Executive Summary

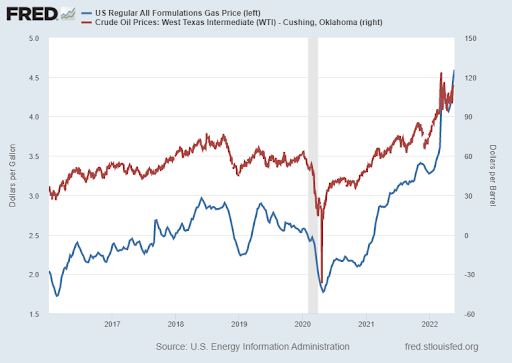

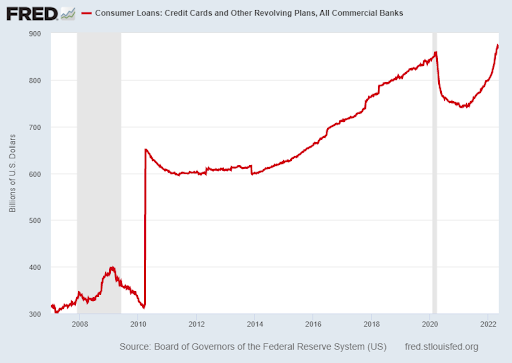

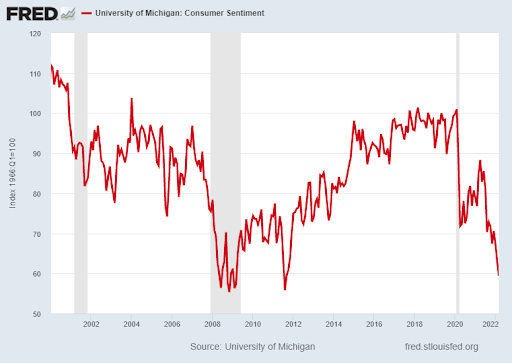

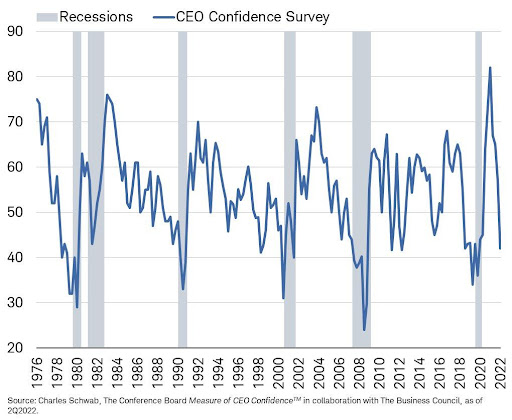

The Dow just finished its eighth consecutive down week, which has not happened since 1923. The Fed is sticking with their plan to fight inflation – even if the stock market suffers. Oil and gas are leading inflation with the record high national average gas price of $4.60 per gallon. Consumers are turning to credit card debt to absorb increased prices (see 2nd graph) and are becoming fearful of future spending (3rd graph). However, it is not just consumers, CEO’s confidence has plummeted to recessionary levels as seen in the fourth chart. And finally, the storm clouds include individual stocks having massive drops of 30-50% in a single day.

Please proceed to The Details.

“Money powers prey upon the nation in times of peace & conspire against it in times of adversity.”

–Abraham Lincoln

The Details

The bear market in stocks continued last week with the Dow Jones Industrial Average (Dow) falling for the eighth consecutive week. The last time this occurred was in 1923. And with such a strong drawn-out downward move, it is expected for the market to experience a short-term bear market rally. Even so, the storm clouds continue to darken. The Federal Reserve Bank (Fed) appears determined to continue with their plan of monetary tightening to try and reign-in inflation. Next month, the Fed has stated they will begin reducing the size of their balance sheet (Quantitative Tightening). This combined with expected 0.5% rate hikes at the next two meetings presents huge obstacles for equities.

A couple of the greatest forces influencing inflation are the cost of oil and gas. Nationally, gasoline prices have jumped to over $4.50 per gallon, with diesel fuel costing almost $1.00 a gallon more. West Texas Intermediate (WTI) oil prices have been hovering around $110 per barrel. Energy experts are claiming that regular gas prices could top $6.00 per gallon by the end of the summer.

High gas and food prices are forcing consumers to re-prioritize their spending habits. After being flush with stimulus cash, consumers are now resorting to the use of credit cards to make ends meet. And many are putting the brakes on discretionary spending. See the drastic increase in credit card and revolving debt below. The current level of debt exceeds the pre-Covid balance and is over 2.7 times the balance prior to the Great Recession in 2007. Also, note the huge dip after the last recession, when consumers used stimulus funds to reduce credit card balances. Now that those funds are gone, the rise in credit card balances resumes.

The impact of inflation and rising interest rates has shaken consumers as sentiment has fallen to levels normally seen during a recession.

The fear is not confined to consumers as businesses are impacted by rising input costs, higher financing costs, and reduced spending by end-users. CEO confidence has also fallen to levels normally seen in recessions. See the chart below.

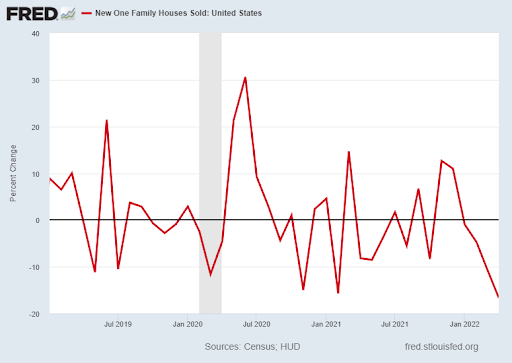

And here is a brief follow-up on last week’s missive about the state of the housing industry. Tuesday, May 24, April sales of new single-family homes was announced. The number of homes sold in April fell 16.6% from March and 27% from the same month last year.

Inflation is taking its toll on consumers, which in turn is impacting businesses. The concern is elevated by the fact that stock prices, despite the recent drop, are still massively overvalued after a decade of Fed-propped monetary policy. I have illustrated in prior newsletters some of the dramatic drops in corporate stock prices, such as Netflix, Facebook, Target and others. On Tuesday, May 24, the company SNAP fell 43%. And retailer Abercrombie & Fitch was down around 29% on the day.

The storm clouds are darkening as inflation continues with energy prices still rising, consumers struggling and the Fed tightening. Although the market will experience intermittent rallies, the general trend remains downward.

The S&P 500 Index closed at 3,901, down 3.1% for the week. The yield on the 10-year Treasury

Note fell to 2.79%. Oil prices rose to $113 per barrel, and the national average price of gasoline according to AAA increased to $4.60 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.