Executive Summary

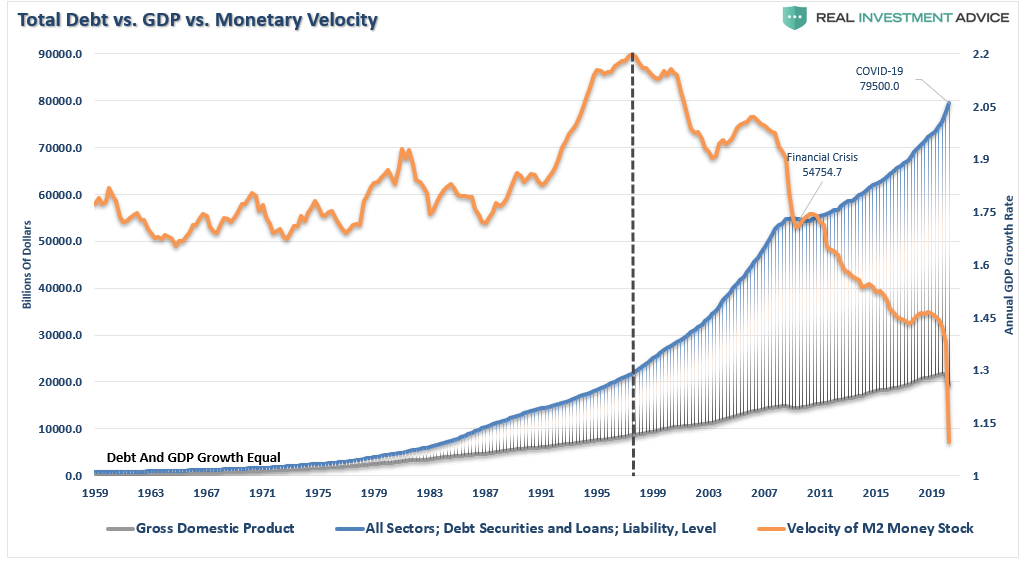

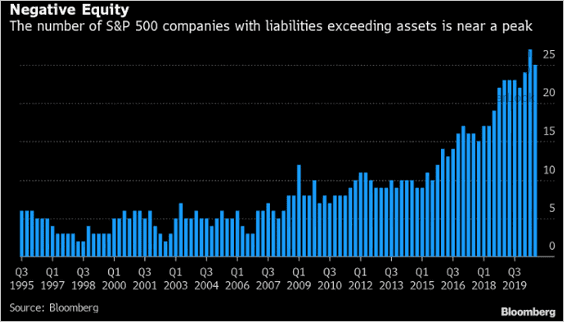

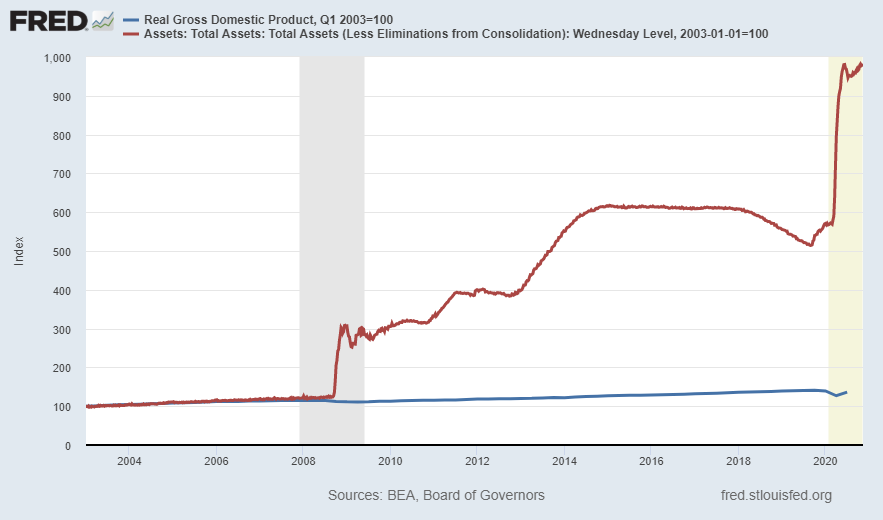

Last Monday the stock market soared upon news that Pfizer had developed a COVID-19 vaccine, and this Monday stock futures were skyrocketing again due to news of a Moderna vaccine. According to a quoted article in the Wall Street Journal, there are issues with the reality of the storage of the vaccine along with the time to produce and distribute. Even if effective, the economy would not just bounce back to pre-COVID-19 levels. The Federal stimulus used in the 2008 Financial crisis and for COVID-19 have created huge debt drags on economic growth. (See first and third graphs below while graph two shows the extent of corporate debt.)

Please proceed to The Details for a more in depth look at how debt and unemployment hinder GDP growth. And with two more companies working on vaccines, do not be surprised by more feelings of déjà vu!

“The only two things you can truly depend upon are gravity and greed.”

–Jack Palance

The Details

If you woke up Monday morning and had a feeling of déjà vu, you are not alone. Last Monday the stock market soared upon news that Pfizer had developed a COVID-19 vaccine where early analysis revealed an over 90% effective rate. This Monday morning, stock futures were skyrocketing again, this time on news Moderna stated preliminary data appeared to show a 94.5% effective rate for their version of a vaccine. Looking only at the stock market, you would expect that the vaccines are ready to be administered to the public; companies will immediately rehire all laid-off employees; and the economy is ready to escalate.

Unfortunately, that is not how it works. The vaccines still have to obtain FDA approvals, then go through production and distribution. An article in The Wall Street Journal stated, “However, it could be many months before any vaccine is administered to enough people to ease the need for lockdown measures that have been recently reimposed across the West [i.e. the U.S.]. Meanwhile, businesses most directly constrained by the virus – particularly in-person services such as hospitality and entertainment – must endure months of weak demand.”

The Pfizer vaccine has additional issues concerning distribution as reported by Reuters, “But the vaccine’s complex and super-cold storage requirements are an obstacle for even the most sophisticated hospitals in the United States and may impact when and where it is available in rural areas or poor countries where resources are tight.

The main issue is that the vaccine, which is based on a novel technology that uses synthetic mRNA to activate the immune system against the virus, needs to be kept at minus 70 degrees Celsius (-94 F) or below.

‘The cold chain is going to be one of the most challenging aspects of delivery of this vaccination,’ said Amesh Adalja, senior scholar at Johns Hopkins Center for Health Security.

‘This will be a challenge in all settings because hospitals even in big cities do not have storage facilities for a vaccine at that ultra-low temperature.’”

Even after the vaccine is available, the economy will not magically return to “normal.” The amount of debt accumulated before and during the pandemic will present an enormous obstacle to future growth. See the chart below from Real Investment Advice. Notice the rate of change of debt is much faster than the economy. And, at the same time, the velocity of M2 (The number of times money turns over during a year) has plummeted to all-time lows.

The debt accumulated by S&P 500 companies has left a record number of companies as zombies, where their liabilities exceed their assets. See the graph below. And the number of smaller companies in this situation far exceeds the larger S&P 500 companies.

Despite claims of a bouncing economy on the verge of a boom, over 21 million people remain on some type of unemployment benefit. You would think if the economy were back near “normal” and a vaccine was near that further stimulus would not be needed. However, if you were to survey small businesses and many households, the need for additional stimulus is critical.

Many believe Federal stimulus will return the economy to a position of strength. However, history proves that not to be the case. Stimulus programs merely create additional debt, plus the appearance of a recovering economy. In actuality, it is a temporary fix and more will be required to keep the economy afloat. We have reached the point of needing perpetual stimulus. Even renowned economist and investment analyst, Mohamed A. El-Erian agrees, recently stating, “They [The Fed] are increasingly on what I call a no-exit paradigm.”

Even with the previous nearly $3 trillion in various stimulus programs this year, the economy remains in recession. Debt is at record highs, and unemployment is rampant. Yet, the stock market is at all-time highs! A friend recently reminded me that gravity is real. You cannot deny it. If you fall from a step, you might skin your knee or elbow. If you fall from a tree, you might break a bone or worse. However, if you fall from an airplane without a parachute…well, God help you! There is no justification for current stock prices. Corporate earnings would have to double to make the current price-to-earnings ratio somewhat reasonable. In this environment, that is not going to happen, even with a new stimulus plan.

Just to see how the Federal Reserve’s (Fed) funding of government programs correlate with economic growth, look at the chart below. Notice prior to the Great Recession (which started in December 2007) the relationship between Fed assets and real GDP growth. After massive programs were initiated to “save” the economy, the Fed balance sheet soared (Red line below). If these programs were a permanent fix to economic growth, then the blue line would not be so disconnected from the red line. This disconnect is likely only to grow. Over a decade of almost continuous stimulus and/or liquidity programs have not stimulated sustainable economic growth.

Although a vaccine is possible over the next six months to a year, which can be cheered by all; in all likelihood it will be too little too late for the economy. The debt-hole and unemployment situation are not matters easily fixed. More debt-funded stimulus will merely provide temporary relief. A restructuring of debt, including defaults, is ultimately needed to provide a point for sustainable future economic growth. There are two more companies with vaccines in development, so do not be surprised if you one again experience déjà vu.

The S&P 500 Index closed at 3,585, up 2.2% for the week. The yield on the 10-year Treasury Note rose to 0.89%. Oil prices increased to $40 per barrel, and the national average price of gasoline according to AAA rose to $2.13 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.