Executive Summary

Markets have been reacting significantly on every news headline regarding the Russian/Ukrainian war. The sanctions and supply disruptions could last long past any potential peace deal. Also, the equity markets were selling off this year before the war started as inflation was rising (see first graph below). Over the last decade, stock prices have been ignoring corporate fundamentals and rather focusing on Fed actions and government fiscal stimulus programs. Together these activities have created asset bubbles in equity and real estate markets. Additionally, Fed actions have created a massive wealth gap. The COVID 19 stimulus programs combined with supply chain disruptions have now filtered into the economy via rising inflation. Thus, it is important to remember what is percolating under the hood, instead of the focusing solely on a potential peace agreement.

Please proceed to The Details.

“The difference between mediocrity and excellence is attention to detail.”

–Sebastian J. Barbarito

The Details

High volatility has been consistent in equity markets of late, as seen by a VIX index exceeding the “red line” of 30. This increased risk has some bullish investors jumping at any possible positive news to send markets back up. In particular, any headline concerning potential peace talks between Russia and Ukraine sends markets immediately surging higher. Often contradictory information is witnessed shortly after the market pushing headline, reversing the temporary jump. Desperate to grasp at straws, investors are allowing too much weight to “peace” talks and less attention to the underlying reasons for current market turbulence. Regarding the Russian/Ukrainian war, it is not the war itself which is causing equity market turmoil. It is the consequences of the sanctions and further disruption in supply chains for many commodities. As outlined in last week’s missive, Russia and Ukraine are significant global sources of many agricultural products, fertilizers and petroleum products.

Even a cease fire would likely not result in the U.S. and its NATO partners immediately lifting sanctions on Russia. It is possible these sanctions could remain in place for years to come. Only a complete reversal by Russia would cause countries to justify removing sanctions. As far as Ukraine is concerned, the disruption and destruction of war combined with the unknown future political makeup will potentially disrupt their exports far longer than investors and algorithms seem to have considered or programmed into their trading.

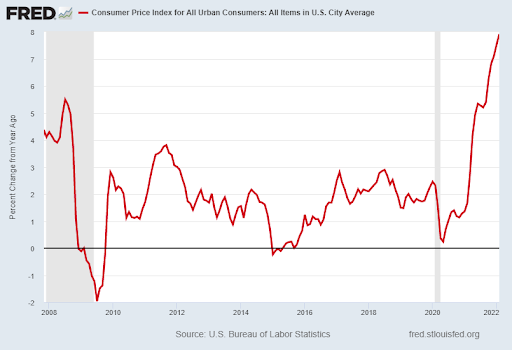

And remember, the equity markets were selling off before the war broke out in Ukraine. Despite what might be bandied about by politicians, inflation has been growing since last year. Notice the rapid rise in the Consumer Price Index (CPI) beginning last year in the graph below.

With inflation soaring and the Federal stimulus programs behind us, the economy has begun showing cracks. The stock market reflected this beginning in January of this year. For over a decade the foundation of corporate stock valuations – revenue and earnings – were irrelevant to the price of a stock traded on the secondary market. What mattered was the massive influx of liquidity through the Federal Reserve Bank’s (Fed’s) Quantitative Easing (QE) programs and the Fed’s determination to hold short-term interest rates to zero percent. These activities, in conjunction with unprecedented fiscal stimulus, created the tremendous inflation in the economy. First witnessed in asset markets – stocks and real estate. For over a decade assets prices rose creating a widening gap between prices and fundamentals. Most pundits cheered this “inflation” because they were conditioned to believe the markets are a good representation of the economy. In reality, they were a good indication of percolating bubbles and absurd monetary policy.

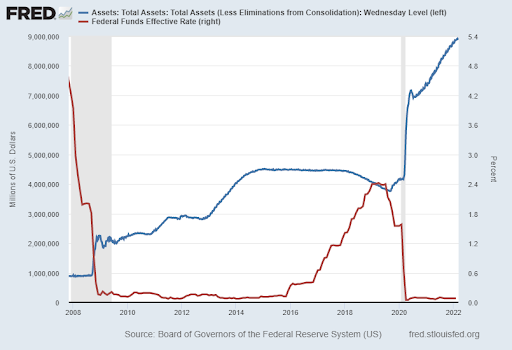

However, when fiscal policy joined the absurdity of monetary policy during the pandemic, the damage crept from solely the asset markets into the real economy. When inflation was confined to the asset markets, it predominantly benefited the wealthy, as they were who owned the preponderance of assets. This created one of the largest wealth gaps in history. Then along came COVID19 which shut down the global economy. In order to avoid another great depression, the Federal Government implemented stimulus programs unlike anything ever witnessed. Without budget surpluses to fund these programs, the Fed jumped in with more QE to fund (monetize) the new debt. It was this surge in consumer spending combined with other supply constraints that sent the CPI soaring last year. The war in Ukraine added fuel to the inflationary fire with serious disruptions in the petroleum and agricultural commodities markets. The graph below illustrates the incredible increase in the Fed’s balance sheet (blue line) growing almost $8 trillion since 2008. Of this, just under $5 trillion was created over the past two years. The Fed Funds Rate is shown in red.

The “inflation” created by the $3.5 trillion of QE from 2008 through 2018 can be found in the prices of stocks and real estate. Then, short-term interest rates forced to the zero-bound by the Fed, followed by an unbelievable $4.8 trillion increase in the Fed’s balance sheet, pushed both asset prices higher along with the prices of goods and services. The latter accomplished by the flow of transfer payments to citizens by way of numerous stimulus programs. Add in the new constraints caused by the war, and voilà the economy is suffering from the highest inflation in 40 years.

So, the next time the market surges higher on the talk of a new peace agreement, please realize that there is far more under the hood than merely the war. The real issues when it comes to the economy are the sanctions, supply disruptions, inflation and massive amounts of debt. These problems will not disappear if and when a cease fire is announced. The market will soar on this news, but soon investors will realize the factors that drove asset inflation have reversed. QE has ended and the Fed is planning to raise the Fed Funds Rate this week. This monetary tightening at the same time the economy is weakening could put continued downward pressure on asset prices. It is my belief that this will occur first in stocks and later in real estate. Investors should not ignore what is under the hood.

The S&P 500 Index closed at 4,204 down 2.9% for the week. The yield on the 10-year Treasury Note rose to 2.01%. Oil prices fell to $109 per barrel, and the national average price of gasoline according to AAA increased to $4.33 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.