Executive Summary

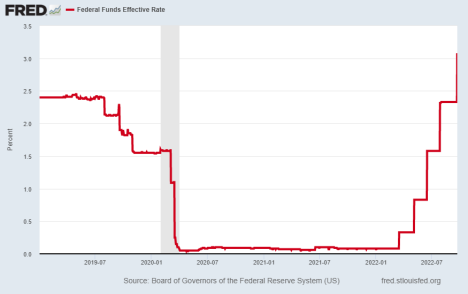

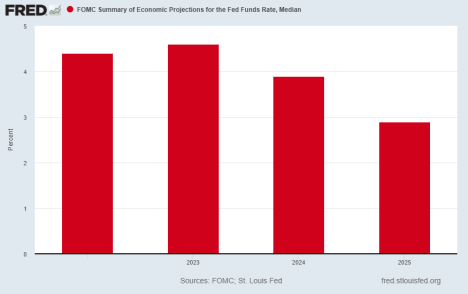

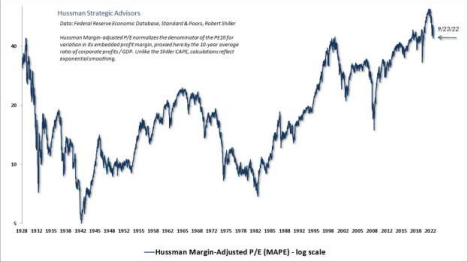

The Fed raised the Federal Funds Rate again last week by 0.75% in the fight against inflation. In the second graph below one can see the estimated rates through 2025. In addition to interest rate moves, the Fed is also tightening monetary policy by reducing the balance sheet – which ballooned to $8.9 trillion when they flooded the market with liquidity. These policies create downward pressure on the stock markets, which hit a new low for the year on Monday, September 26. The last graph shows the decline brought the valuation down to around the valuation at the peak of the Technology Bubble. Many are eager to call market bottoms, but history would caution otherwise. After the peak of the Technology Bubble, markets took a second leg down, much further than the initial drop.

Please continue to The Details for more of my analysis.

“The only thing that goes up in a bear market is correlation.”

–Unknown

The Details

Last week, the Federal Open Market Committee (FOMC) of the Federal Reserve Bank (Fed) raised the short-term Federal Funds Rate (FFR) by 0.75%. The most recent increase brought the FFR to a range of 3.0 – 3.25%. Since March, the Fed has raised the FFR by a whopping 3% in attempts to gain control over the dramatic rise in inflation. In addition to 0.25% and 0.50% increases earlier this year, the increase last week was the third 0.75% move this year. Since 1990, the Fed has raised the FFR by at least 0.75% at one meeting only one time.

The following chart illustrates the FOMC members’ median projections for future changes in the FFR. They are currently estimating a 4.4% rate at the end of 2022. This is almost one and one half percent higher than the current rate. In 2023 the rate could rise to 4.6% before slightly falling in 2024 and 2025. Of course, these projections could change drastically if inflation does not abate and/or if the economy weakens significantly.

In addition to raising the FFR, the FOMC plans to continue reducing the size of the Fed balance sheet by $95 billion per month. Assets topped-out at about $8.9 trillion, rising from a mere $900 billion in 2007. Although the balance sheet is scheduled for significant reductions, so far, little has been accomplished. The draining of liquidity from the economy through Quantitative Tightening (QT) could put serious downward pressure on the stock market, which remains drastically overvalued. The graph below overlays the S&P 500 Index (blue line) over the balance of Fed assets (red line).

The S&P 500 began falling at the beginning of the year. By June 15, it had fallen close to 23% reaching a low of 3,667. A subsequent bear market rally from June 16 through August 15 pushed the S&P 500 up about 17% from its low to 4,300. Since then, the bear market has resumed and the S&P 500 set a new low for the year at 3,655 on Monday, September 26, down just over 23% for the year. In the past two weeks, the Index is down over 9%.

The drop in the S&P 500 seems mild when compared to the technology heavy Nasdaq 100 Index. The Nasdaq 100 Index has fallen 32% since its high last November. These types of drops lead many to believe the market must be near its bottom, and maybe it is time to jump back in. This could be a serious mistake. As seen below from economist John Hussman, the Hussman Margin-Adjusted P/E (MAPE: a margin-adjusted variation of the Shiller P/E) – even after the recent pullback – remains at the highest levels in the history of the stock market.

And in his recent newsletter, Hussman pointed out that after the March 2000 peak in the Technology Bubble, the Nasdaq 100 Index fell 36% by November 2000. Many investors assumed the worst was over and jumped in to buy-the-dip. “Yet from that lower level, it would go on to lose another 68% by October 2002.” All-in-all, the Nasdaq 100 lost an incredible 83%. And according to the MAPE above, the current market remains slightly more overvalued than the peak of the Technology Bubble.

Overvalued stock market prices will continue to feel the pressure of the Fed using both interest rates and QT to rein-in inflation, and the pressure from falling corporate profits. Profits could drop considerably due to the impact of input costs on profit margins, combined with a weakening economy and likely recession.

The current bear market has only begun to eliminate over a decade of overvaluation attributable to easy monetary policies and unprecedented stimulus programs. If this bear market cycle rhymes with previous cycles, there is definitely more to go.

The S&P 500 Index closed at 3,693, down 4.6% for the week. The yield on the 10-year Treasury Note rose to 3.70%. Oil prices fell to $79 per barrel, and the national average price of gasoline according to AAA increased to $3.71 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.