“And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

– Ben Bernanke

Executive Summary

Have you heard interest rates are rising? Do you know all interest rates are not the same? In this week’s newsletter, I explain the differences between short-term and long-term interest rates. The Federal Reserve Bank raises and lowers short-term interest rates in attempts to control inflation or deflation. These rates tend to impact banking rates such as savings accounts, credit cards, auto loans, etc. Longer-term rates, such as the 10-year Treasury Note, tend to move according to economic activity and inflation. For my outlook on both long-term and short-term interest rates, as well as factors influencing both, please proceed to The Details.

“I will say that until recently, the idea of prominent Federal Reserve officials publicly talking of the stock market as an instrument for creating a ‘wealth effect’ would have seemed rather foreign. I see considerable peril, for a variety of reasons, in having officials make these types of comments.”

– Ted Kavadas, EconomicGreenfield

The Details

Oftentimes investors tend to lump all interest rates together as if they all move in-sync. Yet, different types of interest rates are influenced by different factors. In general, rates can be influenced by the supply and demand for the debt instrument, the credit quality of the issuer, and the time to maturity. Additionally, inflation, economic growth, and central bank policy can affect the level of interest rates.

Short-term rates are largely controlled by the Federal Reserve Bank (Fed). The Fed’s Federal Open Market Committee (FOMC) establishes the Federal Funds Rate (FFR), which is the rate banks charge each other for overnight loans. This rate in-turn impacts other short-term interest rates. Setting the FFR is one of the main monetary policy tools used by the Fed in attempting to meet their dual mandate of maximum employment and price stability. Beginning with former Fed Chairman Ben Bernanke, the Fed added an unwritten mandate, influencing the stock market to create the wealth effect. After the Great Recession, Bernanke indicated that a rising stock market would make investors feel wealthier. Therefore, they would spend more, thus helping spur an economic recovery.

The primary factor, until recently, driving short-term interest rate decisions by the FOMC has been fear of inflation or deflation. After lowering the FFR to almost zero percent, the target has been raised to between 2.25 and 2.5%. Further rate hikes seemed to be in the works up until the recent stock market meltdown. Many thought current Fed Chair Jerome Powell would be different than his predecessors and would focus on the dual mandate without influence from stock market activity or politicians. However, over the past few weeks, Chair Powell’s comments indicate he is falling in line with his forerunners. His recent remarks seem to contradict his statements made merely weeks before. The further the stock market recently fell, the more dovish the comments from the Fed. The outlook for Fed rate hikes for 2019 has almost dissipated with the growing concern over economic growth and the stock market (the unwritten mandate).

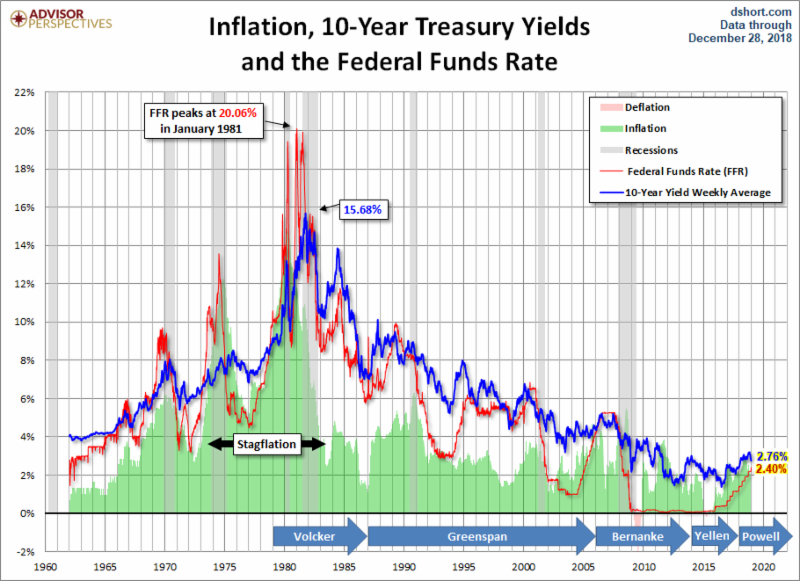

Long-term interest rates tracked by the 10-year Treasury Note tend to move based upon the outlook for inflation and GDP growth. Although the outlook for FOMC actions regarding the FFR tends to impact the 10-year yield in the short-run, these short-term movements eventually give way to the bigger picture surrounding inflation and economic growth. See the chart of interest rates below from Advisor Perspectives.

Notice in the graph above, after peaking in the early 1980’s the overall trend for the 10-year Treasury yield (blue line) has been downward. Former Fed Chair Paul Volcker drastically raised the FFR in the early 1980’s to combat skyrocketing inflation. The result was a precipitous drop in inflation. The 10-year yield has remained in a downward channel, albeit with annual fluctuations within the channel. Over the past decade, most pundits have repeatedly called for rising long-term rates. I have consistently stated I felt rates would continue to fall as the trend for GDP and inflation has been down.

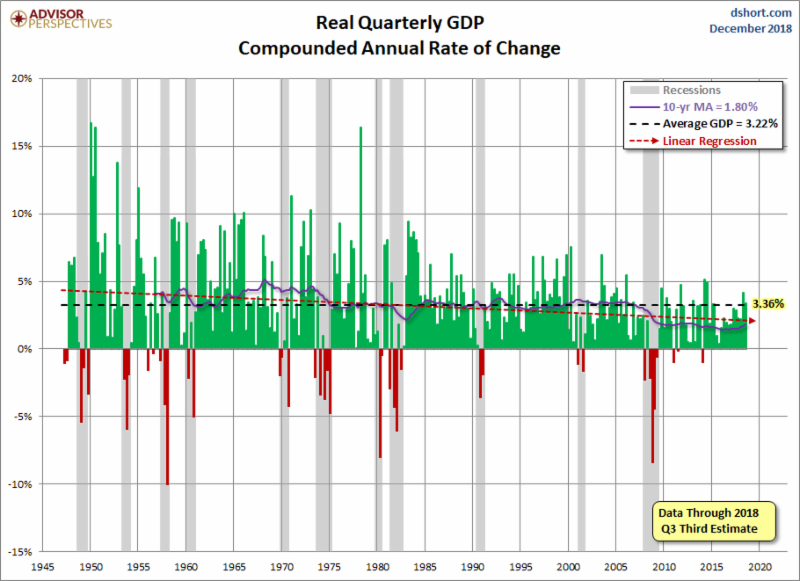

The 10-year Treasury yield rose to about 3.25% in early November 2018 inciting panic among many investors and calls for much higher rates by certain bond gurus. Since then, the yield has fallen to around 2.7%. Global growth is slowing. The World Bank reduced its outlook for 2019 growth in advanced economies to a mere 2%, while the forecast for emerging and developing economies is a weaker-than-expected 4.2%. The U.S. economy is also slowing. After a temporary surge in annualized real GDP growth to 4.2% in the second quarter, spurred by tax cuts and front-running expected tariffs, growth accelerated at a slower pace in the third quarter (3.5%), and projections for fourth quarter range from sub-2% (Hedgeye Risk Management) to 2.8% (Atlanta Fed GDPNow). The chart below illustrates the long-term downward trend in GDP growth.

Bonds other than Treasuries also carry the risk of default. The lower their credit rating, the higher their interest rates. As bank and Treasury interest rates practically disappeared with the Fed’s ZIRP (Zero Interest Rate Policy), many investors fled to high yield (also known as junk) bonds, rated below investment grade, in search of higher rates. As demand increased for high yield bonds, prices rose pushing yields down. Increased demand for these bonds incentivized lenders to create more product. However, many investors don’t realize the risk of default imbedded in many of these bonds/bond funds. A future recession will lead to increasing defaults and plummeting prices. There is a reason these bonds are nicknamed “junk” bonds.

There is no simple answer to which way rates are headed. It depends upon the underlying instrument and the length to maturity. The Fed controls short-term rates. Long-term Treasuries tend to track inflation and economic growth. For these reasons, I believe long-term Treasuries rates will fall further, albeit with temporary bounces. The direction of short-term rates is up to Chair Powell and the FOMC. Will the FOMC succumb to stock market movements or political influences? Or, will they stay the previously outlined course? Only time will tell.

The S&P 500 Index closed at 2,596 up 2.54% for the week. The yield on the 10-year Treasury note rose to 2.70%. Oil prices increased to $52 per barrel, and the national average price of gasoline according to AAA rose slightly to $2.25 per gallon.

At Cremerius Wealth Management, portfolios are developed to take into account the state of the economy, market cycle and valuation, and relative strength. Our goal is long-term growth with limited downside potential. If you need assistance with your portfolio, please give me a call. I would be happy to review your situation and explain how we can help you work towards achieving your goals.

Best Regards,

Bob Cremerius, CPA/PFS

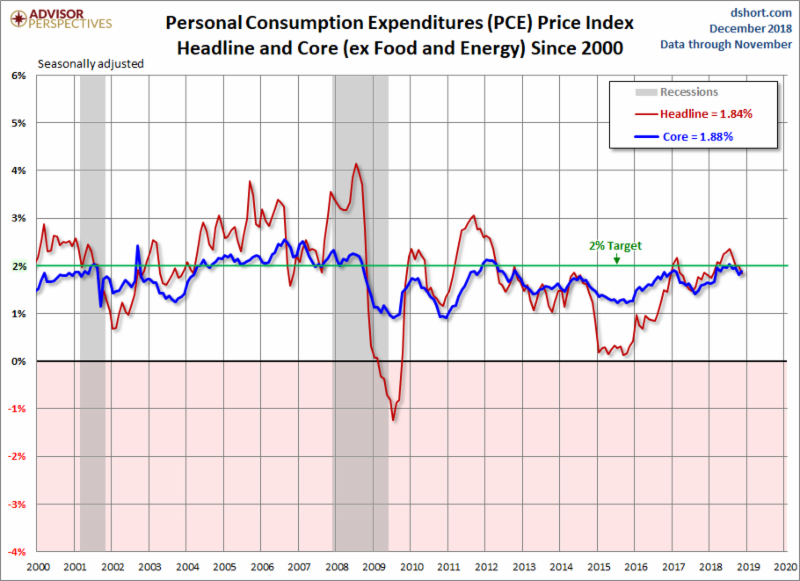

Inflation has remained muted according to the Fed’s favorite barometer, the PCE (Personal Consumption Expenditures) Price Index. Enormous debt at all levels of the economy will keep a lid on economic growth and inflation. This projection could be interrupted depending upon future action by the Fed. If the economy slips into recession over the next year or two, I expect the Fed to halt their reversal of Quantitative Easing, referred to as Quantitative Tightening, and return to massive experimental Quantitative Easing. The form of this QE will determine the potential for increased inflation.

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Cremerius Wealth Management, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Cremerius Wealth Management is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.