Executive Summary

Over the past month and a half, the stock market has experienced its fourth “bear market rally” since the start of the bear market at the beginning of this year. In every bear market there are strong bear market rallies. The current bear market rally has investors convinced that the Fed will begin to “pivot” (the word of the day) and stop hiking interest rates to rescue the market. Unfortunately, the Fed has not provided any signals this will occur. In fact, they have declared the opposite. In this missive I provide examples of previous bear market rallies.

Please proceed to The Details.

“Right now I’m having amnesia and déjà vu at the same time…I think I’ve forgotten this before.”

–Steven Wright

The Details

Over the past month and a half, the stock market has experienced its fourth “bear market rally” since the start of the bear market at the beginning of this year. Throughout the past decade, investors have been conditioned to believe that whenever the market would fall, the Federal Reserve Bank (Fed) would cave and begin loosening monetary policy to save the market. It is understandable that investors feel this way since the Fed has accommodated them during the previous “bull” cycle. However, it is important to recognize how historical bear market cycles transpired.

In every bear market there are strong bear market rallies. These are short-term rallies due to technical over-sold conditions and are often brought on by short squeezes. For this missive, it is not important to understand the details of what causes these rallies, merely that they always occur. The current bear market rally has investors convinced that the Fed will begin to “pivot” (the word of the day) and stop hiking interest rates to rescue the market. Unfortunately, the Fed has not provided any signals this will occur. In fact, they have declared the opposite. Chairman Powell, during his last press conference, spoke plainly about the need to get inflation under control. The Fed’s goal is a return to 2% inflation. Many suspect that with the weakening economy, inflation will fall, and the Fed will pivot. However, the current cycle is unlike any experienced, at least in recent decades. Controlling inflation might become harder and more drawn-out than many investors believe. Investors do not appear prepared for drawn-out inflation, recession and rising interest rates.

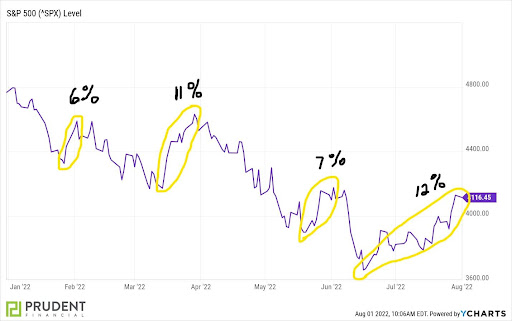

To provide an example of previous bear market rallies, I have prepared graphs highlighting historical stock market cycles. First up is the current bear market.

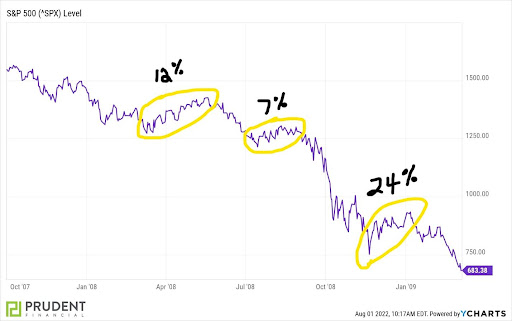

Next, the S&P 500 during the Financial Crisis (shown below) experienced three strong bear market rallies.

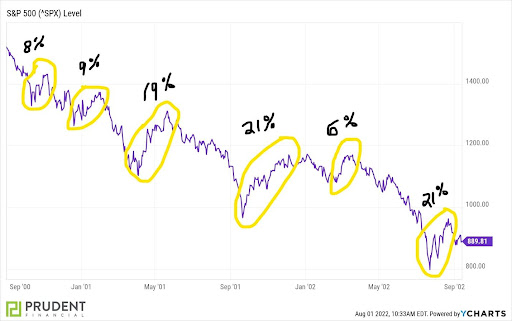

The bursting of the Technology Bubble (2000-2002) saw at least six strong rallies and several smaller upturns during the full bear market cycle.

The strength of the present bear market rally remains far below historical rallies, as observed during these other cycles. Again, the strength of this rally does not indicate a new bull market. Economic conditions and Fed positioning clearly indicate a continued bear market.

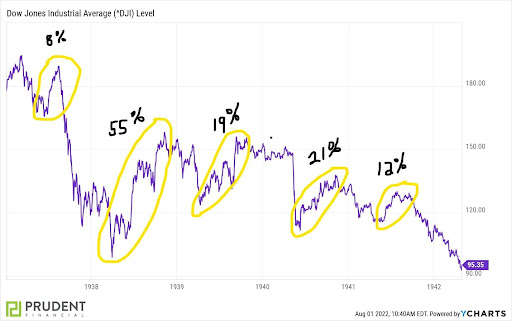

To see how strong a bear market rally can get, look at the bear market below from the later years of the Great Depression. The Dow Jones Industrial Average (the S&P 500 was not in existence at the time) saw a 55% rally in 1938, only to turn back downward seeing several more rallies before bottoming.

The point of this newsletter is to highlight complete bear markets, illustrating the commonality

of strong bear market rallies. Though conditioned to believe the Fed will pivot and return

investors to an (artificial) bull market, history and the Fed’s current proclamations suggest the

contrary.

The S&P 500 Index closed at 4,130, up 4.6% for the week. The yield on the 10-year Treasury

Note fell to 2.64%. Oil prices increased to $99 per barrel, and the national average price of

gasoline according to AAA fell to $4.22 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.