Executive Summary

A recent article in The Wall Street Journal claimed consumers were “in good shape.” The fact missing from the article is the rapid decline in consumer finances. In the second graph below, one can see household debt as a percentage of real disposable personal income has increased by about 15%. When inflation came knocking, the negative impact on the consumer was swift. Look at the third graph for the inflation impact on disposable personal income (red line) compared to nominal disposable personal income (blue line). And the last graph shows the utilization of credit cards to fill the spending gap needed to pay bills. The tremendous rate of change in credit card debt versus the decline in disposable personal income is evident.

Please continue to The Details to see if households are really “flush.”

“Debts are like children – begot with pleasure, but brought forth with pain.”

–Moliére

The Details

A recent article entitled “Cash-Rich Consumers Could Mean Higher Interest Rates for Longer” by Nick Timiraos – often referred to as the “unofficial” mouthpiece for the Federal Reserve Bank (Fed) – in The Wall Street Journal speculated on the terminal rate for the Fed Funds Rate once rate hikes are ceased. The article focused on the financial status of households in which he stated were left in “unusually strong shape” after the flood of pandemic stimulus. To bolster this claim, the following graph was provided illustrating the level of U.S. household savings sorted by income quartile.

The article left many readers confused by the suggestion that household “balance sheets are in a historically strong position.” In this missive, I will divert from a discussion of the terminal Fed Funds Rate and will focus on the status of household finances.

In reviewing some of the discourse on financial Twitter surrounding this article, I found many succumbing to the belief that the consumer is in good shape. The detail that seems to be absent from the discussion is the rapidity of the decline in consumer finances. Yes, households were able to reduce some debt and build additional savings with the receipt of unprecedented Government benefits. And yes, extremely low interest rates kept debt service payments low as a percentage of income. But then inflation came knocking. And its arrival spread throughout the economy like wildfire. Notice the impact of inflation on households’ debt balances relative to real (inflation-adjusted) disposable personal income (DPI) in the graph below. Just since the middle of last year, household debt as a percentage of real DPI has increased about 15%.

Some analyses of household debt focused on “nominal,” or before inflation, DPI. However, households are impacted by net disposable personal income. Income drained by inflated prices is not available to save or to spend on other items. The graph below illustrates the disparity between nominal and real DPI since the beginning of 2019. Notice the decline in “real” DPI since early 2021.

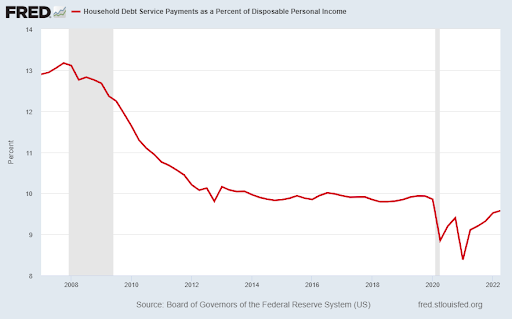

The pre-pandemic Fed Funds Rate of close to zero percent allowed households to borrow at record low interest rates, thus lowering debt service payments on homes, automobiles and other large purchases. As a result, household debt service payments dropped from around 13% of (nominal) DPI to a low of around 8.5% when the stimulus peaked last year.

The majority of households were living paycheck to paycheck before the temporary stimulus distributions. The elimination of said distributions along with the arrival of soaring prices and rising interest rates brought the “good times” to an abrupt halt.

The swiftness with which the “good times” ended can be seen in the graph below. The blue line shows credit card and revolving debt soaring on a rate of change basis, while real DPI has been declining (red line). Credit card and revolving debt are increasing at over 18% year-over-year. As this debt skyrockets, inflation is eating away at DPI. Mortgage interest rates have pushed above 7%, bringing the real estate market to a halt. Mortgages, both first and second, with variable rates will see drastic increases in required payments. Auto loans too will reflect the jump in interest rates.

Again, the “level” of household assets as of a specific date, which is lagged due to the time it takes to accumulate accurate data, should not give comfort that the consumer is in “good shape.” The speed at which inflation rocketed higher, forcing interest rates on loans to follow suit, will quickly undo any pandemic-based benefits accumulated by households. The evidence is clear and is seen in the rate of change in credit card debt. If household balance sheets were really flush, then this phenomenon would not occur on the scale witnessed. The higher interest rates climb, and the longer inflation remains elevated the quicker the damage to the average household. The further the decline in household finances, the deeper the current or upcoming recession. Interest rates and inflation are already inflicting pain.

The S&P 500 Index closed at 3,901, up 3.9% for the week. The yield on the 10-year Treasury Note fell to 4.01%. Oil prices rose to $88 per barrel, and the national average price of gasoline according to AAA decreased to $3.76 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.