Executive Summary

In a healthy economy, long-term interest rates are higher than short-term rates (see first graph). However, when short-term rates are higher than long-term rates (inverted yield curve), it has typically been a precursor to a recession (see third graph). Most people have recognized steep inflation through the gas pump and the grocery store. In order to curb inflation, the Federal Reserve Bank started to raise short-term interest rates and has halted QE. This change in monetary policy to fight inflation risks a sell-off in the stock market. See, long-term rates track economic growth, which is slowing. Now the conundrum is do they keep fighting inflation in a slowing economy and risk an equity market sell-off? Over the last ten years the mantra for investing has been “don’t fight the Fed.” The question for investors now is whether to continue that mantra given the policy change, or begin “fighting the Fed”? Monetary policy, economic growth, inflation, bond yields, valuations, and earnings forecasts all point to significantly lower stock prices. It appears only a major change in policy can “save” the markets, but at the expense of what? Hyperinflation? Is it time to pay the piper for over a decade of irrational exuberance?

Please proceed to The Details.

“Market timing, by the way, is a tag some buy-and-hold investors use to put down anything that involves using your brain.”

–Jeremy Grantham

The Details

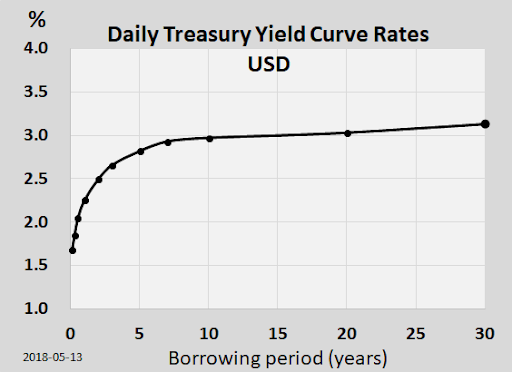

In a healthy economy, long-term interest rates are higher than short-term rates. The difference between long-term and short-term rates can be seen graphically on a yield curve. To illustrate a sample yield curve (via Wikipedia) see below.

Because of the greater risk involved in long-term loans, they typically have higher interest rates as opposed to short-term loans. Banks make money on the interest spread – interest earned on loans versus interest paid on deposits.

As an economy gets stronger inflation tends to rise with increased demand for goods and services. In order to keep inflation under control, the Federal Reserve Bank (Fed) will tighten monetary policy by raising the short-term Federal Funds Rate (FFR). The increase in the FFR filters through to other short-term rates. What most people misunderstand is the Fed does not control long-term rates. Long-term rates tend to track economic growth.

As everyone has realized, if they have been to the grocery store or the gas station, is inflation is soaring. The Fed has now painted themselves into a corner with no easy way out. And, despite the claims of many, this time is different. The great prosperity many were led to believe existed pre-Covid19 was actually an illusion. The illusion was created by years of unprecedentedly loose monetary policy combined with unparalleled Federal stimulus and deficit spending. The system is more leveraged this time than ever before in history.

Now that the latest round of stimulus is in the rear view mirror, the economy is slowing – rapidly. In the fourth quarter 2021, the incredible annualized real GDP growth rate of 7% fooled many into believing the economy had recovered. In reality, the jump was due explicitly to extraordinary stimulus and a decade of zero percent interest rates. The encouragement by the powers-that-be to take advantage of low interest rates and lever-up was intentional. The problem is that this spiral has been spinning for over a decade and the destructive result is just now rearing its head. The devastating inflation is crushing middle and lower class wage earners. And first quarter 2022 annualized real GDP growth estimated by the Atlanta Fed is a mere 0.9%.

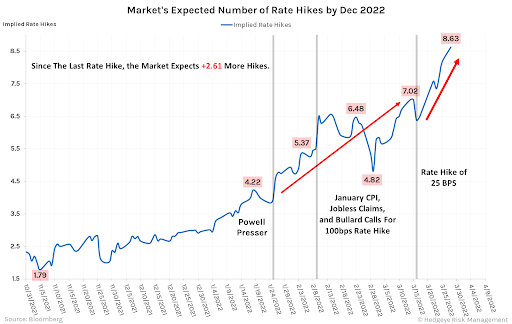

So, with GDP growth projected to slow to near-recessionary levels and inflation rising, the Fed has to choose between trying to get inflation under control or encouraging more leveraged spending to boost the economy. Recently, the Fed halted their Quantitative Easing (QE) – or increasing their balance sheet by purchasing bonds with created money – and indicated they will likely begin to reduce their balance sheet by allowing maturing bonds to roll-off and possibly selling certain existing bond holdings. Additionally, they raised the FFR by 0.25% at their last meeting and have stated further rate hikes are in the works. The market is now pricing in over eight more rate hikes totaling over 2%. See the graph below via Hedgeye Risk Management.

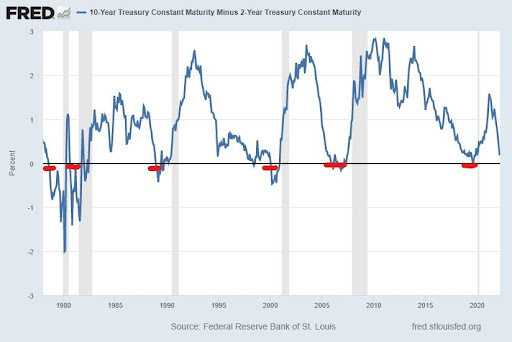

As the Fed raises the short-term FFR, long-term rates will fall due to slowing economic growth. Lately, long-term rates have risen, but short-term rates are rising faster creating a flattened yield curve. When short-term rates get above long-term rates a yield curve inversion occurs. Historically, an inverted yield curve is a warning sign for an upcoming recession. The eight prior recessions were preceded by an inverted yield curve, using the 10 and 2 year Treasury rates to determine inversion. The following graph shows yield curve inversions prior to recessions dating back to 1978.

Josh Steiner of Hedgeye Risk Management stated, “Yield curve inversions have a long track record of predicting equity market corrections and broader economic slowdowns. Often outright recessionary, but always decelerating. The current backdrop appears to be no exception.”

Inverted yield curves can strain banks as they reduce interest rates on loans and increase interest paid on deposits. The more debt in the financial system, the more the Fed’s new policies will hurt the economy. As of the close of markets on Monday, March 28, the 3-year Treasury was higher than 5,7, 10 & 30 year Treasuries. The 5-year was higher than the 7, 10 & 30 year Treasuries. The 7-year was higher than the 10 & 30 year Treasuries. And the 20-year was higher than the 30-year. Inversions have started.

Previously, the Fed has been more concerned about juicing the stock market and the economy. They let inflation get out of control without letting up on the accelerator. Now they have no good options. Raise rates and the economy and stock market will suffer. Return to monetizing Federal government deficits and poor gasoline on the inflationary fire. Their error in over a decade of fueling asset bubbles has come home to roost. Now, inflation has escaped the confines of assets and has hit the economy. Welcome to stagflation.

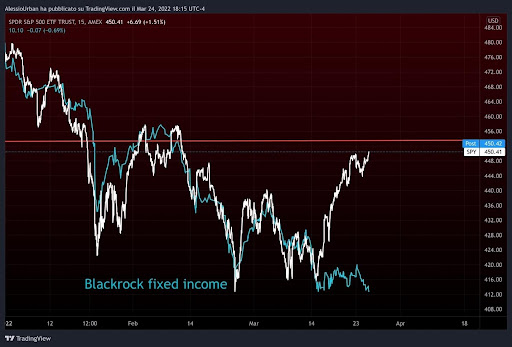

The stock market haven fallen over 10%, rebounded the past two weeks recovering over half of its descent. It appears many speculators are convinced the Fed will save the markets again. After following the mantra “Don’t fight the Fed” as over a decade of unprecedented monetary policy allowed asset bubbles and surging debt, investors don’t know how to reverse course. They are now Fighting the Fed. Typically, the fixed income markets are better indicators of reality than equity markets. Notice in the graph below, the recent surge in the S&P 500 (white line) was not confirmed by the Blackrock fixed income fund (blue line). Currently, there is nothing supporting a bullish view of the equity markets. Monetary policy, economic growth, inflation, bond yields, valuations, and earnings forecasts all point to significantly lower stock prices. It appears only a major change in policy can “save” the markets, but at the expense of what? Hyperinflation?

While the yield curve is foretelling a recession is likely, taken together with a plummeting economy, soaring inflation and asset bubbles ready to pop, the normal lead time could be reduced. Is it time to pay the piper for over a decade of irrational exuberance?

The S&P 500 Index closed at 4,543 up 1.8% for the week. The yield on the 10-year Treasury Note rose to 2.49%. Oil prices increased to $114 per barrel, and the national average price of gasoline according to AAA decreased to $4.24 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.