Executive Summary

Since the pandemic took charge of the economy, several stimulus plans have been enacted by Congress. Each round produced a short-term economic sugar boost before settling down to zero percent growth (see first graph). The stimulus created more Federal debt. Although Federal debt has been soaring since the 1980’s, the trajectory moved noticeably higher after the Financial Crisis of 2007-2009, and then went vertical (see second graph) in the pandemic. Then on Monday, May 17, 2021, the U.S. Treasury reported:

Eligible families will receive a payment of up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 and above.”

These government payments resemble the beginning of UBI (Universal Basic Income). As families become dependent upon these payments, there will be pressure to continue indefinitely. And thus, it appears UBI is here…just under a different name.

Please proceed to The Details.

“If everyone is thinking alike, then somebody isn’t thinking.”

–George S. Patton

The Details

After over a decade of Fed-induced stock market support, many investors today have forgotten the difference between investing and speculating. Using prior years’ stock market performance to formulate an opinion on future stock market activity is akin to driving down a street while looking solely in the rear-view mirror. At some point, the road ahead will divert from the road just travelled. Even many “professional” investment managers on Wall Street have never experienced anything but a Fed-propped bull market. Talk of anything other than a continuation of the status quo draws derision.

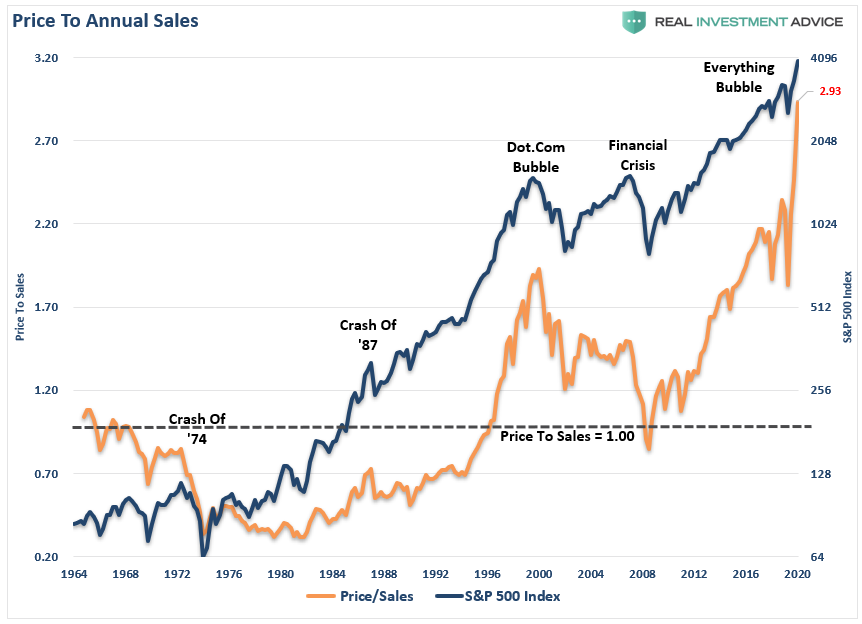

Investing involves purchasing assets at reasonable prices relative to their ability to generate future cash flows. Over time these investments should produce reasonable real (inflation-adjusted) returns with lower risk of losing value. Speculation, on the other hand, is grounded in the idea that there is an endless supply of other speculators willing to pay more for one’s assets. Fundamentals such as growing revenue streams, increasing profits, etc. are of little importance to the average speculator. The longer speculation ensues, the more disconnected prices become from fundamentals and the less they even factor into the equation. The excitement of getting rich quick builds as more speculative opportunities arise. In addition to pushing stock prices higher than ever before, relative to corporate revenues, other more speculative vehicles are utilized because they offer the opportunity to “get rich quicker.” And no one ever loses money at the casino.

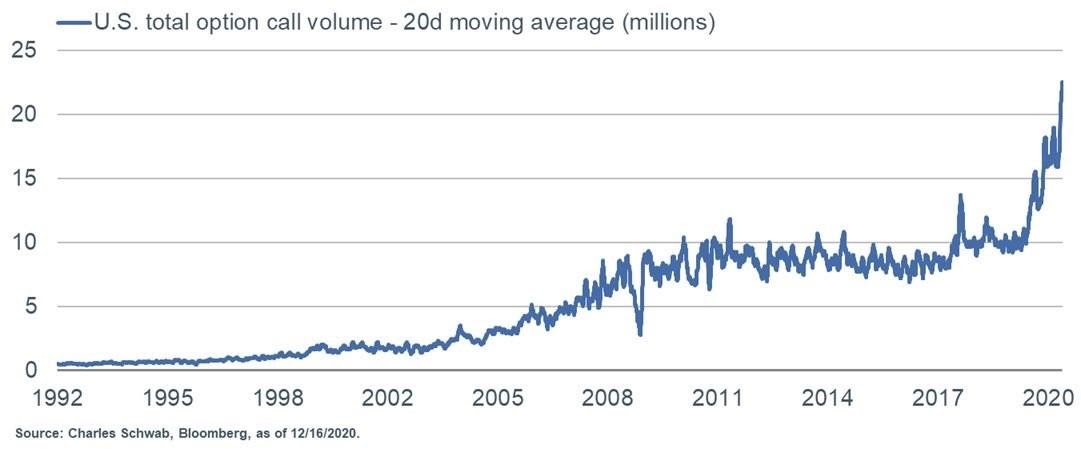

Beyond stocks, speculators have flocked to stock options. Especially short-dated call options. Speculators purchase short-dated call options when they want to “bet” that the price of a stock will rise by an amount sufficiently over their target (strike) price to cover their option cost (premium) and provide a profit, all within a matter of days. If it does not rise above the strike price, they lose their premium. This is really no different than going to a casino and betting on “red.”

The chart below shows the explosion in call option volume by speculators in the current stock market mania.

There has also been a surge in IPOs (Initial Public Offerings) as companies rush to take advantage of the public’s speculative imprudence. A large number of SPAC IPOs, also known as “blank check” companies, have hit the market. These Special Purpose Acquisition Companies raise money through IPOs, then afterwards look for private companies in which to invest or purchase.

Ben Inker, of the investment firm GMO, LLC, recently wrote that, “…speculative episodes tend to end badly because the goals of speculators are usually unsupportable by the underlying fundamentals of assets.” As mentioned, the speculative nature of the current stock market cycle has been fueled by the Fed’s easy-money policies including holding short-term interest rates to near-zero. What began as a snowball back in 2012 could now turn into an avalanche. Speculation has expanded beyond stocks to derivative investments, new Wall Street concoctions, real estate, and most other investable assets.

The speculative nature of this cycle has now drawn in not only the retail investor, but also the novice university student who truly believes markets only go up. Former waiters and waitresses have left their jobs to become “professional” day-traders. If one wants to become a day trader and turn $500 into $1 million, all one has to do is search You Tube for subscription services offered by former retail workers with no prior investment experience. When bartenders and Uber drivers are offering investment advice, one can rest assured a speculative bubble is present.

The lesson speculators will eventually learn is that markets will never reach a “permanently high plateau” and the Fed cannot prop markets forever. Unlike a football game, there is no game clock in a stock market cycle to tell one how much time is left in the cycle. With stock prices relative to revenues now over 3 times higher than the long-term average, the fourth quarter of this game (cycle) will be one for the record books. Future scholars will study the behavior of speculators in the years following the Financial Crisis of 2007-2009 in attempts to understand the herd mentality.

The major difference between investors and speculators is investors tend to survive the backside of the market cycle. The speculators will learn, and oh, the stories that will be told.

The S&P 500 Index closed at 4,204, up 1.2% for the week. The yield on the 10-year Treasury Note rose to 1.59%. Oil prices increased to $66 per barrel, and the national average price of gasoline according to AAA rose to $3.05 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.