Executive Summary

Does a lender paying a borrower to hold his money make any logical economic sense? In attempts to boost growth, central banks across the globe resorted to massive Quantitative Easing programs. These programs allowed the monetization of incredible amounts of government debt. As a result, there is now about $14 trillion of negative yielding debt in existence. Yes, lenders paying borrowers to hold their money! However, according to the International Monetary Fund, Real GDP growth for advanced economies is still around 2%. Please proceed to The Details for the complete picture of the house of cards being built by politicians and central bankers.

The Details

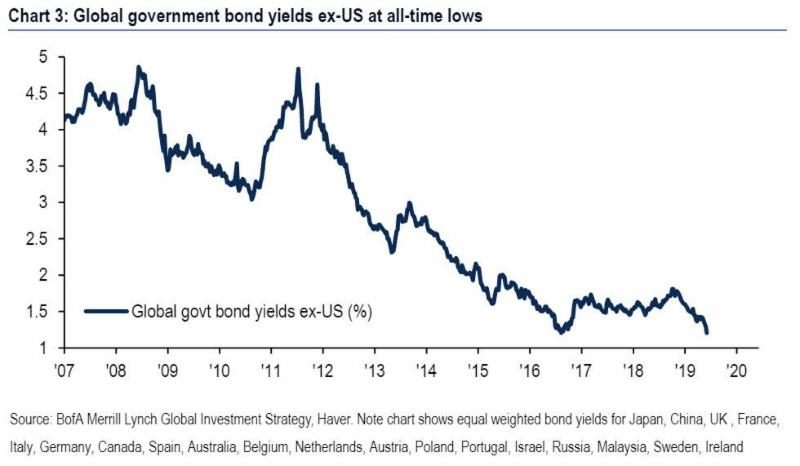

Does a lender paying a borrower to hold his money make any logical economic sense? In attempts to boost growth, central banks across the globe resorted to massive Quantitative Easing programs. These programs allowed the monetization of incredible amounts of government debt. As a result, there is now about $14 trillion of negative yielding debt in existence. Yes, lenders paying borrowers to hold their money! However, according to the International Monetary Fund, Real GDP growth for advanced economies is still around 2%. Please proceed to The Details for the complete picture of the house of cards being built by politicians and central bankers.

Currently, the entire yield curve, from 1-year through 30-year maturities, of German government bonds, and Swiss government bonds out to 50 years, have negative yields.

So, with this massive infusion of “created” money driving bond yields to their all-time lows, has global growth surged? The graph below from the International Monetary Fund (IMF) illustrates Real GDP growth for advanced economies hovering around the 2% line. Not hardly what one would call strong growth. Consider what central banks had to do to achieve this tepid number.

It has become so absurd that recently in Europe negative yields have spread beyond government bonds, beyond investment grade corporate bonds, to high-yield or junk bonds. Remember, junk bonds typically maintain higher interest rates to compensate for their added risk of default. Now, investors are purchasing below investment grade debt at negative yields! They are paying a high-risk borrower to participate in the possibility of higher defaults. Insane!

Many might be thinking, this is interesting but how does it affect me. It probably doesn’t now, but it could in the future. A good example of how an individual investor could be impacted was recently described by a European pension fund manager in a blog by Charles Gave of Gavekal Research. The pension manager recalled,

“One day he was called by a pension regulator at the central bank and reminded of a rule that says funds should not hold too much cash because it’s risky; they should instead buy more long-dated bonds.

His retort was that most eurozone long bonds had negative yields and so he was sure to lose money.

‘It doesn’t matter,’ came the regulator’s reply: ‘A rule is a rule, and you must apply it.’

Thus, to ‘reduce’ risk the manager had to buy assets that were 100% sure to lose the pensioners money.”

Imagine being a pensioner in Europe today.

Even more disturbing is that even with no real tangible positive results to show for this absurdity, it continues. Not only that, but the Fed is watching these actions and is not ruling out negative yields in the U.S. when the next crisis arrives. Why can’t politicians and central bankers see the absurdity of their actions? Is it because they realize they are building a house of cards? This house might be getting a little too tall.

The S&P 500 Index closed at 2,932 down 3.10% for the week. The yield on the 10-year Treasury dropped to 1.86%. Oil prices remained at $56 per barrel, and the national average price of gasoline according to AAA decreased to $2.71 per gallon.

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.