Executive Summary

Stock analysts’ earnings estimates tend to error on the optimistic side, as shown in first graph below 2023 estimates start at the peak and go up. Analysts often revise estimates down so corporate earnings will “beat” estimates, even when earnings decrease over prior year. During the pandemic, earnings plunged. Instead of the government and Fed merely providing enough help to avoid catastrophe, they injected an extreme amount of liquidity resulting in a spike in corporate earnings (4 ½ times above pandemic lows). However, first quarter 2022 corporate earnings stopped their ascent (year-over-year) while GDP dropped 1.6%. Second quarter GDP could be negative as well, indicating recession. Higher input costs from inflation could squeeze profits more. This week the Fed is expected to raise interest rates and more earnings releases could increase volatility.

Please proceed to The Details.

“The only thing you should do with pro forma earnings is ignore them.”

–Benjamin Graham

The Details

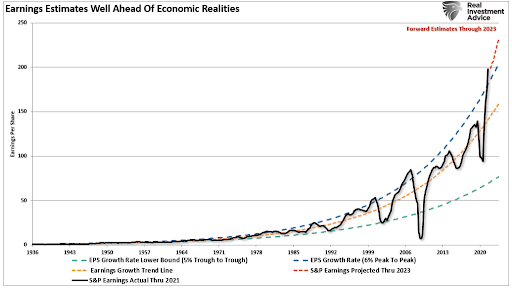

When it comes to corporate earnings estimates, analysts tend to error on the optimistic side. As their earnings release date approaches, estimates are usually revised downward. At this point, some analysts will drop their estimates just low enough so corporations can score an earnings “beat” versus lowered estimates (despite falling when compared to prior year). Notice in the graph of S&P 500 earnings below from Real Investment Advice, the earnings projections through 2023 start at the peak and go up from there.

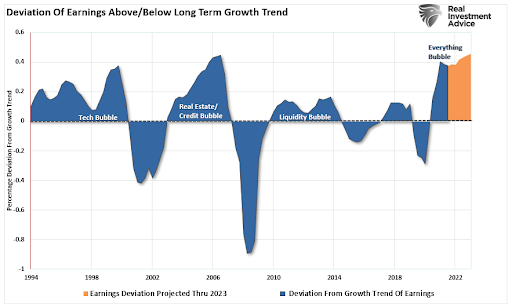

Over the long run earnings growth tends to correlate with nominal (before inflation) economic growth of about 6%. However, in the shorter term, earnings growth rates tend to fluctuate more wildly than GDP. Notice in the graph below the large cyclical swings in earnings versus the long-term 6% average. And despite the current slowdown in GDP growth and possible recession, the projected earnings deviation (in orange) remains high.

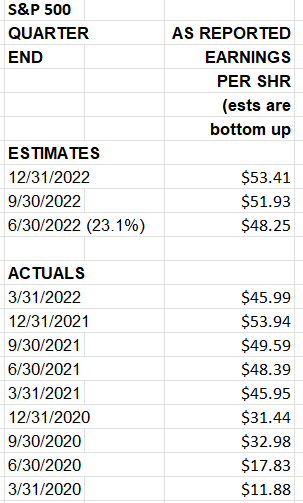

Corporate earnings plunged during the depths of the pandemic. Then, with the help of massive Federal government stimulus and unprecedented monetary policy by the Federal Reserve Bank (Fed), consumers went on a spending rampage sending earnings skyrocketing. The chart below, from the Dow Jones S&P website, shows S&P 500 quarterly net earnings bottoming on March 31, 2020, at $11.88 per share. Instead of merely providing enough fiscal and monetary assistance to avoid catastrophe, the Fed and the government took it to the extreme pushing far too much liquidity into the economy. Not only did this help corporations, pushing quarterly net earnings over four and a half times above their low, topping at $53.94 per share by December 31, 2021, but also instigating the highest levels of inflation seen in 40 years.

Earnings for the first quarter 2022 began to fall again, dropping to $45.99 per share at the same time GDP growth turned negative, falling 1.6%. As is usual, the estimates shown in the chart above are far higher than likely actual results. Second quarter GDP growth results will be released this Thursday. Currently the Atlanta Fed’s GDPNow model is forecasting another negative quarter at -1.6%. Two consecutive quarters of negative economic growth is a solid indicator of the presence of a recession (despite what political spin is being espoused).

With 23.1% of the companies in the S&P 500 having reported, earnings are slightly below last year. The biggest hits so far have been in the financial sector. I expect this number to drop further as more earnings are announced, largely due to a consumer no longer benefitting from government stimulus and corporate profits being squeezed by higher input costs than they are able to pass through to consumers. Also, the dollar has strengthened tremendously against other major currencies. The strong dollar will result in foreign currency translation losses for multi-national corporations.

This week is a busy week for earnings releases as many large corporations will be publicizing results. Additionally, the Fed FOMC (Federal Open Market Committee) will announce a rate hike on Wednesday. It is anticipated that the Federal Funds Rate will be increased by between 0.75% and 1.0%.

With GDP, interest rates and earnings all released this week, the stock market could be even more volatile than normal. The economy is most likely currently in a recession. Corporate earnings are falling, interest rates are rising, the Fed is reducing the size of its balance sheet and inflation persists. Individually, these suggest a high level of concern; combined, they almost demand consideration. Pay close attention to current earnings and changes to forecasted earnings. The results could be telling.

The S&P 500 Index closed at 3,950, up 2.3% for the week. The yield on the 10-year Treasury

Note fell to 2.78%. Oil prices decreased to $95 per barrel, and the national average price of gasoline according to AAA fell to $4.68 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.