Executive Summary

This week’s market update is relatively short in words and is composed mostly of charts and graphs of various stock market valuation methodologies. It is important to note that valuation methodologies are great indicators of long-term price movements; however, they are terrible short-term indicators. What they demonstrate is the embedded risk in the stock market. The average of seven separate valuation approaches, using different data points, indicate the stock market would have to fall over 62% to return prices to long-term norms. Please scroll through.

Please proceed to The Details for a look at this important information.

“Reversion to the mean is the iron rule of the financial markets.”

–John C. Bogle (Founder, The Vanguard Group)

The Details

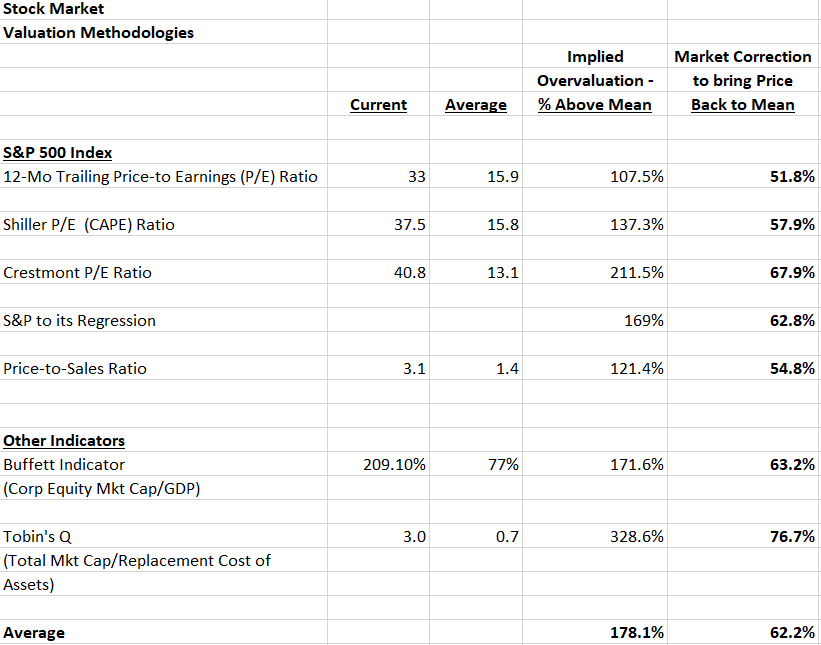

It is apparent to most investors today that the stock market is at extreme levels. In order to illustrate the overvaluation of the stock market, I have prepared a summary of seven different valuation methodologies. To counter the potential argument that the conclusion is due to using similar data points in the calculations, I have included methodologies utilizing disparate inputs. These include: earnings, sales, fixed-asset values, gross domestic product, and regression analysis. In the chart below, I summarize the seven different valuation methodologies.

The various methodologies all indicate a stock market massively overvalued. They range from 107.5% above the mean to a high of 328.6%. The overall average is 178.1% above the mean. The mean represents the long-term average valuation level or what might be considered the “norm.” Since the mean is the long-term average, over time valuations will run above and below this level. The stock market has not experienced a prolonged period of undervaluation since the 1970s-1980s. Investors would be wise not to misconstrue this to mean that valuations will never fall below the mean. That is not how the math, nor the cycle works.

At current valuation levels, the stock market correction needed to bring prices back to the mean range from 51.8% to 76.7% utilizing the seven approaches shown above. The average of these calculations indicates a market correction of 62.2% is needed to bring the level back to the long-term average. And this would merely bring valuations to the mean. As the market is long overdue for a drop below the mean, a larger correction would be required.

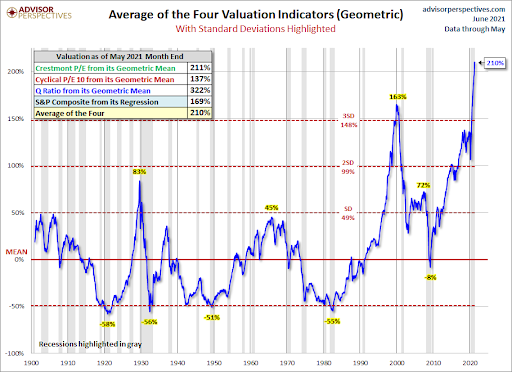

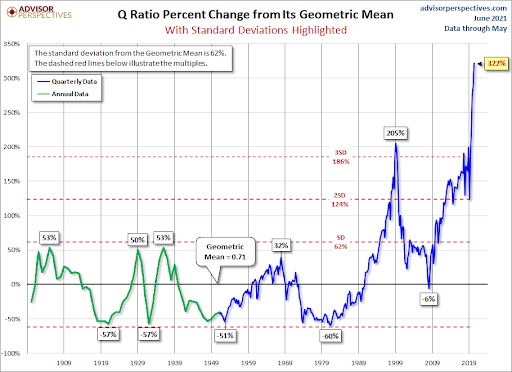

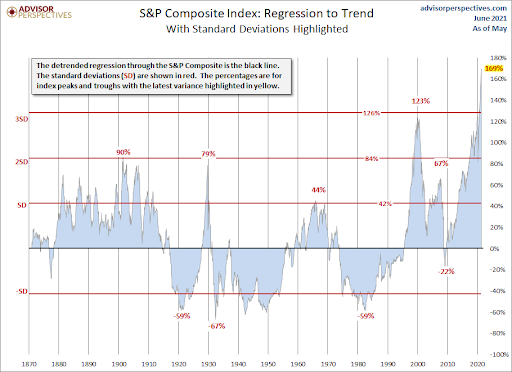

Below are several graphs highlighting different valuation methodologies, from Advisor Perspectives. All of these graphs reveal prices so high that valuations are over three standard deviations from the mean. Without getting too deep into the math, following a normal distribution, a variance only exceeds three standard deviations 0.3% of the time. Or stated differently, 99.7% of the time the variance lies within three standard deviations. The data indicates consistency in the results that the stock market is in an extremely rare state of overvaluation. Never in history has this persisted without an eventual reversion to the mean or below.

The graph below charts the path of the average of four valuation methods. The current level exceeds all previous points and is well above three standard deviations from the mean.

The following graph illustrates Tobin’s Q, the calculation resulting in the highest overvaluation level. Named after economist James Tobin, the methodology compares market capitalization to the replacement cost of assets. Again, the outcome is well above three standard deviations.

And finally, the graph below shows the level of the real S&P 500 above its long-term trend. It too is far above three standard deviations from the trend.

No matter how one slices it, the stock market is tremendously overvalued. It is important to note that valuation methodologies are great indicators of long-term price movements; however, they are terrible short-term indicators. In other words, while the outcomes forecast by the valuation outcomes above will likely prove true, the timing of those outcomes cannot be determined by these calculations.

Investors need to understand the potential ramifications of current valuations, especially if nearing or in retirement. Seven separate valuation approaches, using different data points, indicate the stock market would have to fall over 62% to return prices to long-term norms. This could be life-changing to the unaware investor.

The S&P 500 Index closed at 4,230 up 0.61% for the week. The yield on the 10-year Treasury Note fell to 1.56%. Oil prices increased to $70 per barrel, and the national average price of gasoline according to AAA remained at $3.05 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.