Executive Summary

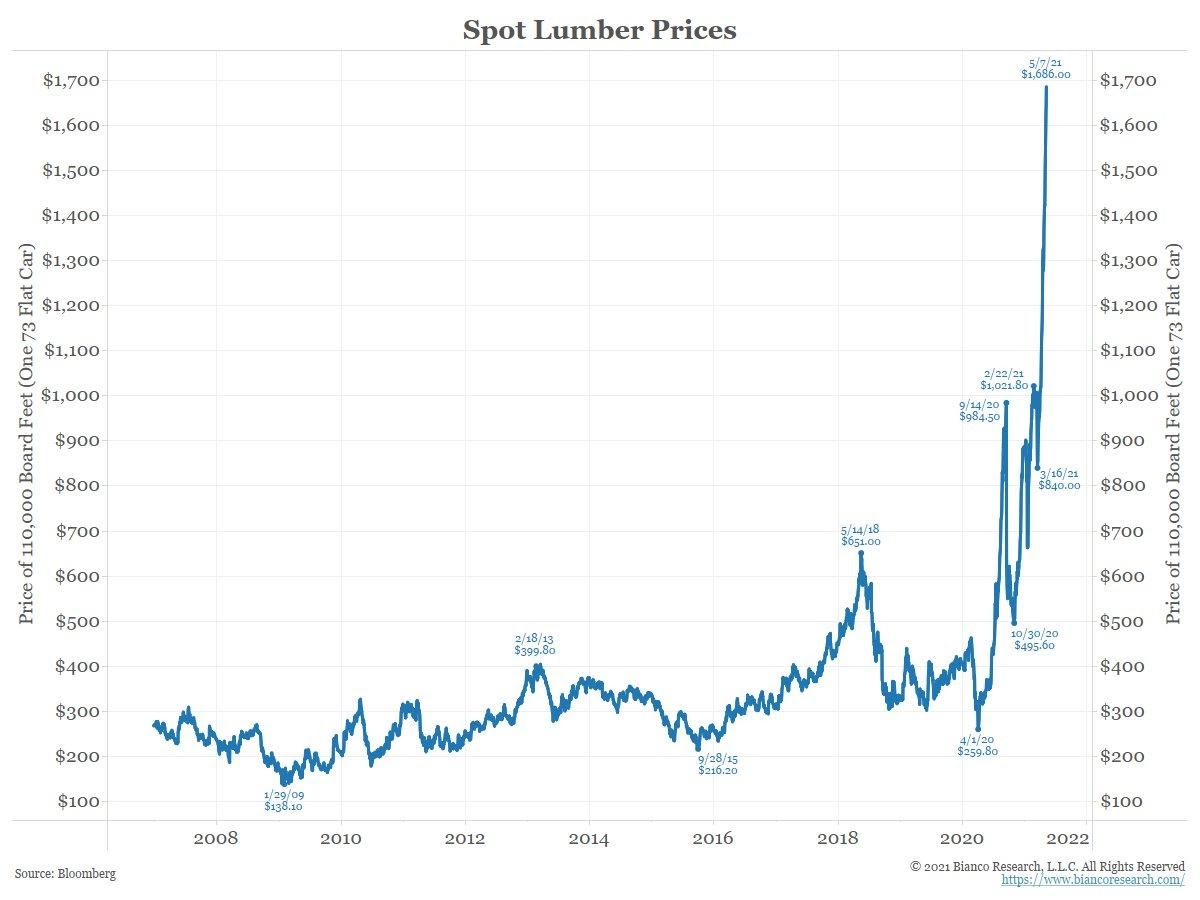

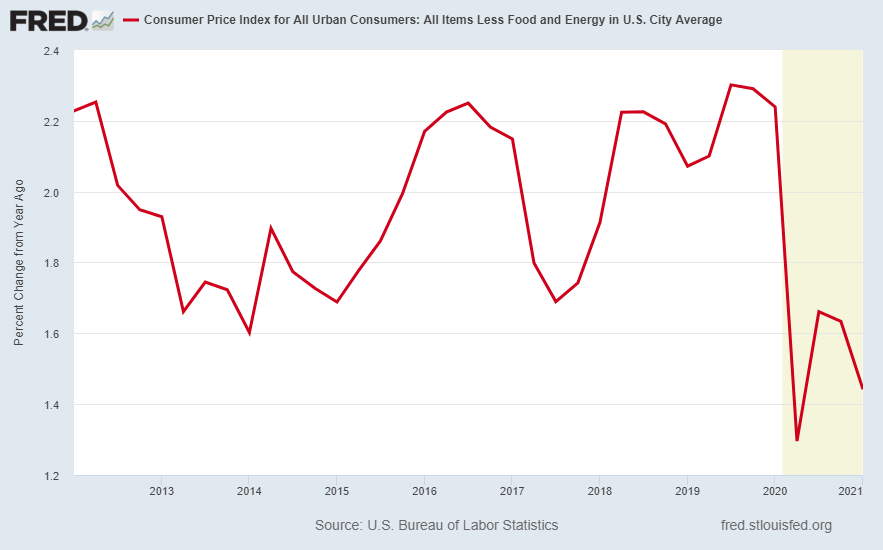

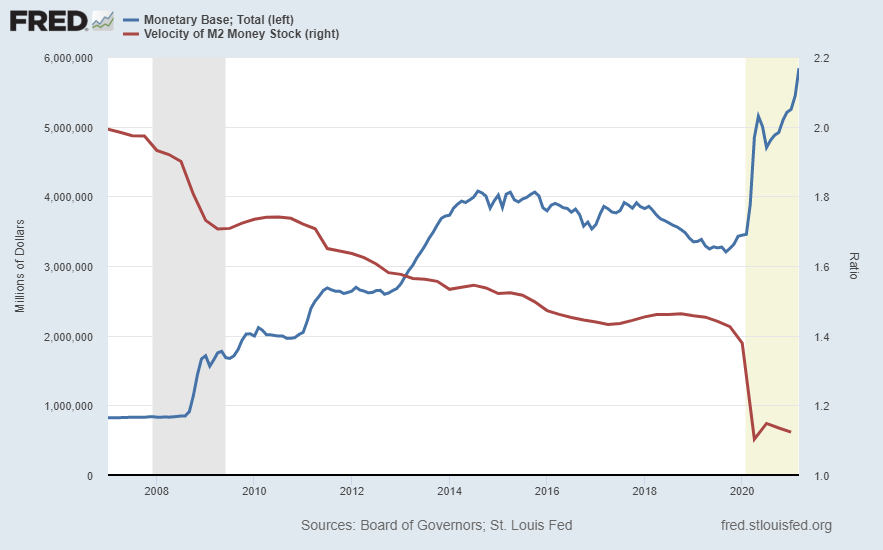

Inflation has different meanings to different people and can show up in different forms. Some insist inflation is strictly a matter of the Money Supply. Others believe it has to do with the prices of goods and services. Some believe the most important factor is wage growth. And others point out the prices of assets. Concerns over massive inflation are being mentioned, usually citing examples such as lumber (see first graph) or gasoline. Global supply and demand are the principal drivers of inflation. Currently the Core Consumer Price Index as shown in the second graph does not reflect inflation as considerable excess capacity remains. Economic growth measured by GDP is the Monetary Supply times the Velocity of Money. The Monetary Base is soaring at the same time the Velocity of Money plunges (fourth graph), which means the government stimulus money is creating minimal economic growth. It appears the majority of the money is being used to pay down personal debts or increase saving/investing (6th graph). Asset price growth witnessed greatly in real estate and the stock market are a reflection of this saving. So, while government stimulus has created some short-term demand; it has created a more significant impact on assets. The country has too many people without jobs or substantial wage growth (7th graph), together with the structural issues of too much debt and aging demographics, to create substantial demand leading to prolonged inflation. So far, Government stimulus may have created some transitory pockets of inflation, but it will take continued massive Federal stimulus to bring about sustained high inflation.

Please proceed to The Details for a more in-depth analysis.

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

–Sam Ewing

The Details

Last week I discussed the concept of “QE” and the general misunderstanding about whether the Federal Reserve Bank (Fed) is actually “printing money.” I explained how the massive surge in “bank reserves” has not filtered into the general economy; however, the psychological impact of such actions has inspired investors to go “all-in.” In today’s missive, I will examine whether the Fed’s activities will result in massive inflation. Although many investors have seen graphs similar to the chart of lumber prices shown below and have concluded hyperinflation has arrived. I encourage readers to maintain an open mind as you delve into the data.

Inflation has different meanings to different people and can show up in different forms. Some insist inflation is strictly a matter of the Money Supply. Others believe it has to do with the prices of goods and services. Some believe the most important factor is wage growth. And others point out the prices of assets. This topic is difficult to cover in a brief newsletter; however, I will attempt to hit the salient points.

I agree with economist Gary Shilling that the difference between global supply and demand for goods and services is the primary driver of inflation or deflation. Although I believe the Fed and the Federal Government would love to see high inflation, as it is the only way the massive Federal debt can be brought back in line with the economy, inflation as measured by the Core CPI (Consumer Price Index minus food and energy) remains below the Fed’s 2% target as shown in the graph below. Not what one would call high inflation.

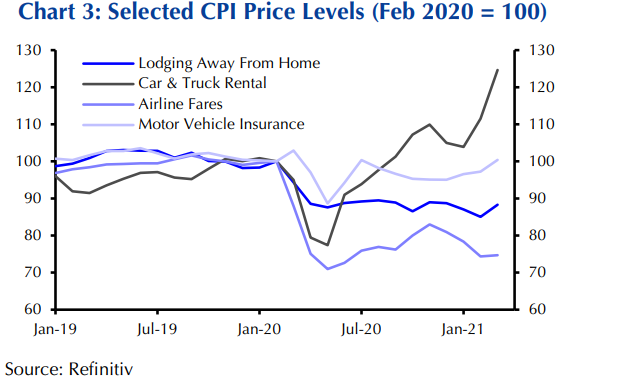

Some will argue the CPI is an inaccurate measure of inflation. That is the topic for another report. It is common for inflation to be seen in some areas, while others experience deflation or disinflation. See the graph below of different components, some showing inflation others deflation.

In last week’s Update, I explained how the Monetary Base has soared due to the Fed crediting reserves to pay for bond purchases under their QE programs. Yet, those reserves have not made their way into the economy (see last week’s newsletter). GDP (Gross Domestic Product) is simply defined as the Money Supply times Velocity (how often money circulates during a year). As the Monetary Base (a broader definition of money versus the Money Supply) has risen, the Velocity of money has plunged. See the graph below.

The graph above illustrates that the enormous surge in the Monetary Base is being offset by falling economic transactions. Economist Lacy Hunt wrote, “When money increases and velocity falls, the money is trapped in the financial markets and has only a minimally lasting impact on the real economy.”

The Federal Government, in attempts at jump-starting the economy, has issued unprecedented levels of stimulus funds to citizens. A combination of this newfound money and businesses which were shut down by the pandemic not being fully re-opened have led to supply and demand imbalances. Many supply chains have been disrupted, and with demand coming back online, pricing pressures have appeared in many areas, especially related to certain commodities. These are short-term imbalances which will be resolved as capacity is ramped-up. In certain countries, production of goods has already returned to pre-pandemic levels.

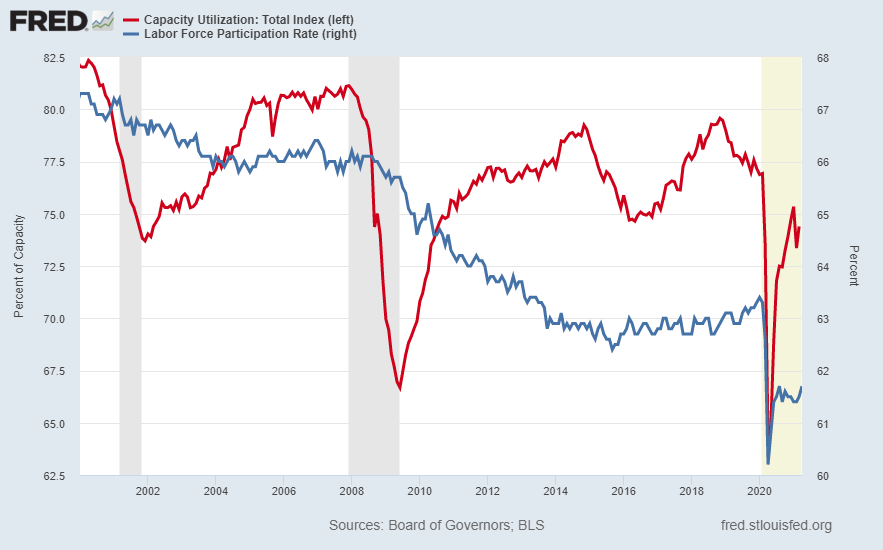

Notice in the chart below that capacity utilization in the U.S. remains far below pre-pandemic levels (red line). And the labor force participation rate also remains well below prior levels (blue line). Excess capacity exists; however, it is not yet being utilized.

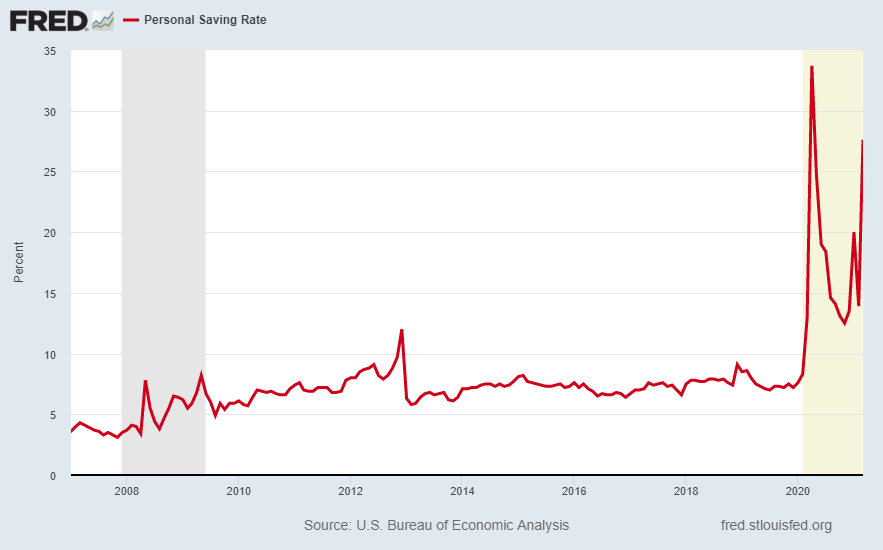

The expectation for inflation rests heavily on a misunderstanding of how QE works combined with the fear the Federal Government stimulus programs will significantly increase velocity. While many recipients of stimulus funds have spent their stipends, Gary Shilling wrote, “According to the Federal Reserve Bank of New York, consumers saved 71% of the government money they received a year ago while spending 18% on essentials, just 8% on nonessentials and 3% for donations.”

Most of the funds received were used to either pay down debt or save/invest. This has contributed to the asset bubbles witnessed in both real estate and the stock market. Notice the increase in the savings rate in the graph below.

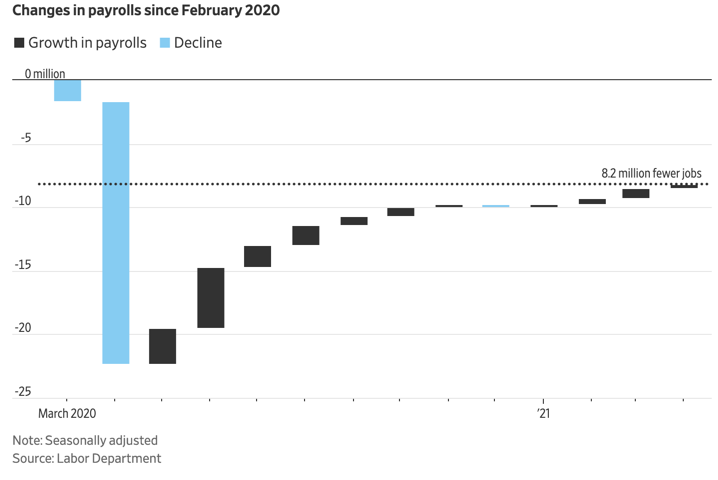

In order for durable inflation to appear, demand for goods and services would need to increase dramatically. For this to occur, the huge number of individuals still unemployed would need to find employment. The graph below shows there are 8.2 million fewer jobs than prior to the pandemic.

In addition to the high number of unemployed workers, weak future demand could result from two structural obstacles. Lacy Hunt wrote, “The two main structural impediments to traditional U.S. and global economic growth are [the] massive debt overhang and deteriorating demographics both having worsened as a consequence of 2020. […]

While the huge debt financed programs were a response to the pandemic, the end result is that global nonfinancial debt increased to a record 282% of GDP in 2020. The 37% surge of debt relative to GDP was also a record.”

The continuation of massive QE, in and of itself, is not inflationary other than the psychological boost it provides investors to buy stocks. However, if (and I believe it is a big IF) Congress is able to push through a continuous stream of stimulus and infrastructure bills, year after year, this could lead to increased spending and velocity putting upward pressure on prices. However, debt burdens and aging demographics are counter-balancing factors. Inflation is derived from demand for goods and services exceeding supply. Beyond the current transitory impact of the economy reopening, and absent perpetual trillion-dollar stimulus programs, I do not believe the present environment is conducive to sustained high inflation.

The Fed’s long-run forecast for U.S. real GDP growth is a mere 1.8% annually. Not what one would expect if a demand-led inflationary spending spree persisted. At this time, I believe the inflationary pressures are transitory. However, stay tuned because the situation could change abruptly.

The S&P 500 Index closed at 4,233, up 1.2% for the week. The yield on the 10-year Treasury Note fell to 1.58%. Oil prices increased to $65 per barrel, and the national average price of gasoline according to AAA rose to $2.96 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.