Executive Summary

The current economic expansion is the longest and weakest in history. Why is that? This “recovery” was sparked and maintained by unprecedented experimental monetary policy. This included printing $3.7 trillion in liquidity and dropping interest rates to zero. The result was massive expansion of debt across all spectrums, and the stock market grew into bubble territory. Corporate debt helped fuel stock buy backs giving the appearance of earnings growth. However, the underlying economic growth was the weakest of any recovery. Eventually these large debt payments drag down future economic growth. Please proceed to The Details for further facts and graphs visualizing this story

“Today, there are three kinds of people: the have’s, the have-not’s, and the have-not-paid-for-what-they-have’s.”

–Earl Wilson

The Details

There has been much celebration of late surrounding the fact that the current economic “expansion” is the longest on record. It’s funny how the narrative can change when the entire picture is examined. Imagine discussing a book after only reading one chapter. The remaining chapters of this story are critical to deriving the correct conclusion.

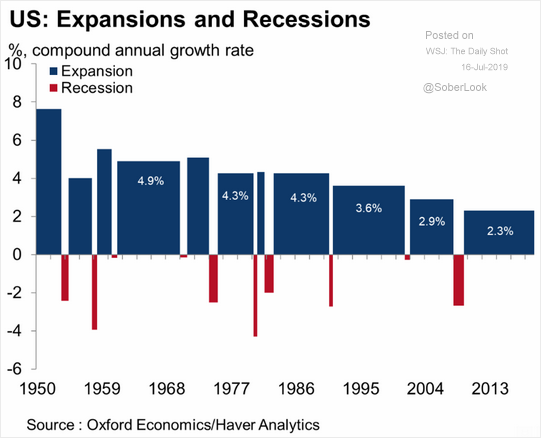

Yes, this has been the longest expansion on record. It has also been the weakest expansion in history.

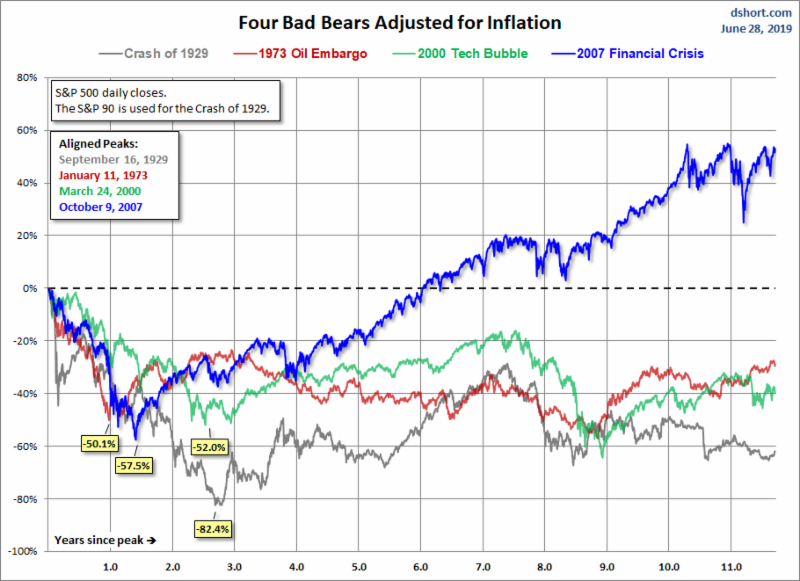

The reason why so many investors believe the expansion has actually been strong is the stock market has soared thanks to the infusion of $3.7 trillion in liquidity from the Federal Reserve Bank (Fed) and dropping interest rates to zero percent. Despite the more recent Fed rate hikes, the Fed Funds Rate remains a meager 2.25%. The chart below from Advisor Perspectives compares the stock market movements for four of the worst bear markets and their subsequent recoveries. Notice the outlier, the most recent recovery. This market bubble took-off once the Fed began implementing unprecedented experimental monetary policy.

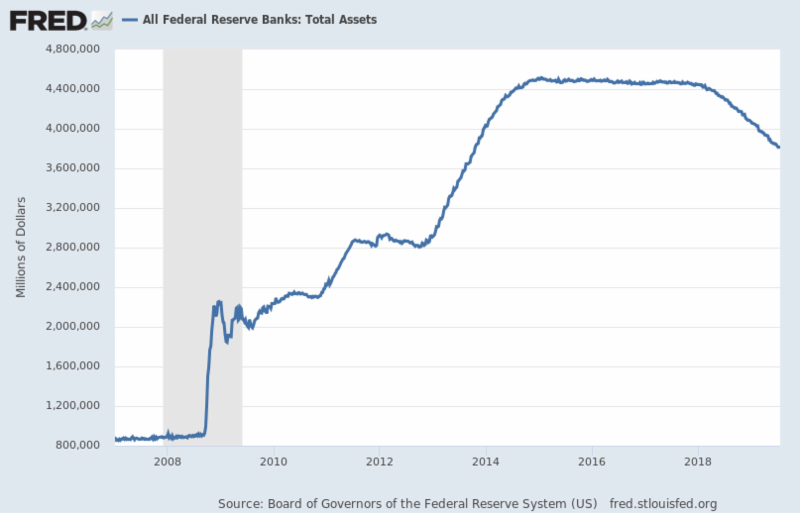

The monetary policy quintupled the Fed balance sheet. See below from the St. Louis Fed FRED database.

And, now as the economy is slowing with second quarter GDP growth anticipated to come in around 1.5%, the Fed is expected to begin dropping rates again. Why would they drop rates if the expansion is the longest on record and short-term interest rates are only at 2.25% with the 10-year Treasury Note yielding 2.05%? The answer is: we are a debt-driven economy. The reason interest rates were lowered to zero percent in the first place was to encourage debt-based consumption. Consumption makes up close to 70% of our economy, so the Fed believes by encouraging debt and consumption, the economy will grow.

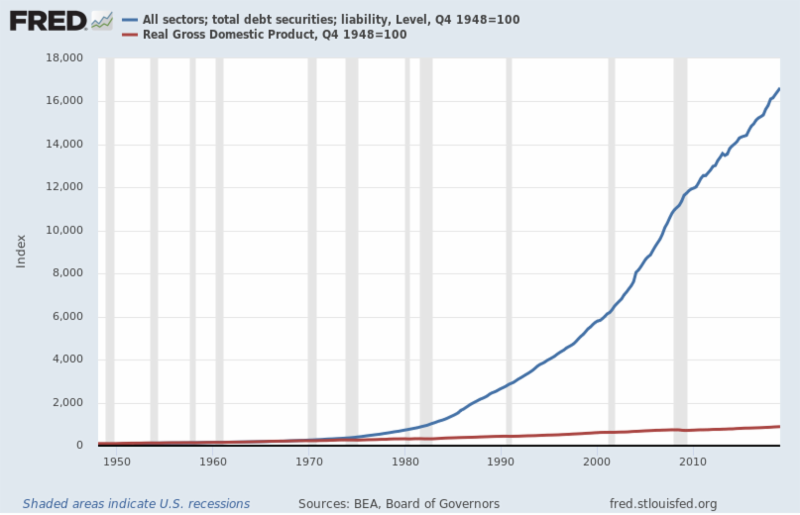

The problem with this theory is non-productive debt, or debt for pure consumption purposes as opposed to investment, merely pulls future consumption forward. In the future, funds will have to be expended to pay-off the debt. As one can see in the chart below, total debt growth in the U.S. has far out-paced economic growth since the early 1980’s. At some point, debt capacity reaches its limits.

Also, as debt balances escalate, the need to service that debt also grows. Lowering interest rates reduces the cost of servicing the debt, but at some point, the principal repayments themselves become burdensome.

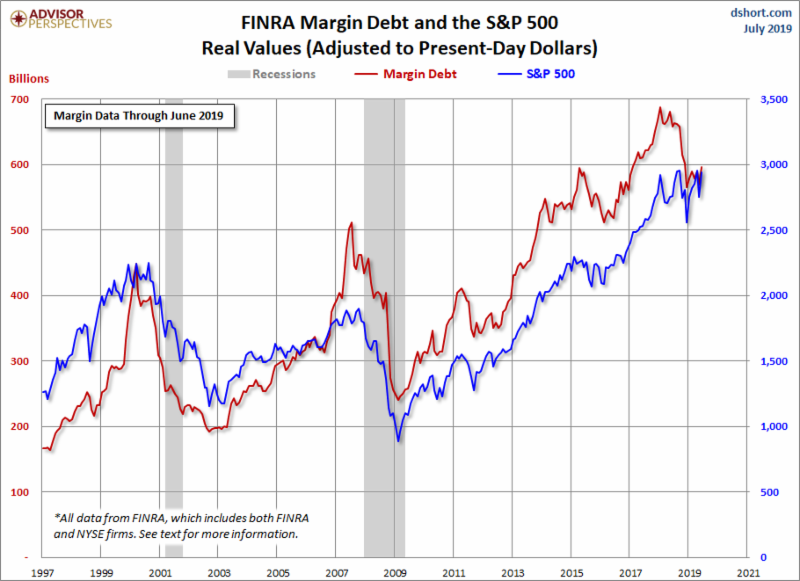

A summary of this record long expansion goes as follows. The Fed effectively printed $3.7 trillion and dropped interest rates to zero percent. Corporations borrowed this cheap money in order to repurchase their stock and improve the appearance of earnings reported on a per share basis. Individuals also borrowed money using margin loans to purchase stock.

Others borrowed merely to make ends meet. The massive infusion of liquidity created debt bubbles in corporate debt, government debt, student loans, auto loans, and now other consumer loans. This debt allowed for stock purchases pushing the stock market higher creating one of the largest bubbles in history. The debt allowed the economy to roll-along albeit at a subpar pace. Current growth is about one-third below the prior long-term trend growth level.

The Fed, and politicians, now realize the “expansion” is fading, both here and globally. Hence the discussion of lowering rates again. However, globally interest rates are far lower than in the U.S. with negative yields all around; yet, the negative yields have not solved their slowing economic growth problems.

In order for U.S. economy to continue growing, the massive growth in debt seen over the past decade would have to duplicate itself. With debt service already straining the Federal government, corporations, and individuals, how would this be possible? The simple answer is absent full and substantially higher government debt monetization, otherwise known as Modern Monetary Theory (MMT), it is not possible. MMT is simply printing money for everything the government deems necessary. This could be bailing out student loans, car loans, banks, etc. If implemented the likely result would be massive inflation.

The growth over the past decade has not been organic. The weakest, and yes longest, expansion on record was fueled by artificially low interest rates and massive experimental money creation; yet to be significantly unwound. And now politicians, the Fed, and investors are calling for more! Can maxed-out debtors continue adding to their pile of loans? If not, the Fed will assume MMT is the only solution to continue the record long expansion.

This house of cards cannot continue much longer. The next recession will likely bring out even more extreme monetary policy, possibly combined with extreme Federal stimulus. This would be on top of the current trillion-dollar deficits. There are limits to debt-fueled growth!

The S&P 500 Index closed at 2,977, down 1.23% for the week. The yield on the 10-year Treasury decreased to 2.05%. Oil prices fell to $56 per barrel, and the national average price of gasoline according to AAA decreased to $2.77 per gallon.

At Prudent Financial, portfolios are developed to take into account the state of the economy, market cycle and valuation, and relative strength. Our goal is long-term growth with limited downside potential. If you need assistance with your portfolio, please give me a call. I would be happy to review your situation and explain how we can help you work towards achieving your goals.

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.