Executive Summary

Economic red flags are waving across the globe, meaning the challenges are not limited to the United States. The European Union’s 27 member states just recoded 8.1% year over year inflation. The E.U.’s partial ban on Russian oil because of the Russian war with Ukraine is driving E.U. energy costs up by 39% (see second graph of E.U. inflation by country). To fight inflation the European Central Bank is tightening, just like the Fed in the U.S. And in China, high-yield property developers are struggling to make bond payments, which forecasters are now predicting almost 32% default rates. One can quickly see the global economic landscape is indeed challenging.

Please proceed to The Details.

“The principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

–Thomas Jefferson

The Details

The scourge of inflation is not confined to the U.S. The European Union (E.U.) – a political and economic union of 27 member states – recorded year-over-year inflation of 8.1%, higher than the expected 7.8%.

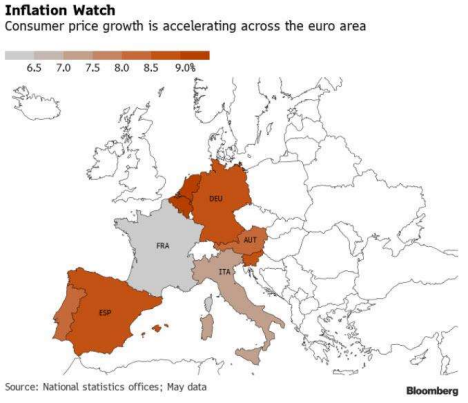

Led by food and energy costs, inflation is accelerating across the Euro Area as shown in the picture below from Bloomberg. (Via Zero Hedge)

By far the largest contributor to inflation is the rapid increase in oil and energy costs, up 39% year-over-year. The E.U.’s recent initiative in response to the Russian – Ukrainian war was to place a partial ban on Russian oil imports. This could add more fuel to the inflationary fire. As

stated in an article in The Epoch Times (via Zero Hedge), “The E.U. is heavily dependent on Russian energy imports, getting around 40 percent of its natural gas and 25 percent of its oil from Russia.

The oil embargo covers Russian oil imports into the E.U. that come by sea, which account for around 90 percent of oil imports into the bloc. Another 10 percent that is delivered by pipeline are exempt, as requested by Hungary.”

Additionally, the European Central Bank (ECB) is planning to tighten their monetary policy, exiting large-scale bond purchases (QE) and raising short-term interest rates in attempts at bringing inflation under control.

According to an article in the Financial Times, the forecast for E.U. economic growth in 2022 by the European Commission was reduced from 4 percent down to 2.7 percent. The war has disrupted supply chains and forced energy costs higher impacting expected economic growth. An absolute elimination of gas from Russia would likely cut 2.5 percent from forecasted growth, leaving growth barely positive for the year.

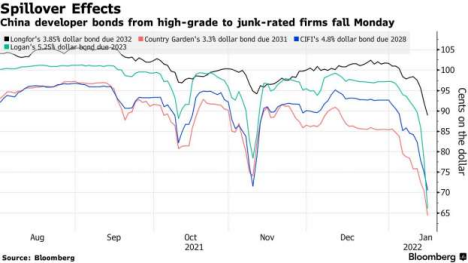

Meanwhile, in China many large property developers are struggling to make payments on their bonds. According to an article in Bloomberg, “Refinancing in global debt markets is out of the question for many firms after average yields on their junk dollar notes jumped above 20%. Covid lockdowns in Shanghai and elsewhere have added to pressure on home sales, amid a sector cash crunch sparked by a crackdown on excessive leverage. Goldman Sachs Group Inc. analysts recently raised their projected 2022 default rate for high-yield Chinese developers to 31.6% from a previous forecast of 19%.”

With Quantitative Tightening (reducing the Fed’s balance sheet) in the U.S. expected to start Wednesday, June 1, signs of weakness and inflation are visible around the globe. Whether it is the E.U.’s rising inflation and slowing growth while bordering a war in which one participant is one of the largest oil and gas suppliers in the area; or over-leveraged developers now on the brink of default in China which could spread rapidly throughout the high-yield bond market. The red flags for the stock market and the global economy continue to wave. The problems are not isolated to the U.S., this is a global predicament.

The S&P 500 Index closed at 4,158, up 6.6% for the week. The yield on the 10-year Treasury Note fell to 2.75%. Oil prices rose to $115 per barrel, and the national average price of gasoline according to AAA increased to $4.62 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.