Executive Summary

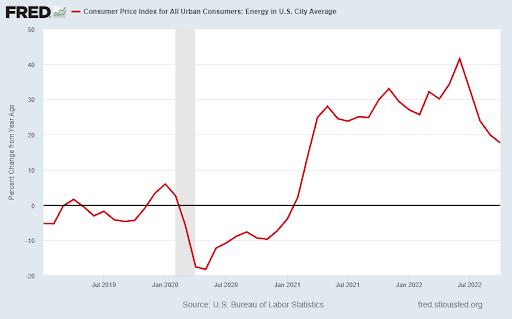

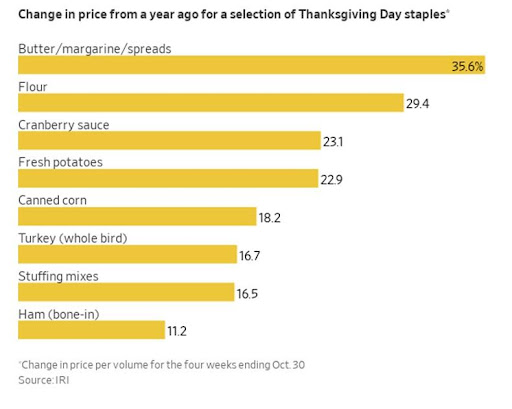

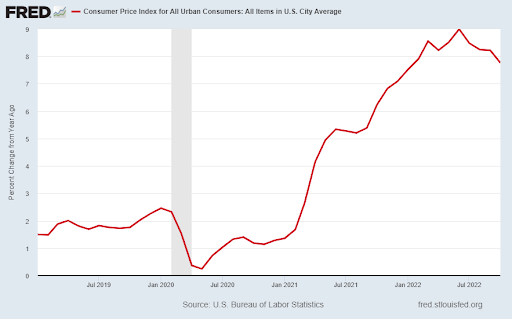

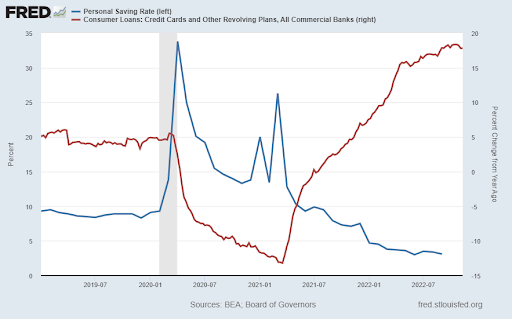

Many people in the U.S. have much to be thankful for; albeit inflation is not one of them. Since energy prices are up 17% over last year (see first graph), holiday travel may be negatively impacted. And Thanksgiving food staples are up significantly (second graph). As these inflationary impacts are felt by consumers, many reduce savings rates and resort to credit cards for needed items (see fifth graph). The Fed is attempting to reduce inflation; however, a study by Research Associates reveals this inflationary scenario has historically taken ten years to get under 3% – hardly transitory. Stanley Druckenmiller shared that when crude oil, the U.S. dollar, and interest rates all spike in the same year, the subsequent year S&P 500 earnings per share decline by 35%. Things could be more challenging in 2023, so take time this season to enjoy family and be thankful for today’s blessings!

Please continue to The Details to see if households are really “flush.”

“Reflect upon your present blessings.”

–Charles Dickens

The Details

As we approach Thanksgiving this week, most people have a lot to be thankful for; however, inflation is not one of them. When the Federal Reserve Bank (Fed) increased their balance sheet by about $5 trillion to fund the massive pandemic stimulus programs, many realized the knock-on effect would be high inflation. As economist Milton Friedman stated, “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Combining this with supply constraints arising due to the Russian invasion of Ukraine, and one has all the makings of high inflation. How is inflation impacting the average consumer today?

The largest impact affecting most families likely comes from the increase in gasoline and energy costs. While these costs have come off of their peak, gasoline is still selling for $3.67 per gallon nationally, and $3.22 per gallon in Tennessee, according to AAA. These costs are over $1.00 per gallon higher than pre-pandemic. Energy costs have increased 17% year-over-year as shown in the graph below.

Additionally, food prices have soared. The chart below illustrates the increase over the past year in the cost of a typical Thanksgiving meal, according to The Wall Street Journal.

Overall, consumer prices have risen 7.8% over the past year according to the Consumer Price Index (CPI). Although peaking around 9% in June of 2022, the inflation rate remains close to four times greater than the Fed would prefer.

The Fed has been consistently raising the Fed Funds Rate (FFR) in an effort to reduce demand and lower inflation. Many investors are hoping the Fed will decide to reduce their rate hikes, believing that inflation will quickly fall as demand wanes. Unfortunately, according to a study by Research Associates, that may not be the case. According to Research Associates,

“Given the recent US inflation rate, which has been above 6% for the last 12 months and above 8% for the last 7 months, history tells us that the median number of years to reduce inflation below 3% is 10 years, with a 20th to 80th percentile range of 6 to 19 years.”

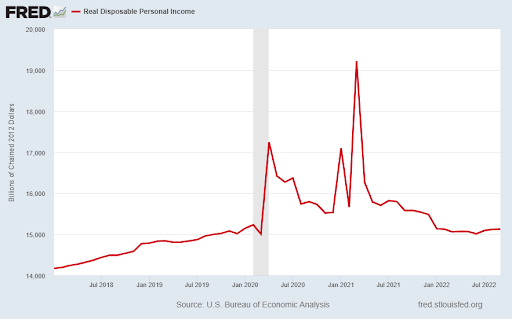

If that is the case, consumers could be in for a rough ride. Real (after inflation) incomes are falling. With inflation being higher than the increase in income, real disposable personal income, after an unprecedented surge due to pandemic stimulus, has fallen back to pre-pandemic levels. So, costs are rising faster than income.

When consumers find themselves in a hole, they tend to resort to the use of credit cards. The chart below shows the personal savings rate has dropped at the fastest rate on record, down to 3.1%. At the same time the use of credit cards has soared up about 18% over last year and setting new record levels of debt.

Not only are the increase in inflation and interest rates taking their toll on consumers, according to well-known hedge fund manager and president of Duquesne Capital, Stanley Druckenmiller, the stock market impact could be severe. Druckenmiller stated (via Puru Saxena on Twitter), “Whenever crude oil, US Dollar and interest rates spiked in tandem in a given year, the S&P 500 earnings per share (EPS) declined by ~35% during the following year (no exceptions).”

A drop in earnings of 35% would have a devastating impact on stock prices.

Whether driving to visit family or preparing a family meal, most people will feel the impact of inflation over the holidays. When push comes to shove, consumers turn to credit cards to fill the gap. High and rising interest rates are making this a more dangerous move. The period of high inflation, which according to Research Associates, could be a long time, will be difficult for many families. The impact will spill over into the stock market as corporate earnings fall. With that will likely come lay-offs which could push the U.S. into a severe recession.

In the meantime, take this holiday to spend time with loved ones and be thankful for the blessings we have. Happy Thanksgiving!

The S&P 500 Index closed at 3,965, down 0.7% for the week. The yield on the 10-year Treasury Note dropped to 3.82%. Oil prices fell to $80 per barrel, and the national average price of gasoline according to AAA decreased to $3.67 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.