Executive Summary

As discussed in previous newsletters, economic growth is slowing. The Atlanta Fed GDPNow model reduced the first quarter GDP growth estimate to 0.0% from the previously reported .6% estimate. Now with Russia invading Ukraine, the effects of war could further negatively impact growth. Gas prices have been rising, but now they are skyrocketing to over $4 per gallon. Russia is the third largest producer of petroleum products, while both Ukraine and Russia are important producers of many commodities. Oil impacts either the production or distribution of almost everything, which means continued inflation. January’s year over year inflation of 7.5% was already the highest since 1982. Thus, with slowing growth and persistently high inflation, the U.S. appears headed for stagflation. Will the Fed continue the path they have outlined (raising rates and eliminating bond purchases) to fulfill their mandates, or will they alter their course to prop up markets?

Please proceed to The Details.

“When you come to a fork in the road, take it.”

–Yogi Berra

The Details

The Russian-Ukrainian war adds to the concerns arising from an already slowing economy. Before any impact from the war was felt, the Atlanta Fed GDPNow model had already reduced their first quarter estimate for U.S. GDP growth to 0.0%. Any downward revisions from here will cause pundits to increase their use of the words “potential recession.” While I am certain any move towards recession will be blamed on the war, it is important to realize what the outlook was pre-war.

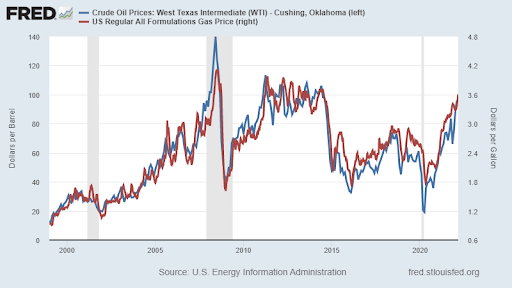

That being said, the spillover effects from the war could be significant. Most people have already noticed the pain at the pump. The price of regular gasoline has risen to $4.065 per gallon nationally and $3.87 in Tennessee. Gas prices are highly correlated to the price of oil. Russia is the third largest producer of petroleum products. Although the sanctions on Russia have excluded energy products, many countries are hesitant to purchase oil from Russia at this time. The disruption in the market pushed oil (WTI) prices up to almost $116 per barrel last Friday. Early Monday morning, the futures price of WTI jumped to around $130 barrel. During the day Monday the price settled back to about $120 per barrel, the highest it has been since the Great Recession in 2008.

The graph below prepared from the St. Louis Fed FRED database shows oil (blue line) at $96 per barrel. This is the price last Wednesday, when their database was updated. Since last Wednesday, the price has jumped about 25%. Oil and petroleum factor into the production or distribution of almost all products. Therefore, the inflationary impact could become widespread. Even if the war ends, depending upon the outcome, will countries resume purchasing oil from Russia?

Real (inflation-adjusted) disposable income is falling while gas prices are pushing $4 per gallon and could see $5 before long. This extra drain on income will negatively impact consumer discretionary spending, adding to weak economic growth already present in first quarter estimates.

The January 2022 CPI (Consumer Price Index) rose 7.5% compared to January 2021. This was the highest year-over-year increase in inflation since 1982. And this was before the effects of the Russian-Ukrainian war. Thursday morning, March 10, February CPI data will be released. This too should exclude the rapid increase in commodity prices resulting from Russia’s aggressive actions.

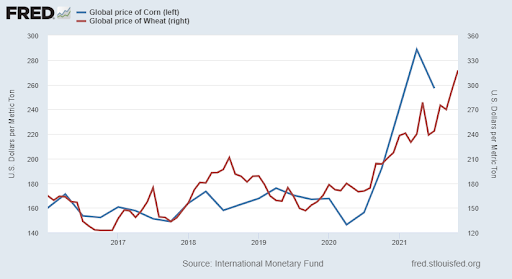

Russia and Ukraine are important producers of many commodities. Combined, they produce 15% of global wheat supplies. Ukraine is the fourth largest exporter of corn. And Russia is a top producer of fertilizer.

According to an article in The Wall Street Journal, “Russia’s invasion of Ukraine could lead to a prolonged global supply crunch in agricultural fertilizers, industry officials said, prolonging the current shortage and exacerbating already high prices for farmers…

Russia and Belarus are the second- and third-largest potash producing countries in the world. Russia was the top exporter of nitrogen in 2019, constituting 17% of global market share, and was the third-largest phosphate exporter, said Kenneth Zuckerberg, a senior economist at agricultural lender CoBank.”

As seen in the graph below, the prices of corn and wheat had already started rising in 2020. The elimination of Russian and Ukrainian corn and wheat (due to sanctions and war) will put significant upward pressure on these prices, even as global demand could fall due to a potential global recession.

In 2021, the U.S. only imported about 3.3% of its crude oil from Russia. However, Russia exports a large amount of oil to other countries, primarily China, South Korea, Germany and several other European countries. If Russia’s oil exports are stymied, the upward pressure on oil prices will continue.

But as explained, it is not just oil prices that will be pushing inflation higher. Fertilizer, and other agricultural products could see a significant jolt as sanctions and war limit exports from Russia and Ukraine.

The current result of geo-political events is to exacerbate what seems to be inevitable: stagflation – defined as an economy with little to no growth and higher than normal inflation. The economy is weakening, the yield curve is flattening, and yield spreads are widening. These indicators when combined with previously present supply disruptions and now additional supply constraints due to war are going to put tremendous upward pressure on prices. The rise in prices will hurt consumers’ ability to spend. Consumer spending is by far the largest contributor to economic growth.

The Federal Reserve Bank (Fed) has a real conundrum on their hands. If they attempt to “save” the economy by re-instituting Quantitative Easing (QE) and keeping rates at zero percent, inflation will likely get worse. If they stop QE as planned this month and raise short-term interest rates, they will put further downward pressure on the economy and financial markets. While their mandates are to work towards stable prices and full employment, will they choose that path over propping up financial markets? We will have to wait and see where their real priorities lie.

The S&P 500 Index closed at 4,329 down 1.3% for the week. The yield on the 10-year Treasury Note fell to 1.72%. Oil prices jumped to $116 per barrel, and the national average price of gasoline according to AAA increased to $4.01 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.