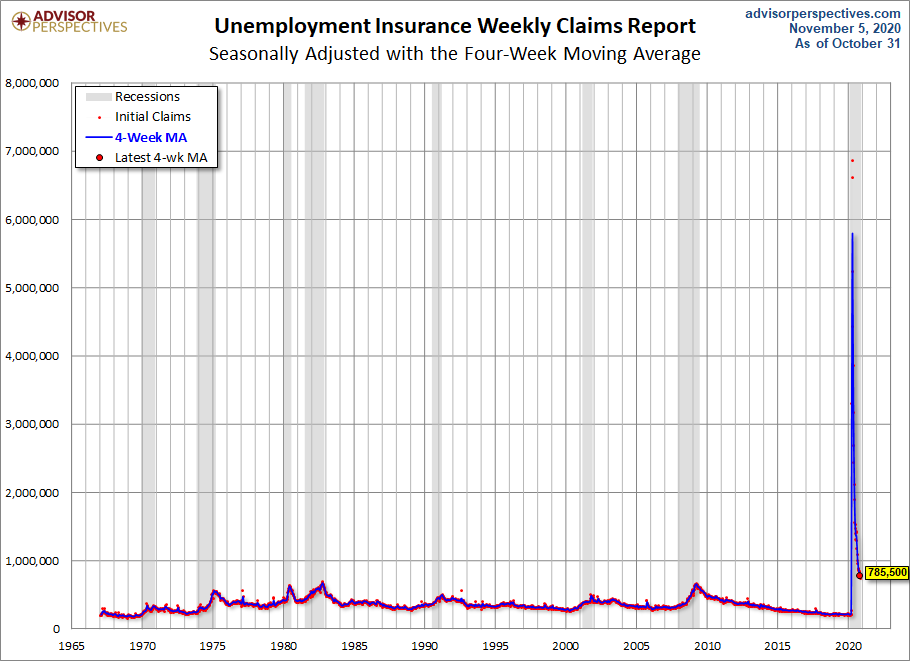

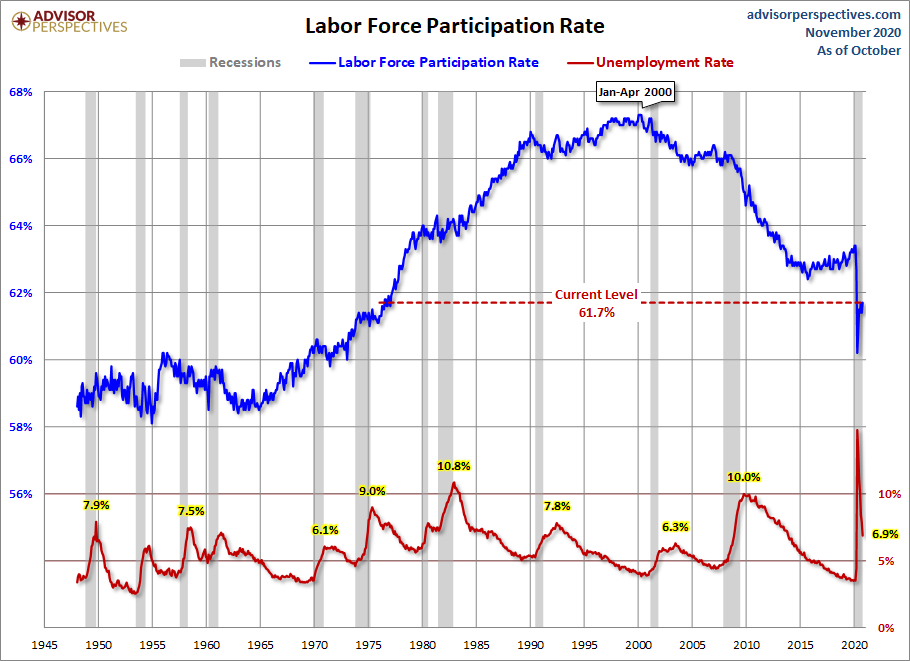

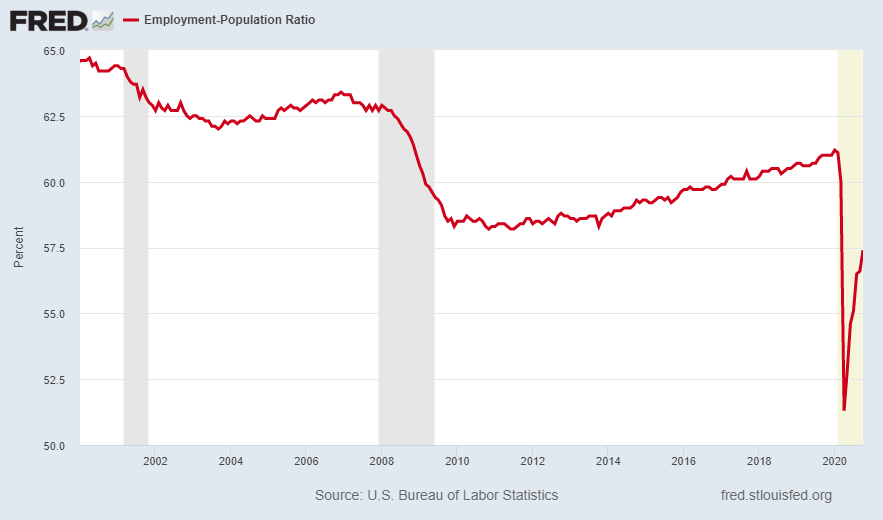

Last week 785,500 people filed for first-time unemployment benefits. Since Covid-19, the number of weekly unemployment claims filed have exceeded the previous all-time record of 695,000, each and every week. (See first graph) Also, one can see the labor force participation rate never recovered much from the Great Recession (2007-2009) (second graph). The employment-to-population ratio, which is not affected by those who have fallen out of the labor force, is a good indicator of the actual employment situation. (third graph) Additionally, I provide my thoughts on how various election results may impact the stock market moving forward.

Please proceed to The Details.

“In the business world, the rear-view mirror is always clearer than the windshield.”

–Warren Buffett

The Details

Last week 785,500 people filed for first-time unemployment benefits. COVID-19 began impacting employment in March of this year. Since then, the number of weekly unemployment claims filed have exceeded the previous all-time record of 695,000, recorded in 1982, each and every week. See the chart below from Advisor Perspectives.

In the graph below, also from Advisor Perspectives, you can see that the labor force participation rate never recovered much from the Great Recession (2007-2009). Currently, even with the October bounce, it remains far below the early-2000 peak.

Last Friday, the Bureau of Labor Statistics (BLS) announced 638,000 new jobs were created in October. Note that the number of new jobs for the month fell below the number of new unemployment claims filed in a week. And the unemployment rate fell 1% to 6.9%, as shown in red in the graph above.

There was a large discrepancy between the BLS’ two surveys used to gather unemployment data. The Establishment Survey is used to announce the number of new jobs created for the month. The Household Survey, on the other hand, is used to calculate the unemployment rate. Although the Establishment Survey showed 638,000 new jobs, the Household Survey looked much brighter with over 2.2 million new jobs created, thus the large drop in the unemployment rate. It is likely over the next few months the two surveys will adjust for such a large discrepancy.

One of my favorite ratios for determining the actual employment situation is the employment-to-population ratio which is not affected by those who have fallen out of the labor force. The graph below from the St. Louis Federal Reserve FRED database illustrates the employment-to-population ratio remains far below even that experienced during the Great Recession.

In other news, the election is finally over! Or is it? It appears it could take quite a while before legal challenges and state recounts are completed. It doesn’t look like anyone will be conceding anytime soon. Although the market surged last week, I am not sure how much was due to the projected election results. If the numbers end up where the Democrats take the Presidency and the Republicans take the Senate, that, in my opinion, would be a worst-case scenario for the market. The reason I state that is a President Biden would likely utilize executive orders to implement as much of his environment plan as possible. This could result in increased prices for fossil fuel related goods and services.

Then, a Republican Senate might determine a large stimulus plan is not warranted, especially with today’s announcement of a potential COVID-19 vaccine from Pfizer. Almost all increases in the stock markets this year have been attributable to either prior stimulus or hopes for a new large stimulus package. A situation where costs increase putting pressure on spending and profit margins at a time when many Americans are still hurting due to the pandemic, is not one where I would foresee the market expecting a surge in corporate earnings. Add to that the plan by the Democrats to raise taxes on the wealthy and on corporations, and lower spending and profits are likely.

Only time will tell who ends up as our next President and which party controls the Senate. The stock market reacted strongly Monday, as could be expected on the day of a potential vaccine announcement. Yet, the market sold-off much of the prior night futures and early-day gains by the close. Also, the VIX, described in last week’s missive, actually rose on the day.

All of this means that volatility and risk have not disappeared, but instead have increased. Today’s market movements put the stock market at an even higher valuation, breaking previous records. Caution and vigilance are warranted. If the news about the Pfizer vaccine pans-out, then this could push the market higher in the short run. However, if the probability for a large stimulus package diminishes, then large downward movements are possible. And that’s where we are now!

The S&P 500 Index closed at 3,509, up 7.3% for the week. The yield on the 10-year Treasury Note fell to 0.82%. Oil prices increased to $37 per barrel, and the national average price of gasoline according to AAA decreased to $2.11 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.