Executive Summary

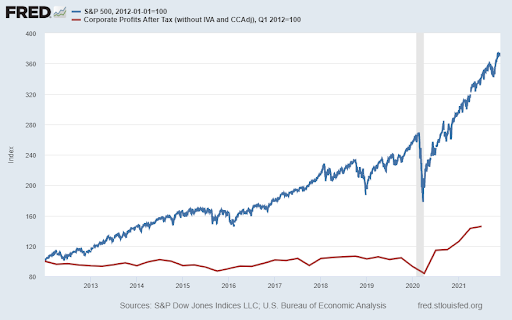

The Friday after Thanksgiving was a short trading day which incurred steep losses in many asset classes. News outlets blamed the identification of the Omicron variant of Covid19 as the cause. However, last week’s update indicated many “red flags” are waving according to Dr. John Hussman’s extensive market research. If speculative psychology were not so rampant in the market, then the corporate performance shown in the graph below would matter.

Please proceed to The Details for a more comprehensive explanation.

“Sensationalism sells: Don’t let the facts get in the way of a good story.”

–Tiger Woods

The Details

Last week I asked if red flags were waving. The reason had to do with weak market internals culminating in several syndromes identified by economist Dr. John Hussman as historically resulting in short-term market losses. Last Friday, on a typical low volume shortened trading day – being the day after Thanksgiving – the stock market fell precipitously across most asset classes except Treasury bonds soared (and yields plummeted). The culprit according to mainstream media was the identification of the Omicron variant of Covid19 in South Africa. However, the massively overvalued market displaying weak internals while the Federal Reserve (Fed) is tapering bond purchases was actually looking for an excuse to sell-off. The real question is whether this is just another short-term head fake or a sign of something bigger on the horizon.

Like the old Don Henley song Dirty Laundry says, many in the mainstream media seemed to jump to the worst possible outcome “People love it when you lose, They love dirty laundry.” So, without any real details other than a new strain was discovered and appears to be fairly transmissible, market participants panicked and sold. The talk of another vaccine is already being bandied about, without any real details about the Omicron variant.

However, Goldman Sachs stated the bank has a “reasonable degree of confidence that this mutation is unlikely to be more malicious and that the existing vaccines will most likely continue to be effective.” And, according to Barry Schoub, chairman of the Ministerial Advisory Committee on Vaccines said, “The cases that have occurred so far have all been mild cases, mild-to-moderate cases, and that’s a good sign,” adding that it was still early days, and nothing was certain yet. (via Zero Hedge)

The article on Zero Hedge went on to state, “It wasn’t just Schoub seeking to taper the fearmongering: Angelique Coetzee, chair of the South African Medical Association, agreed with Schoub’s assessment calling symptoms associated with the variant at this point ‘different and so mild’ compared with others she’d treated for the virus in recent months.”

The stock market reaction was just that, a reaction. It was typical in today’s 24/7 news cycle for the market and its many algorithmic trading programs to trade first and verify later. But it is not really about Omicron, it is about investor psychology in a market stretched to its limit and exhibiting internal weakness. If it were about fundamentals instead of bubble psychology, then the following graph would be relevant to investors, but at this time it isn’t.

In the meantime, speculators prop up a fragile market while red flags are waving. The most common sentiment expressed by speculators after a down day like last Friday is, “Buy the dip.” Whether it is Omicron, Covid or some other geopolitical concern, at some point “buying the dip” will prove disastrous. It is too early to tell what will transpire after market action last Friday but know the media will continue to hype the worst case scenario regarding Covid19 because it’s profitable.

It is time to be cautious. And, according to Don Henley,

You don’t really need to find out what’s goin on

You don’t really wanna know just how far it’s gone

Just leave well enough alone

Eat your dirty laundry

The S&P 500 Index closed at 4,595 down 2.2% for the week. The yield on the 10-year Treasury Note fell to 1.49%. Oil prices decreased to $68 per barrel, and the national average price of gasoline according to AAA dropped to $3.39 per gallon.

Thank you for taking the time to read this week’s report. If you frequent these posts, you know that I always like to take a moment of my day to be grateful for the life I live and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.