Executive Summary

Financial media and the stock market seem to hang on every word released by the Fed. In fact, last week the S&P 500 Index jumped by about 1.5% in a matter of seconds on virtually no new news regarding monetary policy in the Fed statement. In their recent Federal Open Market Committee meeting, positive revisions were initiated for their estimates of the unemployment rate (4.5%) and GDP growth (6.5%) for the year 2021. However, when looking at the real employment situation, there are almost 10 million unemployed and over 100 million considered “out of the labor force.” When compared to 2007 before the Great Recession, there were 7 million unemployed and 80 million out of the labor force. (See second graph below) The Fed is well aware the unemployment rate does not provide an accurate depiction of the unemployment situation. And in regard to the revised GDP growth estimate – suffice it to say the FED has never forecast a recession. In the end, I believe investors and the general public would be better served by realistic forecasts not perpetual “feel good” optimism. The public deserves the truth.

Please proceed to The Details.

“The Federal Reserve is not currently forecasting a recession.”

–Ben Bernanke, January 10, 2008 (Official start of the Great Recession, December 2007)

The Details

As the hour approaches on days when the Federal Reserve Bank (Fed) holds its press conferences, financial media channels have gathered their roundtable of pundits, all sitting on pins and needles for the announcement. Even the stock market prepares for a jolt in one direction or another. In reality, the Fed statement is rarely a surprise. The Fed reveals their overly optimistic pronouncements to an audience bent on spinning in the most bullish manner possible. As an example, last Wednesday’s press conference revealed no earth-shattering news regarding monetary policy, yet the S&P 500 Index shot up about 1.5% in seconds.

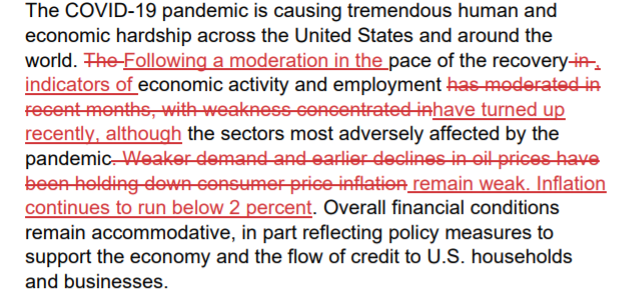

The more concerning issue is whether the Fed is trying to hoodwink the public. A study of Fed forecasting reveals their dismal record. Yet, market aficionados remain fixated on literally every word in their written report. Financial media will show a “marked-up” version of the previous report with current wording changes in red. However, rarely do Fed forecasts pan out. The most recent report is a prime example. It is amazing how much attention a slight variation in adjectives can get. Here is an excerpt from their statement:

In their recent FOMC (Federal Open Market Committee) meeting, positive revisions were initiated for their estimates of the unemployment rate and GDP growth for 2021. Currently, they are projecting an end of year unemployment rate of 4.5% (versus the current 6.2% rate) and GDP growth of 6.5% (versus prior projections of 4.2%). The data indicates both numbers are highly suspect. But remember their goal is to hoodwink the public, as they (almost always) revise these estimates at a later date.

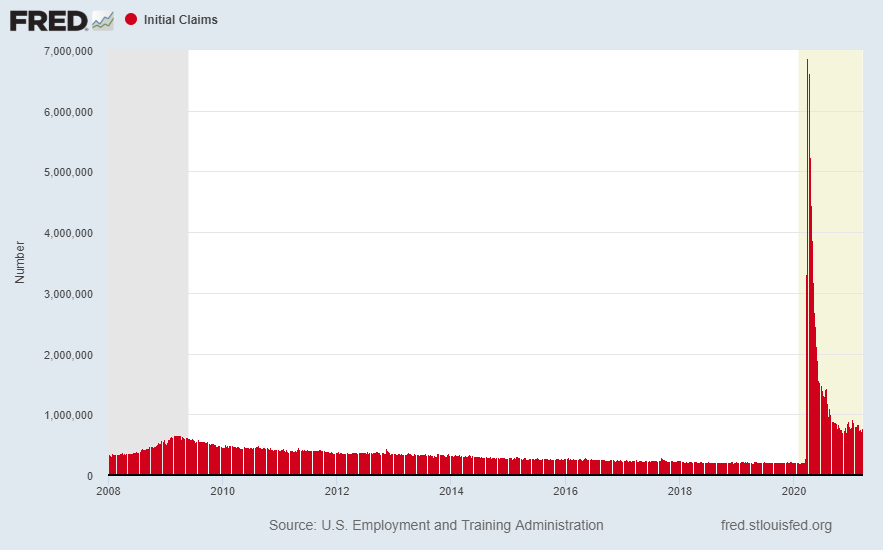

In this missive, I will dig into the data relating to the unemployment picture to see if these forecasts are realistic. First, let’s look at initial unemployment claims. The highest number of first-time unemployment claims ever recorded prior to the pandemic was in October 1982 when 695,000 claims were filed. Initial weekly unemployment claims have exceeded the prior record every week over the past year. Last week the number rose to 770,000. See the chart below prepared with data from the St. Louis Fed FRED database.

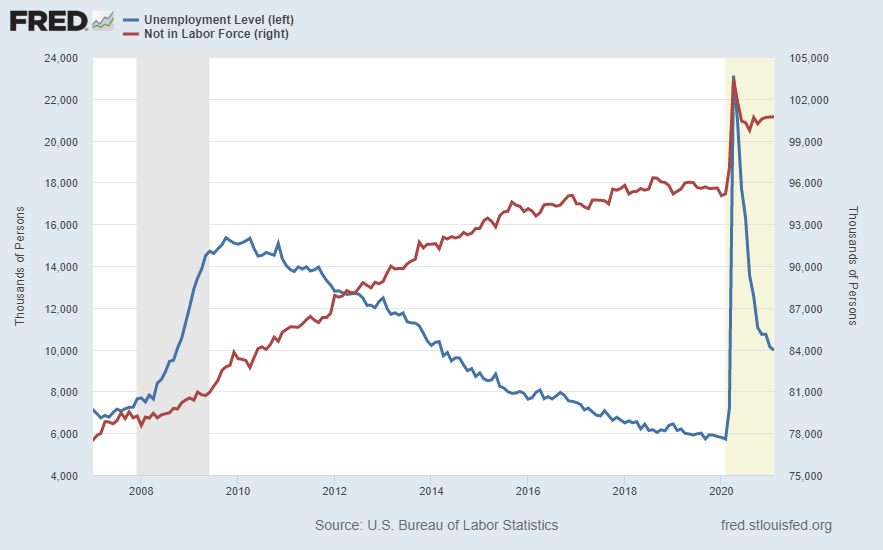

The unemployment rate proclaimed by the Fed is not the best measure of the employment situation in the U.S., as it excludes those who have dropped out of the workforce. The graph below is extremely important in analyzing the unemployment picture. I encourage readers to take the time to study the details. Notice prior to the Great Recession which began at the end of 2007, the unemployment level was around 7 million and rising (blue line, left side of graph). The number of workers not in the labor force (red line, right side) was close to 80 million. Therefore, there were approximately 87 million working age Americans either unemployed or not in the labor force. Today, there remain almost 10 million unemployed, but over 100 million out of the labor force. The number unemployed plus out of the labor force is now about 110 million, or 23 million higher than before the Great Recession. That represents a 26% increase. These numbers are verified by the total number of individuals receiving some form of unemployment benefits. This number has been hovering around 20 million or double the “official” number of unemployed.

In order for the unemployment rate to fall to 4.5% (as projected by the Fed), assuming the labor force participation rate remains the same, the number of unemployed individuals would have to decrease by about 2.75 million people. However, as can be seen above such a move, while an improvement, is no where near what is needed to improve the employment picture. This would only reduce the total receiving unemployment benefits by about 15%. A real improvement would involve an increase in the labor force participation rate, with a dramatic surge in the number of individuals employed. Following is a picture of the significant decrease in the labor force participation rate.

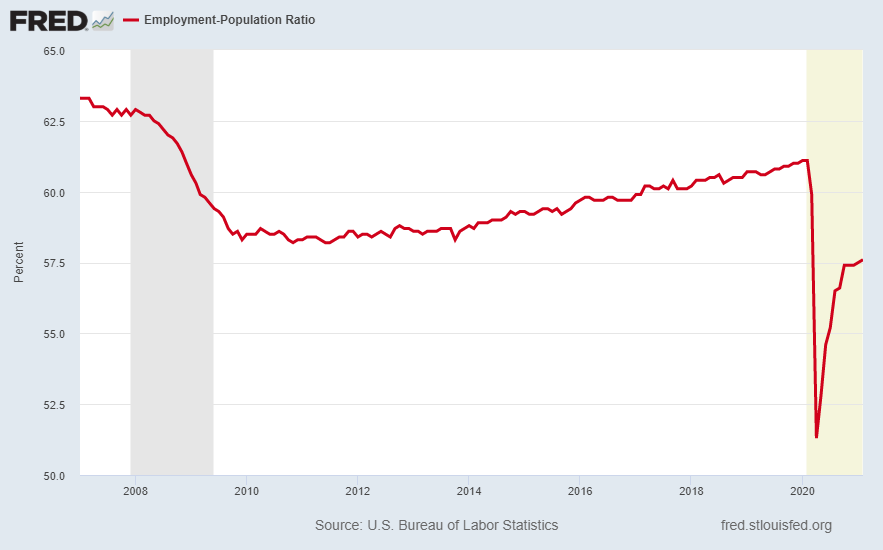

The Fed is well aware the unemployment rate does not provide an accurate depiction of the total number of out of work individuals. Whether the number of officially unemployed individuals drops to 4.5% is not indicative of a “recovered” employment situation. Attention should be on the labor force participation rate and an increasing employment-to-population ratio. The employment-to-population ratio remains below the worst level attained during the Great Recession. Will there be dramatic improvement over the next nine months or is the Fed trying to pull the wool over the public’s eyes?

Is the Fed’s reduced unemployment rate forecast for 2021 realistic based upon the overall economic outlook? Even with its limitations, it seems unlikely the unemployment rate will fall to 4.5% by the end of the year. And it is even more unlikely the number of individuals “not in the labor force” will significantly drop this year. Today’s release of one of the most comprehensive analytics for the economy, the Chicago Fed National Activity Index (CFNAI), a composite of 85 monthly indicators, turned back negative in February counteracting the Fed’s forecast of significantly higher GDP growth for the year.

With the Fed’s poor track record forecasting economic growth and unemployment, it amazes me the extent to which pundits and investors react to even minor changes in their outlook. If it appears I am being hard on the Fed, I encourage a review of their prior predictions and actual outcomes. The mere fact that the Fed has never forecast a recession should be enough to prove their optimistic bias.

In the end, I believe investors and the general public would be better served by realistic forecasts not perpetual “feel good” optimism. The public deserves the truth.

The S&P 500 Index closed at 3,913, down 0.8% for the week. The yield on the 10-year Treasury Note rose to 1.73%. Oil prices fell to $61 per barrel, and the national average price of gasoline according to AAA rose to $2.88 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.