Executive Summary

S&P Global website is showing third quarter earnings falling 2.7% year over year. Due to the following reasons, the potential is there for a greater drop: 1) higher input costs, 2) higher interest expense, 3) higher labor costs, and 4) falling personal disposable income. Corporations are incurring higher input costs. These cannot fully be passed on to the consumer and will erode profits (second graph). As the Fed raises interest rates, the cost of corporate debt increases (third & fourth graphs). And real disposable income is dropping (last graph), which is reducing demand for goods and services. Combined with tight labor markets, these are a recipe for falling corporate profits. Maybe expectations are too high.

Please continue to The Details for more of my analysis.

“The man who is a pessimist before 48 knows too much; if he is an optimist after it, he knows too little.”

–Mark Twain

The Details

Second quarter 2022 S&P 500 “as reported” earnings fell about 12% versus the same quarter in 2021. The overly optimistic forecast for the third quarter, according to the S&P Global website, shows earnings falling by about 2.7% year-over-year. I believe actual results reported will show a much larger drop in third quarter earnings for the following reasons: 1) higher input costs, 2) higher interest expense, 3) higher labor costs, and 4) falling personal disposable income.

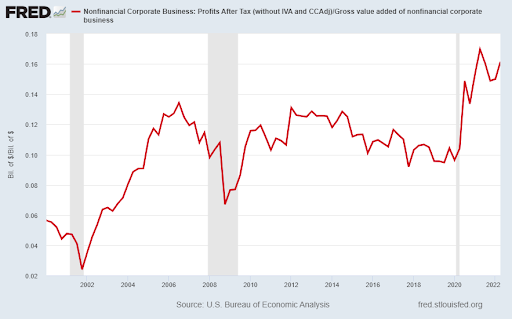

Corporate profit margins have been boosted over the past decade by near zero percent interest rates and unprecedented Federal stimulus during the Financial Crisis, and again during the Covid19 pandemic. Additionally, in 2018 corporations received another lift when the corporate tax rate was lowered to a flat 21%. See the graph of profit margins below, notice the spike after the pandemic.

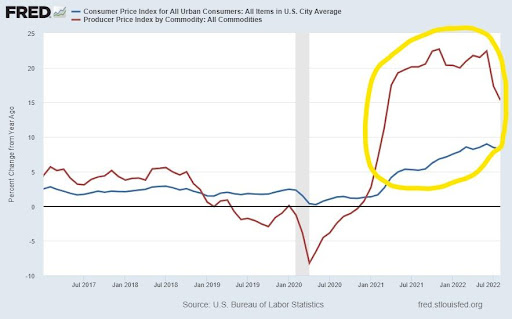

Corporate profits will be hit by soaring input costs. While some of the higher costs can be passed through to consumers, the extent of rising input costs, including skyrocketing energy costs, are too much to pass through, and will be borne by corporations, thus reducing profit margins. The graph below shows the change in consumer prices (CPI) versus the change in producer input costs (PPI). Notice the huge gap circled in yellow showing drastically higher producer prices.

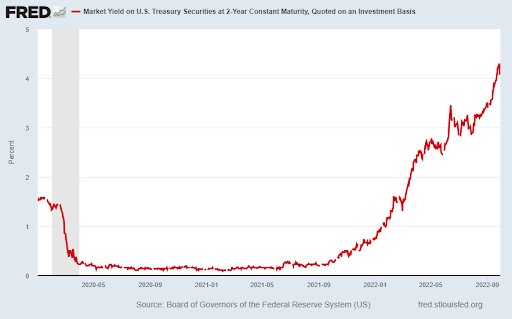

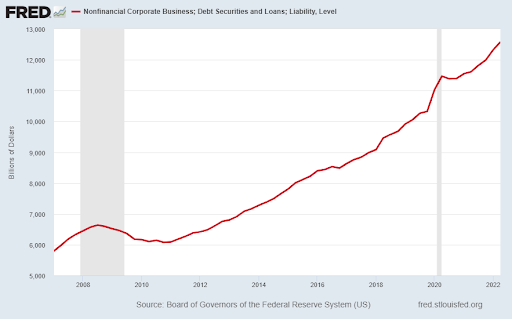

In addition to rising input costs, the cost to borrow funds has profoundly increased. The chart below illustrates that over the past year, the yield on a 2-year Treasury Note has increased by about 4%. With corporate debt over doubling since just prior to the Financial Crisis (second graph below), growing by over $6.5 trillion, increased borrowing costs will have a severe impact on future earnings.

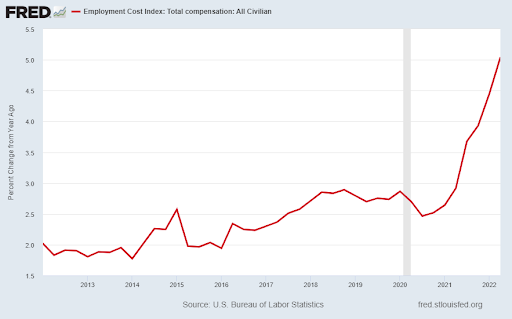

As inflation remains high in a tight job market, even with the economy sputtering, employees are demanding higher wages. Higher employee costs represent one more hurdle employers must overcome as their profit margins shrink. Notice the spike in employee costs after the pandemic in the graph below.

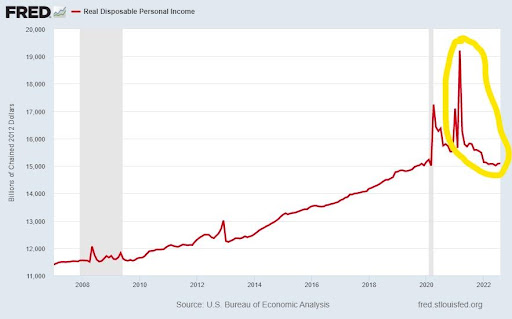

The increased costs outlined above present a challenge to employers. However, in addition to higher costs, employers are facing reduced demand as global and domestic economies enter recession. Stimulus funds have been spent. Inflation, especially for energy and food, is hurting consumers, forcing them to tighten their belts. Consumers are also heavily indebted, and therefore, are being hit with higher interest costs. Consumer sentiment, although slightly rising last month, remains far below the pre-pandemic highs. The graph below illustrates the plunge in real disposable personal income once the stimulus funds were no longer available (circled in yellow).

All in, corporations are seeing lower demand for their goods and services, thus lower revenues. On top of that rising input costs, interest rates, and employment costs are adding to the squeeze on profit margins. Wall Street does not seem to realize the extent to which corporate profits will eventually fall. The third quarter ended Friday, September 30. Soon corporations will begin to report quarterly results. I do not believe the street and the stock market have factored in the upcoming drop in corporate profits.

As earnings fall the “e” or denominator in the Price-to-Earnings calculation drops. Thus, the P/E ratio will rise, further revealing the overvaluation in stock prices.

The S&P 500 Index closed at 3,586, down 2.9% for the week. The yield on the 10-year Treasury Note rose to 3.80%. Oil prices rose to $80 per barrel, and the national average price of gasoline according to AAA increased to $3.80 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.