Executive Summary

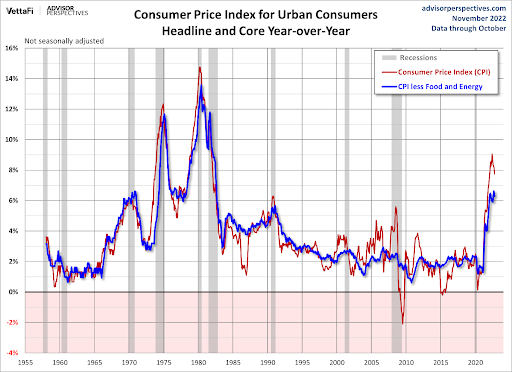

Last week when the Consumer Price Index was released, the stock market reacted with a large one-day rally – capping off a volatile week of up, down, and way up. Historically, these types of one-day gains occur during bear markets (first graph). In the age of program trading, algorithms react to specific data points. The CPI data release sparked the extreme hope the Federal Reserve Bank will soon “pivot” and stop raising interest rates. However, a look at inflation numbers (fourth graph) reveals inflation is still high and persistent. While the market can hope for the pivot, the Federal Reserve is determined to keep fighting inflation. Last week may just indicate there will be continued volatility while this bear market lasts longer than anticipated.

Please continue to The Details for the full report.

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.”

–Seth Klarman

The Details

Last week the stock market exhibited tremendous volatility. The week began with the S&P 500 trending slightly upwards, gaining around 2% through Tuesday. Then on Wednesday, the market plummeted 2%. On Thursday, the October Consumer Price Index (CPI) data was released before the market opened. It was as if investors were looking for an excuse for a rally, and a rally they got. With the CPI “missing expectations” by 0.2%, the S&P 500 soared 5.5%, the Dow jumped 3.8% and the Nasdaq 100 skyrocketed by an outstanding 7.4%! All because the CPI increased 7.7% year-over-year instead of the 7.9% “expected.” Many investors, once again, began hoping this was the start of a new bull market. However, as history has shown, these are the types of one-day gains reserved for bear markets.

The chart below obtained from Wikipedia (prepared from data obtained from the SPGlobal.com website), highlights the largest one-day gains in history for the Dow. The majority of these gains occurred during the Great Depression era. There was one large gain on October 21, 1987, occurring two days after the 23% crash of Black Monday. The gains occurring in 2020 were attributable to the unprecedented Government stimulus programs initiated in response to the pandemic.

In this age of algorithmic trading, programs are written to jump on the slightest “unexpected” datapoint. In a bear market, these jumps tend to fade almost as fast as they arrive. The impetus for last week’s jump makes no sense logically. The hope was that inflation would drop. Thus, the Federal Reserve Bank (Fed) will soon “pivot” (the word of the year) and stop raising interest rates. However, Fed Chairman Jerome Powell has made it perfectly clear that there will be no “pivot” until inflation is under control. The Fed’s preferred inflation index is the Personal Consumption Expenditures (PCE) which tends to run slightly lower than the CPI. Any way you slice it, the 7.7% y-o-y increase in the CPI is too high. The Fed Funds Rate (FFR) will likely need to rise above the inflation rate before the Fed changes policy. Currently, the effective FFR is 3.83%, far below the inflation rate.

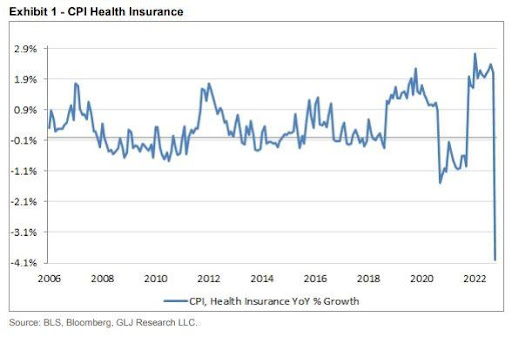

Another interesting point about the Government contrived data was highlighted by Gordon Johnson of GLJ Research. Johnson pointed out that “There was a record ‘periodic adjustment’ to Health Care Inflation CPI that artificially lowered Oct. Services Inflation (which WON’T be reflected in the Dec. 1st PCE inflation data…)”

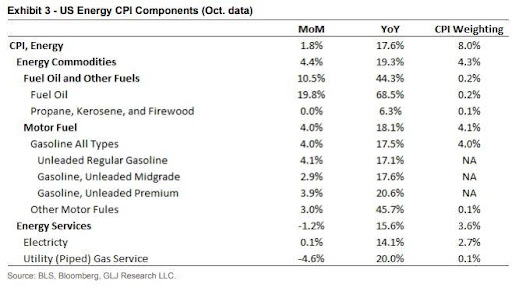

And the “Core” numbers the Fed likes to focus on exclude food and energy. Unfortunately, food and energy are two of the largest expenses for the average American. As Johnson pointed out, energy inflation is soaring again.

The bottom line is there is often more to the picture than included in the “headline.” And the incredible algorithmic reactions to such headlines often do not last. In the end, the U.S. remains in a bear market with still extremely overvalued stocks. It appears the volatility will continue, and the bear market could last longer than most investors had hoped. Until the excesses are eliminated from the market, the bear market will trudge along.

One-day gains as witnessed last week are confirmation that the bear market remains. The largest market gains have almost always occurred in the midst of bear markets.

The S&P 500 Index closed at 3,993, up 5.9% for the week. The yield on the 10-year Treasury Note dropped to 3.83%. Oil prices fell to $89 per barrel, and the national average price of gasoline according to AAA decreased to $3.78 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.